Question: Hi! I need help with this! Luke will use the straight-line method (assuming no residual value) to record the depreciation of the equipment. Luke has

Hi! I need help with this!

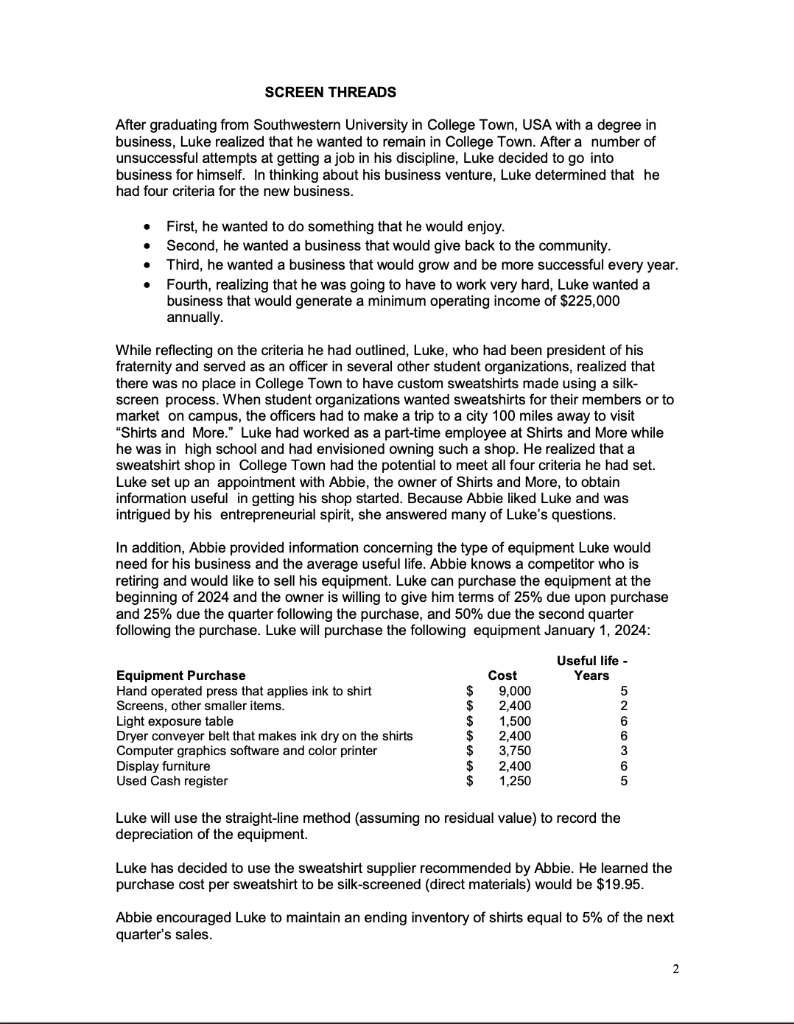

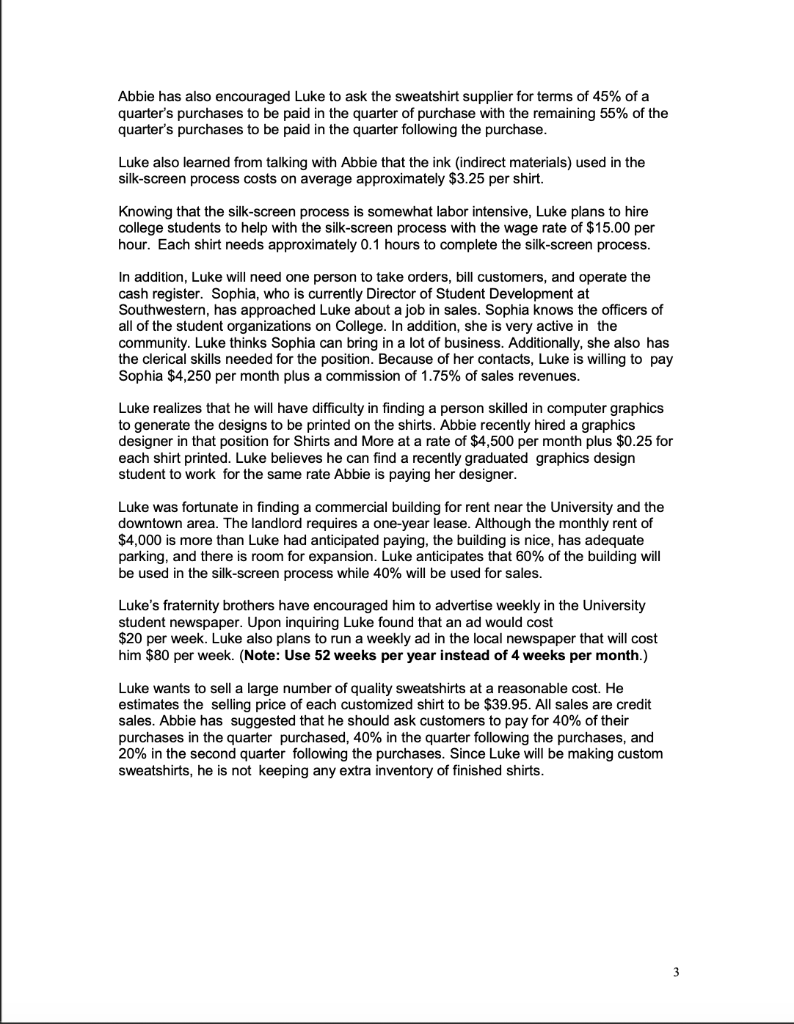

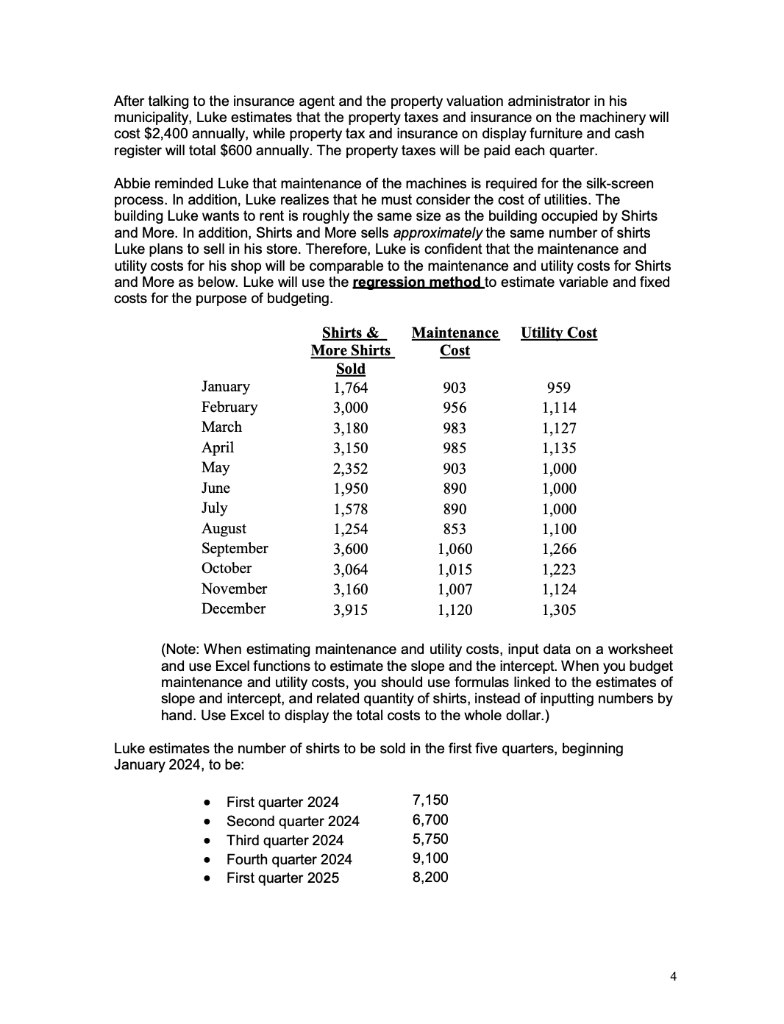

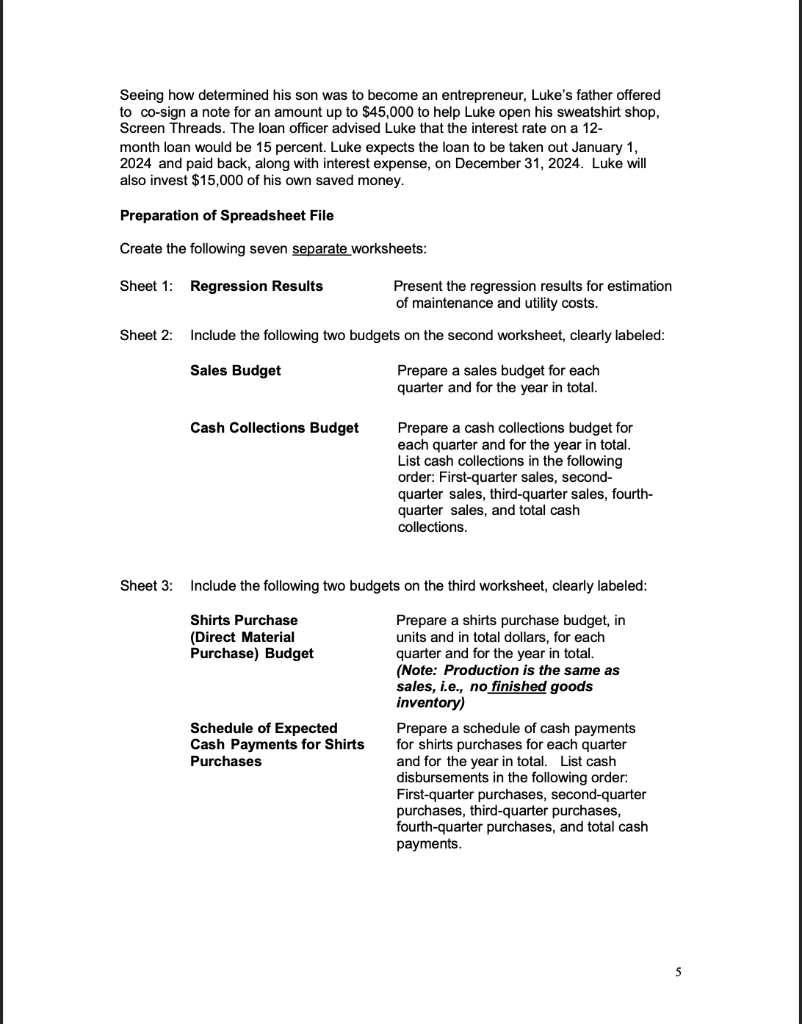

Luke will use the straight-line method (assuming no residual value) to record the depreciation of the equipment. Luke has decided to use the sweatshirt supplier recommended by Abbie. He learned the purchase cost per sweatshirt to be silk-screened (direct materials) would be $19.95. Abbie encouraged Luke to maintain an ending inventory of shirts equal to 5% of the next quarter's sales. Abbie has also encouraged Luke to ask the sweatshirt supplier for terms of 45% of a quarter's purchases to be paid in the quarter of purchase with the remaining 55% of the quarter's purchases to be paid in the quarter following the purchase. Luke also learned from talking with Abbie that the ink (indirect materials) used in the silk-screen process costs on average approximately $3.25 per shirt. Knowing that the silk-screen process is somewhat labor intensive, Luke plans to hire college students to help with the silk-screen process with the wage rate of $15.00 per hour. Each shirt needs approximately 0.1 hours to complete the silk-screen process. In addition, Luke will need one person to take orders, bill customers, and operate the cash register. Sophia, who is currently Director of Student Development at Southwestern, has approached Luke about a job in sales. Sophia knows the officers of all of the student organizations on College. In addition, she is very active in the community. Luke thinks Sophia can bring in a lot of business. Additionally, she also has the clerical skills needed for the position. Because of her contacts, Luke is willing to pay Sophia $4,250 per month plus a commission of 1.75% of sales revenues. Luke realizes that he will have difficulty in finding a person skilled in computer graphics to generate the designs to be printed on the shirts. Abbie recently hired a graphics designer in that position for Shirts and More at a rate of $4,500 per month plus $0.25 for each shirt printed. Luke believes he can find a recently graduated graphics design student to work for the same rate Abbie is paying her designer. Luke was fortunate in finding a commercial building for rent near the University and the downtown area. The landlord requires a one-year lease. Although the monthly rent of $4,000 is more than Luke had anticipated paying, the building is nice, has adequate parking, and there is room for expansion. Luke anticipates that 60% of the building will be used in the silk-screen process while 40% will be used for sales. Luke's fraternity brothers have encouraged him to advertise weekly in the University student newspaper. Upon inquiring Luke found that an ad would cost $20 per week. Luke also plans to run a weekly ad in the local newspaper that will cost him $80 per week. (Note: Use 52 weeks per year instead of 4 weeks per month.) Luke wants to sell a large number of quality sweatshirts at a reasonable cost. He estimates the selling price of each customized shirt to be $39.95. All sales are credit sales. Abbie has suggested that he should ask customers to pay for 40% of their purchases in the quarter purchased, 40% in the quarter following the purchases, and 20% in the second quarter following the purchases. Since Luke will be making custom sweatshirts, he is not keeping any extra inventory of finished shirts. After talking to the insurance agent and the property valuation administrator in his municipality, Luke estimates that the property taxes and insurance on the machinery will cost $2,400 annually, while property tax and insurance on display furniture and cash register will total $600 annually. The property taxes will be paid each quarter. Abbie reminded Luke that maintenance of the machines is required for the silk-screen process. In addition, Luke realizes that he must consider the cost of utilities. The building Luke wants to rent is roughly the same size as the building occupied by Shirts and More. In addition, Shirts and More sells approximately the same number of shirts Luke plans to sell in his store. Therefore, Luke is confident that the maintenance and utility costs for his shop will be comparable to the maintenance and utility costs for Shirts and More as below. Luke will use the regression method to estimate variable and fixed costs for the purpose of budgeting. (Note: When estimating maintenance and utility costs, input data on a worksheet and use Excel functions to estimate the slope and the intercept. When you budget maintenance and utility costs, you should use formulas linked to the estimates of slope and intercept, and related quantity of shirts, instead of inputting numbers by hand. Use Excel to display the total costs to the whole dollar.) Luke estimates the number of shirts to be sold in the first five quarters, beginning January 2024 to be: Seeing how determined his son was to become an entrepreneur, Luke's father offered to co-sign a note for an amount up to $45,000 to help Luke open his sweatshirt shop, Screen Threads. The loan officer advised Luke that the interest rate on a 12month loan would be 15 percent. Luke expects the loan to be taken out January 1 , 2024 and paid back, along with interest expense, on December 31, 2024. Luke will also invest $15,000 of his own saved money. Preparation of Spreadsheet File Create the following seven separate worksheets: Sheet 1: Regression Results Present the regression results for estimation of maintenance and utility costs. Sheet 2: Include the following two budgets on the second worksheet, clearly labeled: Sheet 3: Include the following two budgets on the third worksheet, clearly labeled: Luke will use the straight-line method (assuming no residual value) to record the depreciation of the equipment. Luke has decided to use the sweatshirt supplier recommended by Abbie. He learned the purchase cost per sweatshirt to be silk-screened (direct materials) would be $19.95. Abbie encouraged Luke to maintain an ending inventory of shirts equal to 5% of the next quarter's sales. Abbie has also encouraged Luke to ask the sweatshirt supplier for terms of 45% of a quarter's purchases to be paid in the quarter of purchase with the remaining 55% of the quarter's purchases to be paid in the quarter following the purchase. Luke also learned from talking with Abbie that the ink (indirect materials) used in the silk-screen process costs on average approximately $3.25 per shirt. Knowing that the silk-screen process is somewhat labor intensive, Luke plans to hire college students to help with the silk-screen process with the wage rate of $15.00 per hour. Each shirt needs approximately 0.1 hours to complete the silk-screen process. In addition, Luke will need one person to take orders, bill customers, and operate the cash register. Sophia, who is currently Director of Student Development at Southwestern, has approached Luke about a job in sales. Sophia knows the officers of all of the student organizations on College. In addition, she is very active in the community. Luke thinks Sophia can bring in a lot of business. Additionally, she also has the clerical skills needed for the position. Because of her contacts, Luke is willing to pay Sophia $4,250 per month plus a commission of 1.75% of sales revenues. Luke realizes that he will have difficulty in finding a person skilled in computer graphics to generate the designs to be printed on the shirts. Abbie recently hired a graphics designer in that position for Shirts and More at a rate of $4,500 per month plus $0.25 for each shirt printed. Luke believes he can find a recently graduated graphics design student to work for the same rate Abbie is paying her designer. Luke was fortunate in finding a commercial building for rent near the University and the downtown area. The landlord requires a one-year lease. Although the monthly rent of $4,000 is more than Luke had anticipated paying, the building is nice, has adequate parking, and there is room for expansion. Luke anticipates that 60% of the building will be used in the silk-screen process while 40% will be used for sales. Luke's fraternity brothers have encouraged him to advertise weekly in the University student newspaper. Upon inquiring Luke found that an ad would cost $20 per week. Luke also plans to run a weekly ad in the local newspaper that will cost him $80 per week. (Note: Use 52 weeks per year instead of 4 weeks per month.) Luke wants to sell a large number of quality sweatshirts at a reasonable cost. He estimates the selling price of each customized shirt to be $39.95. All sales are credit sales. Abbie has suggested that he should ask customers to pay for 40% of their purchases in the quarter purchased, 40% in the quarter following the purchases, and 20% in the second quarter following the purchases. Since Luke will be making custom sweatshirts, he is not keeping any extra inventory of finished shirts. After talking to the insurance agent and the property valuation administrator in his municipality, Luke estimates that the property taxes and insurance on the machinery will cost $2,400 annually, while property tax and insurance on display furniture and cash register will total $600 annually. The property taxes will be paid each quarter. Abbie reminded Luke that maintenance of the machines is required for the silk-screen process. In addition, Luke realizes that he must consider the cost of utilities. The building Luke wants to rent is roughly the same size as the building occupied by Shirts and More. In addition, Shirts and More sells approximately the same number of shirts Luke plans to sell in his store. Therefore, Luke is confident that the maintenance and utility costs for his shop will be comparable to the maintenance and utility costs for Shirts and More as below. Luke will use the regression method to estimate variable and fixed costs for the purpose of budgeting. (Note: When estimating maintenance and utility costs, input data on a worksheet and use Excel functions to estimate the slope and the intercept. When you budget maintenance and utility costs, you should use formulas linked to the estimates of slope and intercept, and related quantity of shirts, instead of inputting numbers by hand. Use Excel to display the total costs to the whole dollar.) Luke estimates the number of shirts to be sold in the first five quarters, beginning January 2024 to be: Seeing how determined his son was to become an entrepreneur, Luke's father offered to co-sign a note for an amount up to $45,000 to help Luke open his sweatshirt shop, Screen Threads. The loan officer advised Luke that the interest rate on a 12month loan would be 15 percent. Luke expects the loan to be taken out January 1 , 2024 and paid back, along with interest expense, on December 31, 2024. Luke will also invest $15,000 of his own saved money. Preparation of Spreadsheet File Create the following seven separate worksheets: Sheet 1: Regression Results Present the regression results for estimation of maintenance and utility costs. Sheet 2: Include the following two budgets on the second worksheet, clearly labeled: Sheet 3: Include the following two budgets on the third worksheet, clearly labeled

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts