Question: Hi, I need help with these exercise E6-9 Estimating Bad Debts from Receivables Balances The following information is extracted from Shelton l0 6-5 Corporation's accounting

Hi, I need help with these exercise

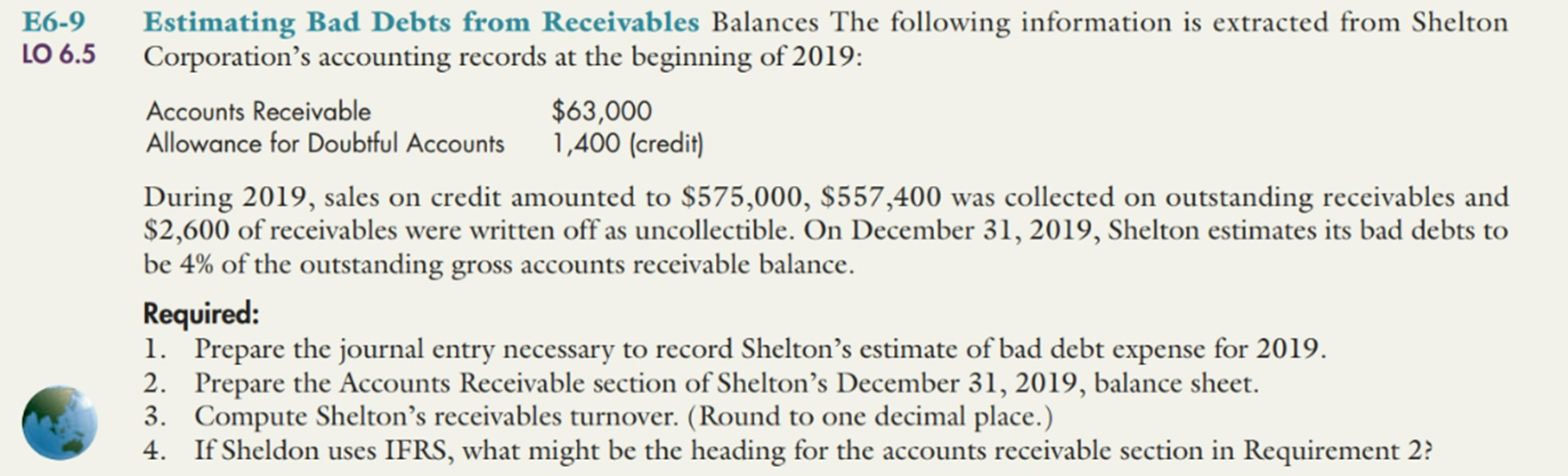

E6-9 Estimating Bad Debts from Receivables Balances The following information is extracted from Shelton l0 6-5 Corporation's accounting records at the beginning of 2019: Accounts Receivable $63,000 Allowance for Doubtful Accounts 1,400 (credit) During 2019, sales on credit amounted to $575,000, $557,400 was collected on outstanding receivables and $2,600 of receivables were written off as uncollectible. On December 31, 2019, Shelton estimates its bad debts to be 4% of the outstanding gross accounts receivable balance. Required: 1. Prepare the journal entry necessary to record Shelton's estimate of bad debt expense for 2019. 2. Prepare the Accounts Receivable section of Shelton's December 31, 2019, balance sheet. . 3. Compute Shelton's receivables turnover. (Round to one decimal place.) 4 IfSheldon uses IFRS, what might be the heading for the accounts receivable section in Requirement 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts