Question: Hi, I need help with this accounting question: Current Attempt in Progress Sunland Kitchen is a small restaurant in Waterloo, Ontario that pays its employees

Hi, I need help with this accounting question:

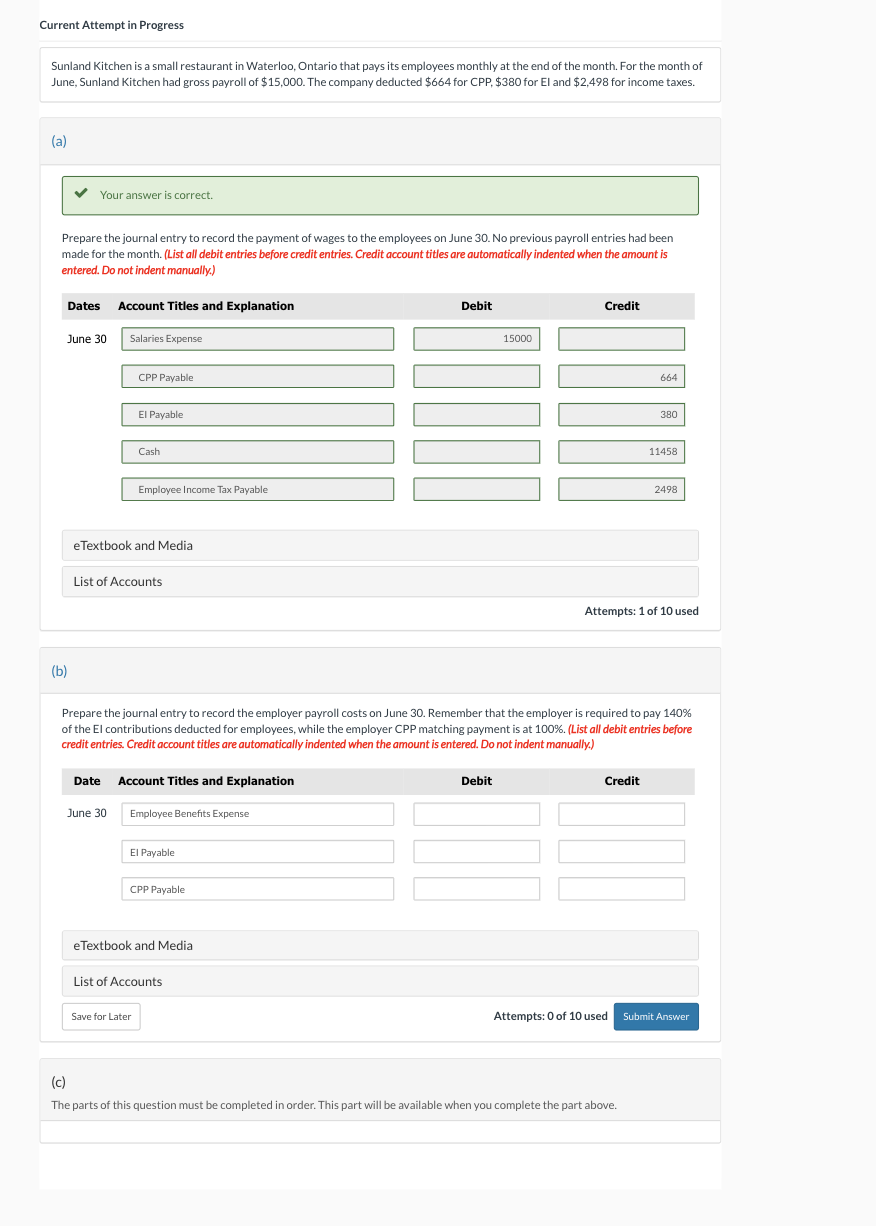

Current Attempt in Progress Sunland Kitchen is a small restaurant in Waterloo, Ontario that pays its employees monthly at the end of the month. For the month of June, Sunland Kitchen had gross payroll of $15,000. The company deducted $664 for CPP, $380 for El and $2,498 for income taxes. (a) Your answer is correct. Prepare the journal entry to record the payment of wages to the employees on June 30. No previous payroll entries had been made for the month. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Dates Account Titles and Explanation Debit Credit June 30 Salaries Expense 15000 CPP Payable 664 El Payable 3.80 Cash 11458 Employee Income Tax Payable 2498 eTextbook and Media List of Accounts Attempts: 1 of 10 used (b Prepare the journal entry to record the employer payroll costs on June 30. Remember that the employer is required to pay 140% of the El contributions deducted for employees, while the employer CPP matching payment is at 100%. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit June 30 Employee Benefits Expense El Payable CPP Payable eTextbook and Media List of Accounts Save for Later Attempts: 0 of 10 used Submit Answer (c) The parts of this question must be completed in order. This part will be available when you complete the part above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts