Question: Hi, I need help with the yellow boxes PLEASE I will rate your answer if correct :) I See The Light Projected Income Statement For

Hi, I need help with the yellow boxes PLEASE I will rate your answer if correct :)

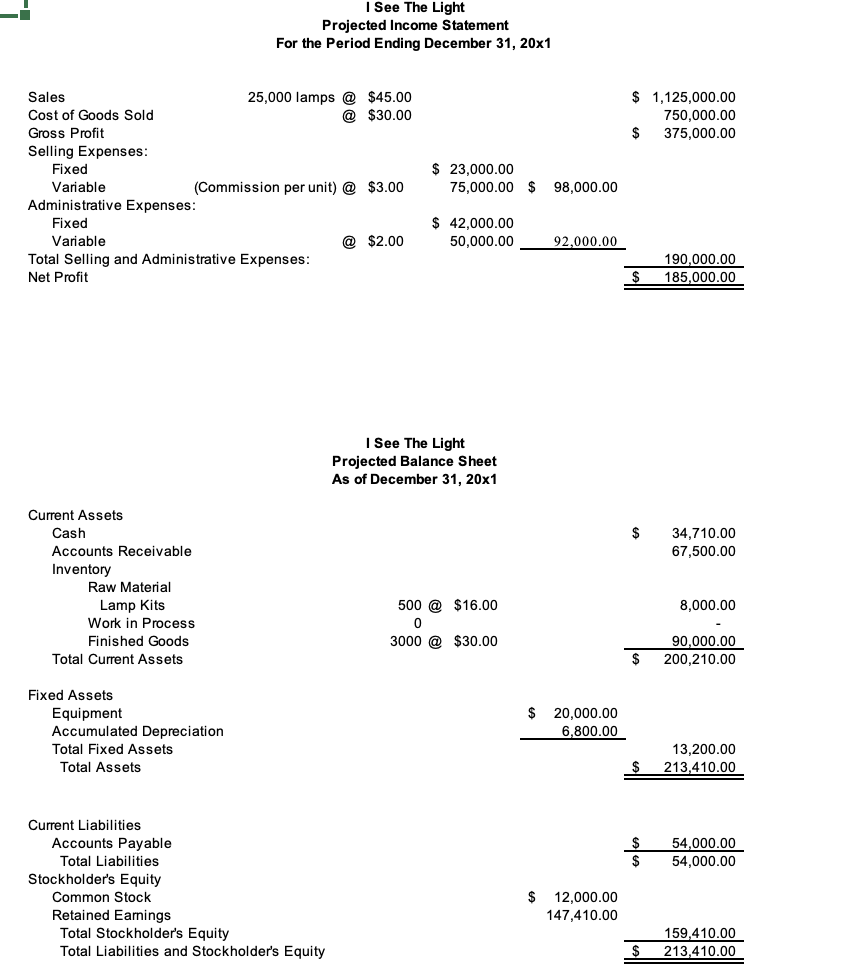

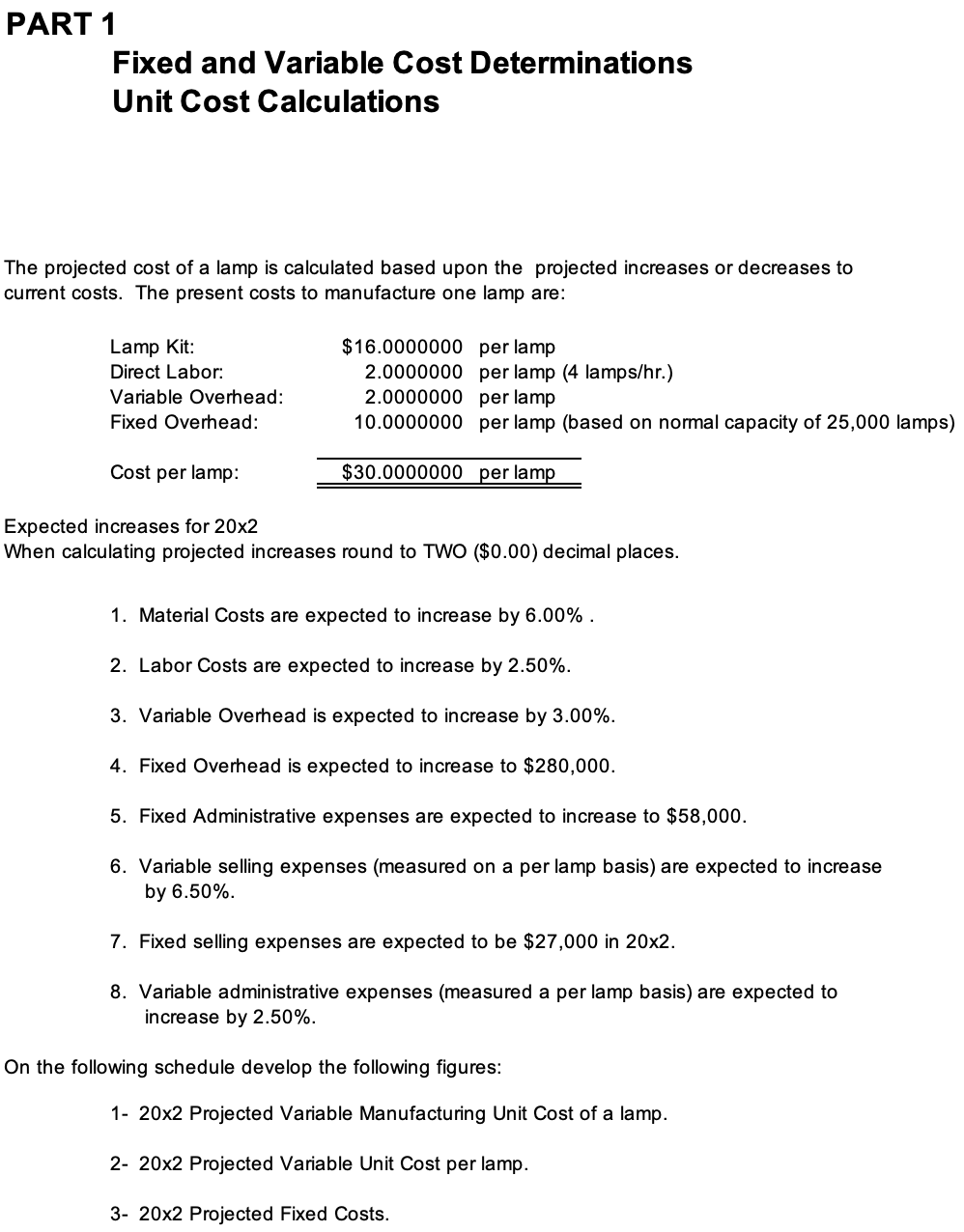

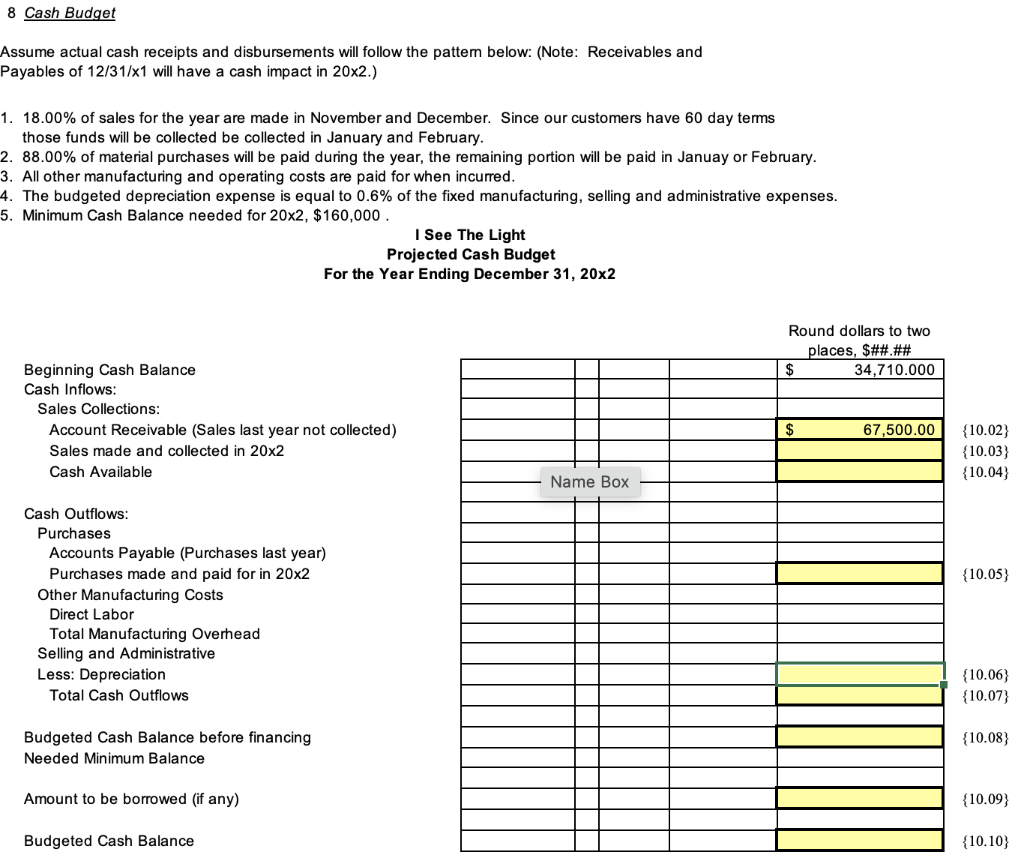

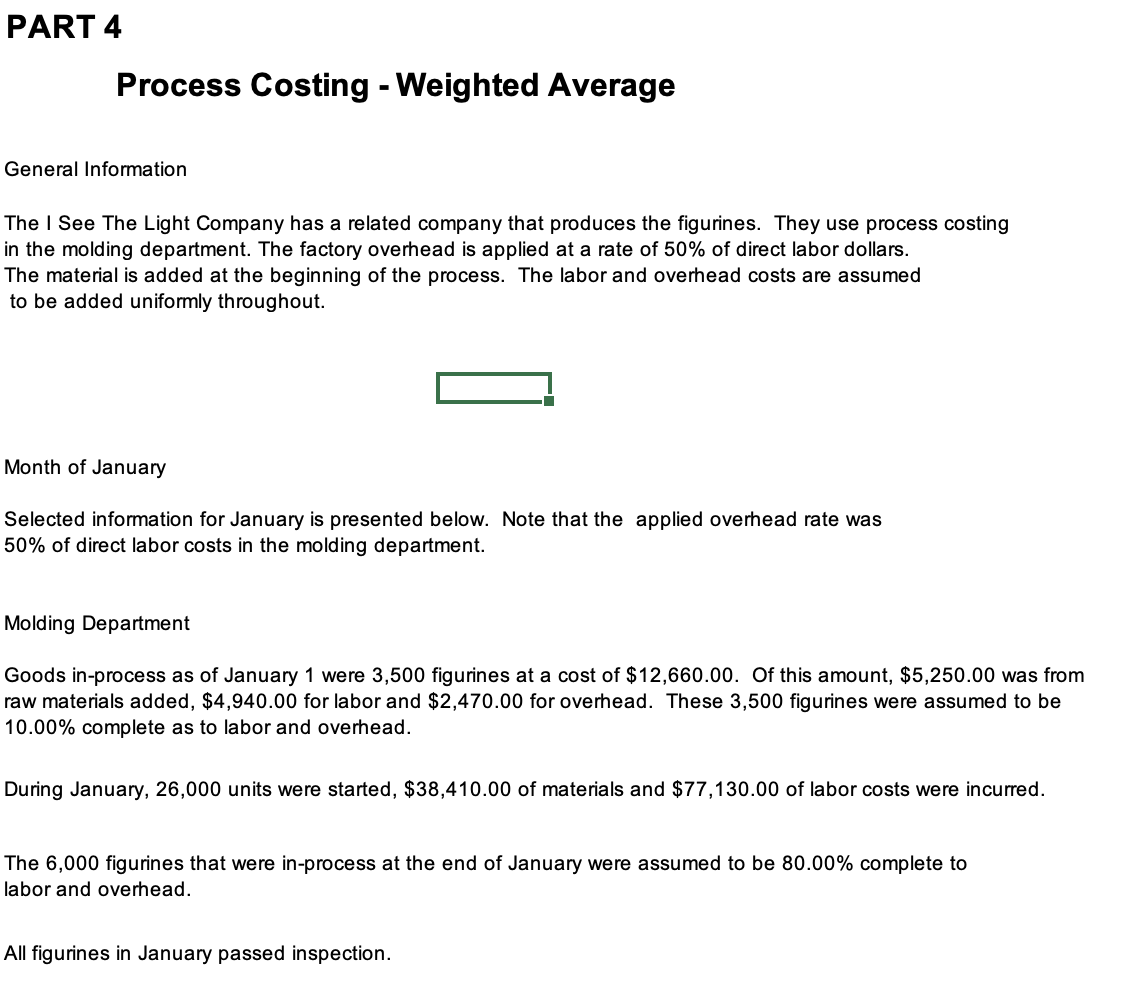

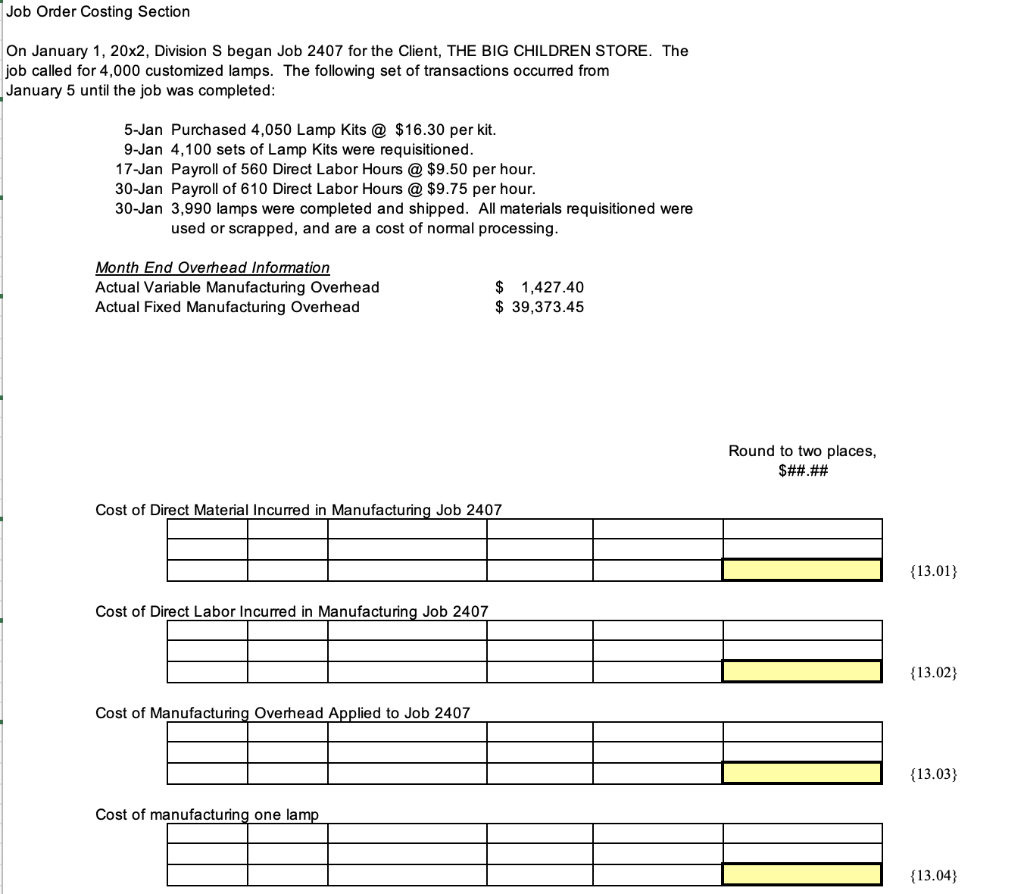

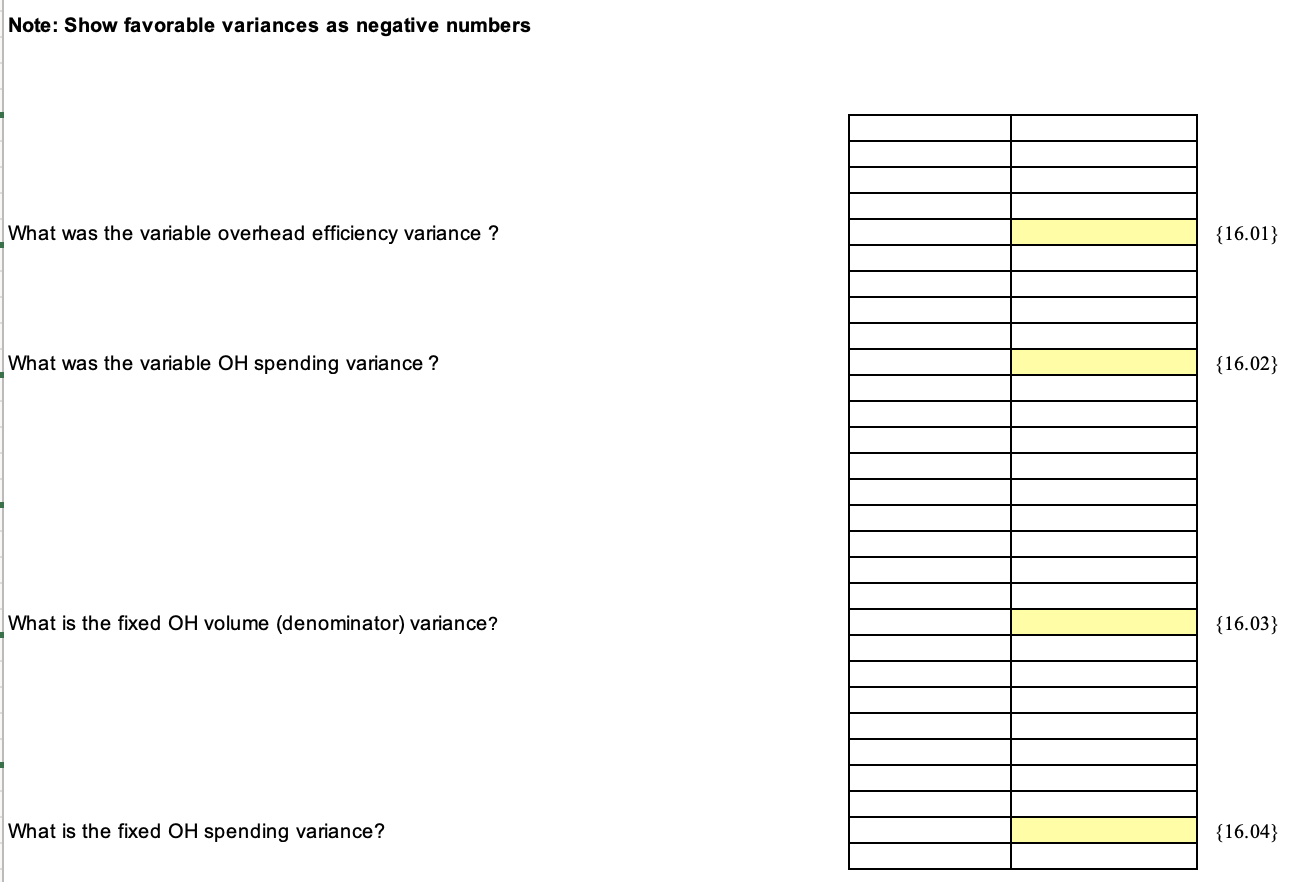

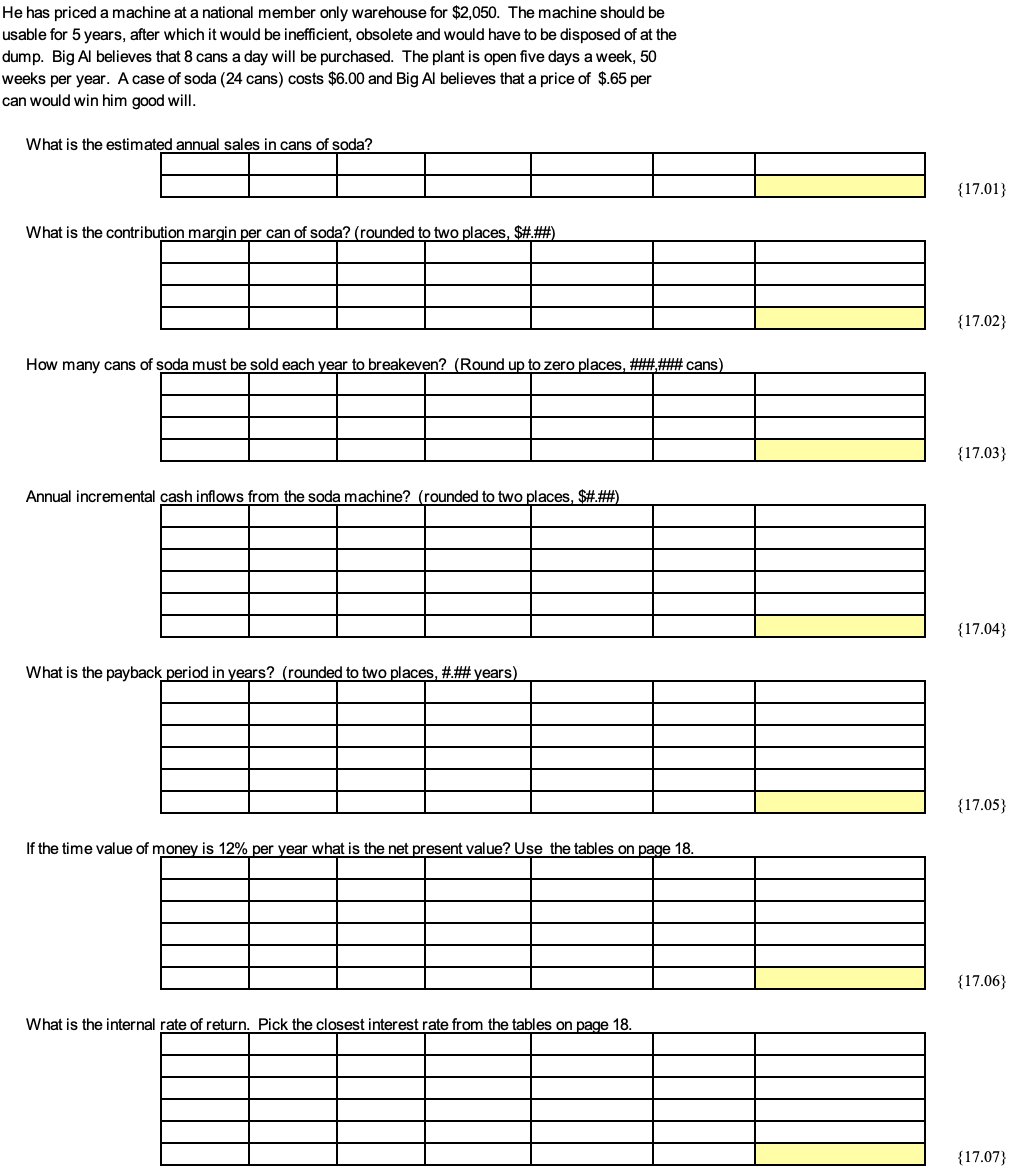

I See The Light Projected Income Statement For the Period Ending December 31, 20x1 I See The Light Projected Balance Sheet As of December 31, 20x1 Current Assets Cash Accounts Receivable Inventory Raw Material \begin{tabular}{lrrr} Lamp Kits & 500@ & $16.00 & 8,000.00 \\ Work in Process & 0 & & - \\ Finished Goods & 3000@ & $30.00 & 90,000.00 \\ \hline Current Assets & & & 200,210.00 \end{tabular} Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets Current Liabilities Accounts Payable Total Liabilities \begin{tabular}{ll} $ & 54,000.00 \\ \hline$ & 54,000.00 \end{tabular} Stockholder's Equity Common Stock Retained Eamings Total Stockholder's Equity Total Liabilities and Stockholder's Equity 159,410.00$213,410.00 PART 1 Fixed and Variable Cost Determinations Unit Cost Calculations The projected cost of a lamp is calculated based upon the projected increases or decreases to current costs. The present costs to manufacture one lamp are: Expected increases for 202 When calculating projected increases round to TWO ($0.00) decimal places. 1. Material Costs are expected to increase by 6.00%. 2. Labor Costs are expected to increase by 2.50%. 3. Variable Overhead is expected to increase by 3.00%. 4. Fixed Overhead is expected to increase to $280,000. 5. Fixed Administrative expenses are expected to increase to $58,000. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 6.50%. 7. Fixed selling expenses are expected to be $27,000 in 202. 8. Variable administrative expenses (measured a per lamp basis) are expected to increase by 2.50%. On the following schedule develop the following figures: 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 2- 20x2 Projected Variable Unit Cost per lamp. 3- 20x2 Projected Fixed Costs. Assume actual cash receipts and disbursements will follow the pattern below: (Note: Receivables and Payables of 12/31/1 will have a cash impact in 202.) 1. 18.00% of sales for the year are made in November and December. Since our customers have 60 day terms those funds will be collected be collected in January and February. 2. 88.00% of material purchases will be paid during the year, the remaining portion will be paid in Januay or February. 3. All other manufacturing and operating costs are paid for when incurred. 4. The budgeted depreciation expense is equal to 0.6% of the fixed manufacturing, selling and administrative expenses. 5. Minimum Cash Balance needed for 202,$160,000. I See The Light Projected Cash Budget For the Year Ending December 31, 20x2 Round dollars to two General Information The I See The Light Company has a related company that produces the figurines. They use process costing in the molding department. The factory overhead is applied at a rate of 50% of direct labor dollars. The material is added at the beginning of the process. The labor and overhead costs are assumed to be added uniformly throughout. Month of January Selected information for January is presented below. Note that the applied overhead rate was 50% of direct labor costs in the molding department. Molding Department Goods in-process as of January 1 were 3,500 figurines at a cost of $12,660.00. Of this amount, $5,250.00 was from raw materials added, $4,940.00 for labor and $2,470.00 for overhead. These 3,500 figurines were assumed to be 10.00% complete as to labor and overhead. During January, 26,000 units were started, $38,410.00 of materials and $77,130.00 of labor costs were incurred. The 6,000 figurines that were in-process at the end of January were assumed to be 80.00% complete to labor and overhead. All figurines in January passed inspection. On January 1, 20x2, Division S began Job 2407 for the Client, THE BIG CHILDREN STORE. The job called for 4,000 customized lamps. The following set of transactions occurred from January 5 until the job was completed: 5-Jan Purchased 4,050 Lamp Kits @ \$16.30 per kit. 9-Jan 4,100 sets of Lamp Kits were requisitioned. 17-Jan Payroll of 560 Direct Labor Hours @ $9.50 per hour. 30-Jan Payroll of 610 Direct Labor Hours @ $9.75 per hour. 30-Jan 3,990 lamps were completed and shipped. All materials requisitioned were used or scrapped, and are a cost of normal processing. Round to two places, \$\#\#.\#\# {13.01} Cost of nimat I ahar Innuimend in Mannifanturina lnh3107 - Cost of {13.03} Cost of manuifanturinn ann lnmn {13.04} Note: Show favorable variances as negative numbers What was the variable overhead efficiency variance? j1} What was the variable OH spending variance? 32} What is the fixed OH volume (denominator) variance? 33} What is the fixed OH spending variance? 34} He has priced a machine at a national member only warehouse for $2,050. The machine should be usable for 5 years, after which it would be inefficient, obsolete and would have to be disposed of at the dump. Big Al believes that 8 cans a day will be purchased. The plant is open five days a week, 50 weeks per year. A case of soda (24 cans) costs $6.00 and Big Al believes that a price of $.65 per can would win him good will. What is the e {17.01} What is the contrit {17.02} How many cans of soda must be sold each vear to breakeven? (Round up to zero places. \#\#\#.\#\#\# cans) {17.03} Annual incrementel anch inflmase from tha ondo manhinas Iraindad ta thas nlanne $H+H {17.04} What is the paybe ... {17.05} {17.06} What is the internal rate of reth irn Dirk the clncect interect rate from the tahlec an nane 18 {17.07} I See The Light Projected Income Statement For the Period Ending December 31, 20x1 I See The Light Projected Balance Sheet As of December 31, 20x1 Current Assets Cash Accounts Receivable Inventory Raw Material \begin{tabular}{lrrr} Lamp Kits & 500@ & $16.00 & 8,000.00 \\ Work in Process & 0 & & - \\ Finished Goods & 3000@ & $30.00 & 90,000.00 \\ \hline Current Assets & & & 200,210.00 \end{tabular} Fixed Assets Equipment Accumulated Depreciation Total Fixed Assets Total Assets Current Liabilities Accounts Payable Total Liabilities \begin{tabular}{ll} $ & 54,000.00 \\ \hline$ & 54,000.00 \end{tabular} Stockholder's Equity Common Stock Retained Eamings Total Stockholder's Equity Total Liabilities and Stockholder's Equity 159,410.00$213,410.00 PART 1 Fixed and Variable Cost Determinations Unit Cost Calculations The projected cost of a lamp is calculated based upon the projected increases or decreases to current costs. The present costs to manufacture one lamp are: Expected increases for 202 When calculating projected increases round to TWO ($0.00) decimal places. 1. Material Costs are expected to increase by 6.00%. 2. Labor Costs are expected to increase by 2.50%. 3. Variable Overhead is expected to increase by 3.00%. 4. Fixed Overhead is expected to increase to $280,000. 5. Fixed Administrative expenses are expected to increase to $58,000. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 6.50%. 7. Fixed selling expenses are expected to be $27,000 in 202. 8. Variable administrative expenses (measured a per lamp basis) are expected to increase by 2.50%. On the following schedule develop the following figures: 1- 20x2 Projected Variable Manufacturing Unit Cost of a lamp. 2- 20x2 Projected Variable Unit Cost per lamp. 3- 20x2 Projected Fixed Costs. Assume actual cash receipts and disbursements will follow the pattern below: (Note: Receivables and Payables of 12/31/1 will have a cash impact in 202.) 1. 18.00% of sales for the year are made in November and December. Since our customers have 60 day terms those funds will be collected be collected in January and February. 2. 88.00% of material purchases will be paid during the year, the remaining portion will be paid in Januay or February. 3. All other manufacturing and operating costs are paid for when incurred. 4. The budgeted depreciation expense is equal to 0.6% of the fixed manufacturing, selling and administrative expenses. 5. Minimum Cash Balance needed for 202,$160,000. I See The Light Projected Cash Budget For the Year Ending December 31, 20x2 Round dollars to two General Information The I See The Light Company has a related company that produces the figurines. They use process costing in the molding department. The factory overhead is applied at a rate of 50% of direct labor dollars. The material is added at the beginning of the process. The labor and overhead costs are assumed to be added uniformly throughout. Month of January Selected information for January is presented below. Note that the applied overhead rate was 50% of direct labor costs in the molding department. Molding Department Goods in-process as of January 1 were 3,500 figurines at a cost of $12,660.00. Of this amount, $5,250.00 was from raw materials added, $4,940.00 for labor and $2,470.00 for overhead. These 3,500 figurines were assumed to be 10.00% complete as to labor and overhead. During January, 26,000 units were started, $38,410.00 of materials and $77,130.00 of labor costs were incurred. The 6,000 figurines that were in-process at the end of January were assumed to be 80.00% complete to labor and overhead. All figurines in January passed inspection. On January 1, 20x2, Division S began Job 2407 for the Client, THE BIG CHILDREN STORE. The job called for 4,000 customized lamps. The following set of transactions occurred from January 5 until the job was completed: 5-Jan Purchased 4,050 Lamp Kits @ \$16.30 per kit. 9-Jan 4,100 sets of Lamp Kits were requisitioned. 17-Jan Payroll of 560 Direct Labor Hours @ $9.50 per hour. 30-Jan Payroll of 610 Direct Labor Hours @ $9.75 per hour. 30-Jan 3,990 lamps were completed and shipped. All materials requisitioned were used or scrapped, and are a cost of normal processing. Round to two places, \$\#\#.\#\# {13.01} Cost of nimat I ahar Innuimend in Mannifanturina lnh3107 - Cost of {13.03} Cost of manuifanturinn ann lnmn {13.04} Note: Show favorable variances as negative numbers What was the variable overhead efficiency variance? j1} What was the variable OH spending variance? 32} What is the fixed OH volume (denominator) variance? 33} What is the fixed OH spending variance? 34} He has priced a machine at a national member only warehouse for $2,050. The machine should be usable for 5 years, after which it would be inefficient, obsolete and would have to be disposed of at the dump. Big Al believes that 8 cans a day will be purchased. The plant is open five days a week, 50 weeks per year. A case of soda (24 cans) costs $6.00 and Big Al believes that a price of $.65 per can would win him good will. What is the e {17.01} What is the contrit {17.02} How many cans of soda must be sold each vear to breakeven? (Round up to zero places. \#\#\#.\#\#\# cans) {17.03} Annual incrementel anch inflmase from tha ondo manhinas Iraindad ta thas nlanne $H+H {17.04} What is the paybe ... {17.05} {17.06} What is the internal rate of reth irn Dirk the clncect interect rate from the tahlec an nane 18 {17.07}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts