Question: Hi, I need help with the below. I've been working on this for about 2 hours but I'm stuck. The bottom part asks for gross

Hi, I need help with the below. I've been working on this for about 2 hours but I'm stuck. The bottom part asks for gross profit rates from FIFO, LIFO, and Average. Thanks!

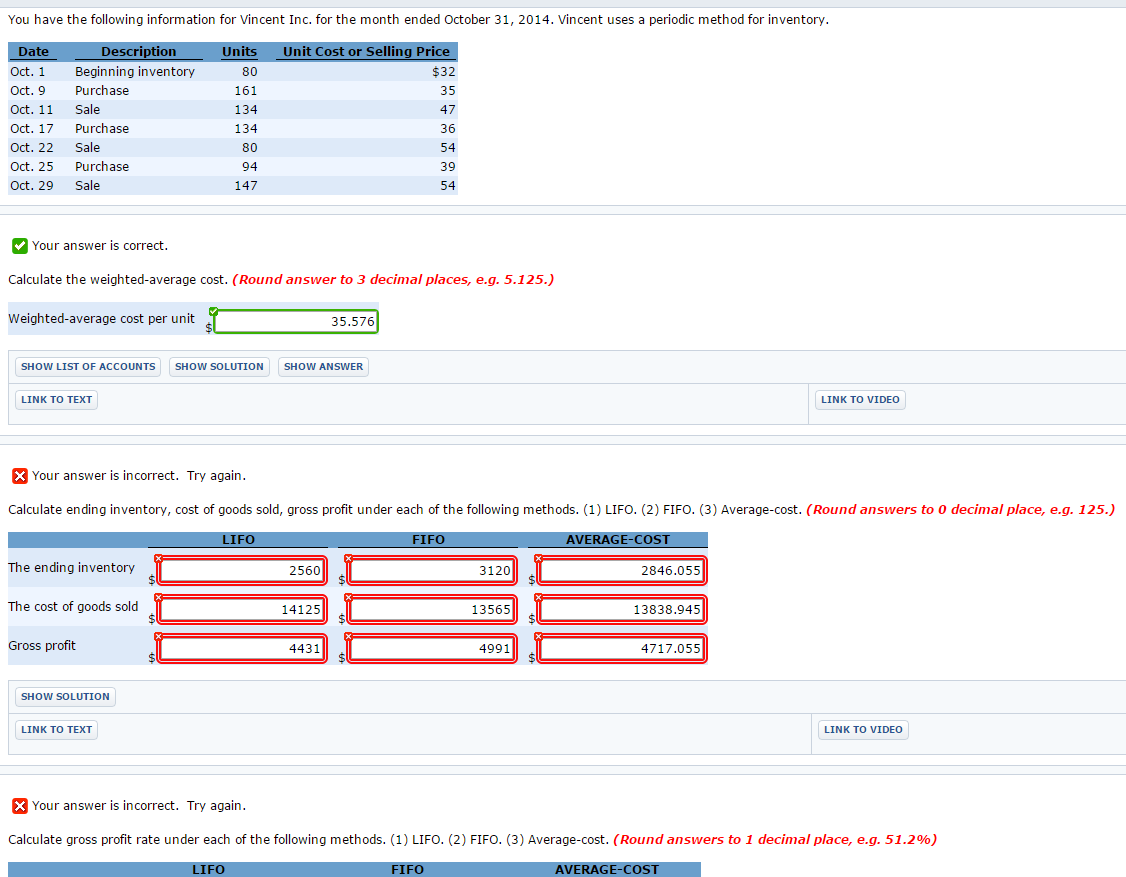

You have the following information for Vincent Inc. for the month ended October 31, 2014. Vincent uses a periodic method for inventory Date Oct. 1 Oct. 9 Oct. 11 Oct. 17 Oct. 22 Oct. 25 Oct. 29 Units 80 161 134 134 80 94 147 Description Unit Cost or Selling Price Beginning inventory Purchase Sale Purchase Sale Purchase Sale $32 35 47 36 54 54 Your answer is correct Calculate the weighted-average cost. (Round answer to 3 decimal places, e.g. 5.125.) Weighted-average cost per unit 35.576 SHOW LIST OF ACCOUNTS SHOW SOLUTION SHOW ANSWER LINK TO TEXT LINK TO VIDEO Your answer is incorrect. Try again Calculate ending inventory, cost of goods sold, gross profit under each of the following methods. (1) LIFO. (2) FIFO. (3) Average-cost. (Round answers to 0 decimal place, e.g. 125.) LIF IFO AVERAGE-COST The ending inventory The cost of goods sold Gross profit 2560 3120 2846.055 14125 13565 13838.945 4431 4991 4717.055 SHOW SOLUTION LINK TO TEXT LINK TO VIDEO Your answer is incorrect. Try again Calculate gross profit rate under each of the following methods. (1) LIFO. (2) FIFO. (3) Average-cost. (Round answers to 1 decimal place, eg, 51.2%) IFO IFO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts