Question: Hi I need some help on connect problem. There are two pictures with two different tables. Thanks Carlos Company had the following stock outstanding and

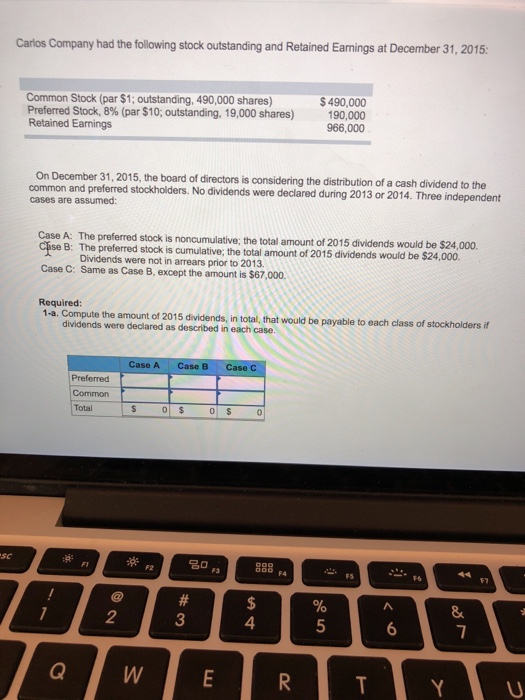

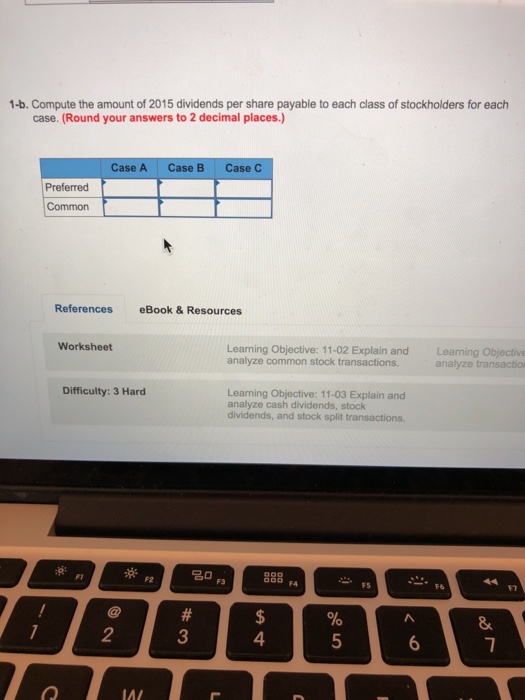

Carlos Company had the following stock outstanding and Retained Earnings at December 31, 2015: 490,000 Common Stock (par $1; outstanding, 490,000 shares) Preferred Stock, 8% (par $10; outstanding, 19,000 shares) Retained Earnings 190,000 966,000 On December 31,2015, the board of directors is considering the distribution of a cash dividend to the common and preferred stockholders. No dividends were declared during 2013 or 2014. Three independent cases are assumed Case A: B: The preferred stock is noncumulative; the total amount of 2015 dividends would be $24,000. The preferred stock is cumulative; the total amount of 2015 dividends would be $24,000. Dividends were not in arrears prior to 2013. Case C: Same as Case B, except the amount is $67,000. Required 1a. Compute the amount of 2015 dividends, in total, that would be payable to each class of stockholders if dividends were declared as described in each case. Case A Case B Case C Preferred Total ?0,3 88F FS 2 3 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts