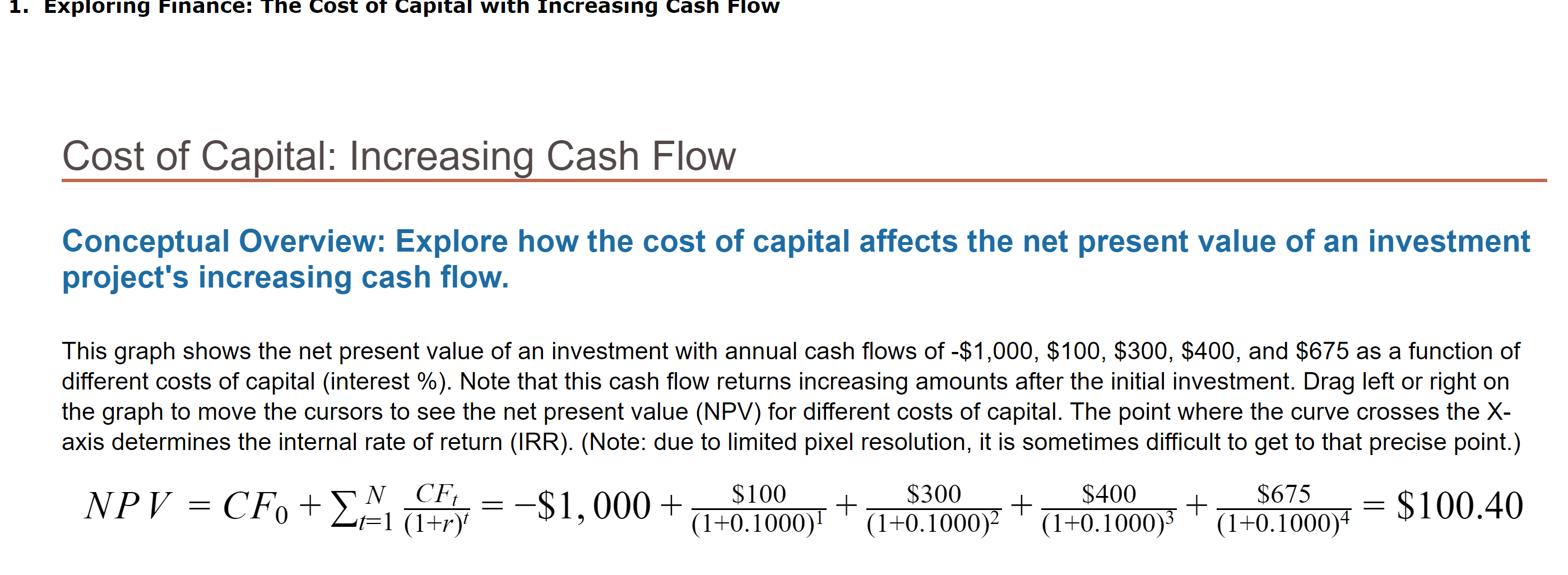

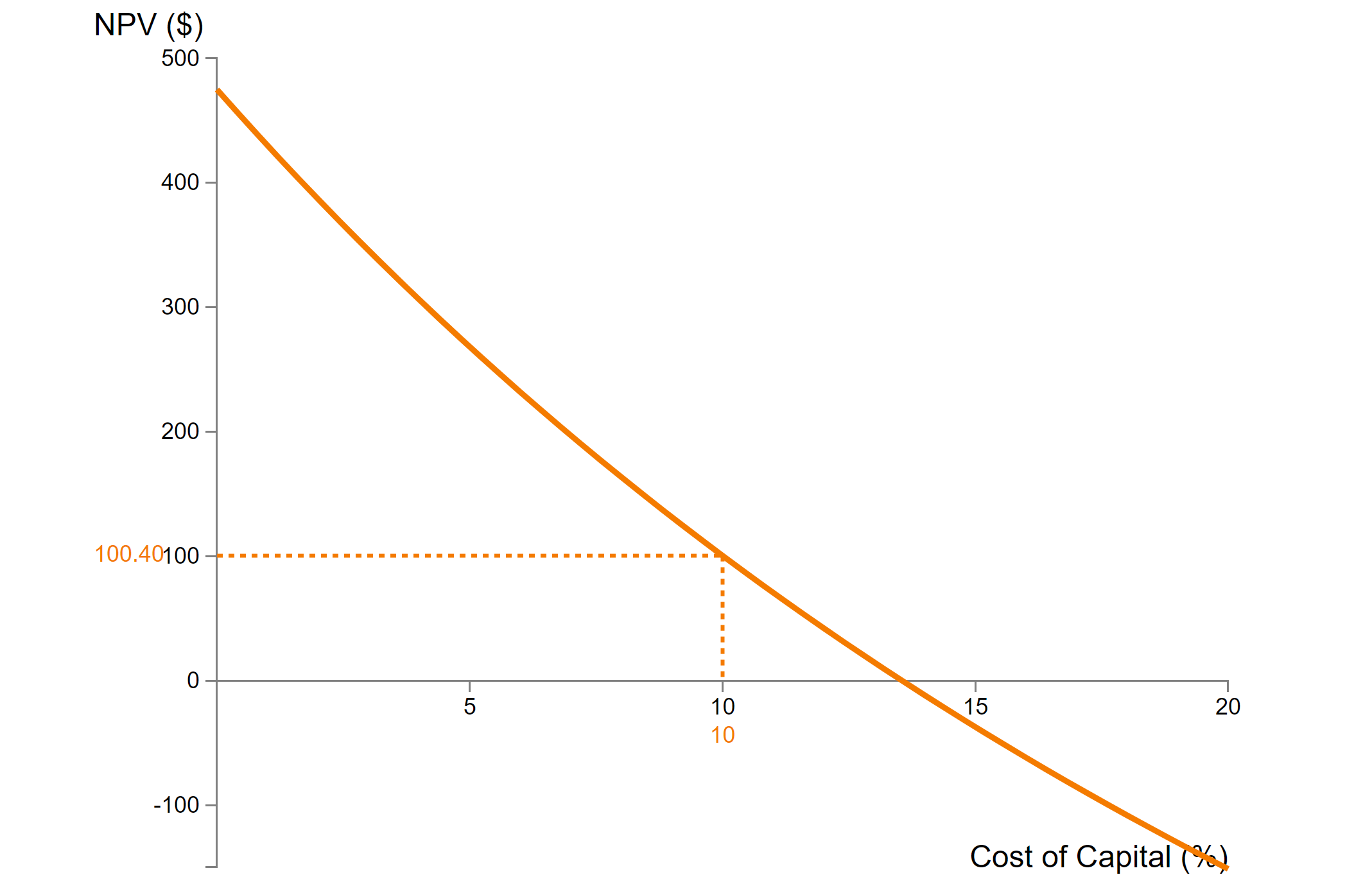

Question: Hi , I need help with solving this assignment. thank you 1. Explorlng Finance: The Cost Of capital Wlth Increasmg Cash Flow Cost of Capital:

Hi , I need help with solving this assignment. thank you

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock