Question: HI I NEED SOMEONE TO HELP ME DO THE WORK SHEET PART OF THIS QUESTION: Prepare a worksheet as of December 31 ,2018. ^^^ THE

HI I NEED SOMEONE TO HELP ME DO THE WORK SHEET PART OF THIS QUESTION:

Prepare a worksheet as of December 31 ,2018.

^^^ THE REST IS DONE. WHAT I HAVE DONE IS ON THE BOTTOM SO FAR. thank you

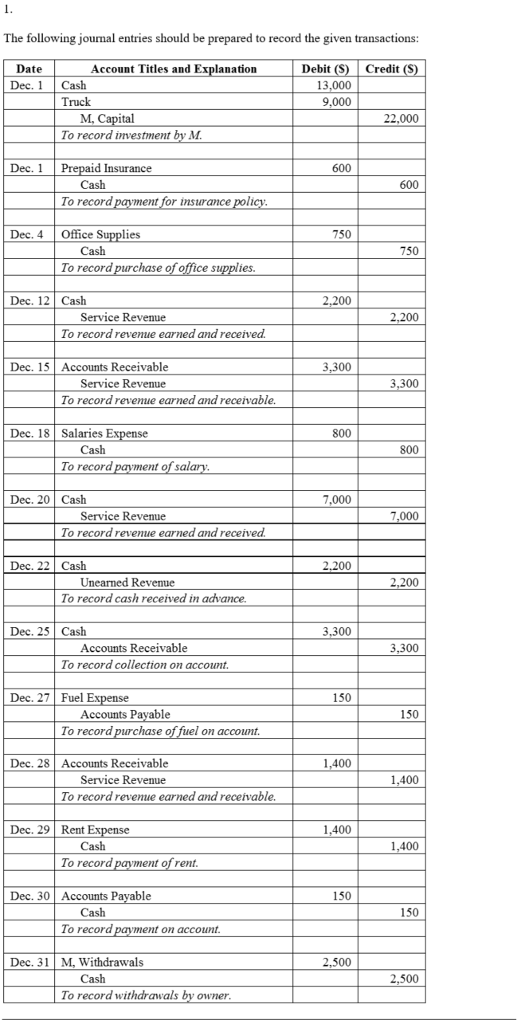

Requirement 1. Record each transaction in the journal. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries.)

Requirement 1) Dec.1:Murphy Delivery Service began operations by receiving $13,000 cash and a truck with a fair value of $9,000 from Russ Murphy.The business issued Murphy

shares of common stock in exchange for this contribution.

-----------------------------------------------

Requirement 2)

Record each transaction in the journal using the following chart of accounts. Explanations are not required.

| Cash | Retained Earnings | |

| Accounts Receivable | Dividends | |

| Office Supplies | Income Summary | |

| Prepaid Insurance | Service Revenue | |

| Truck | Salaries Expense | |

| Accumulated DepreciationTruck | Depreciation ExpenseTruck | |

| Accounts Payable | Insurance Expense | |

| Salaries Payable | Fuel Expense | |

| Unearned Revenue | Rent Expense | |

| Common Stock | Supplies Expense |

------------------------------------------------------------------------------------------------

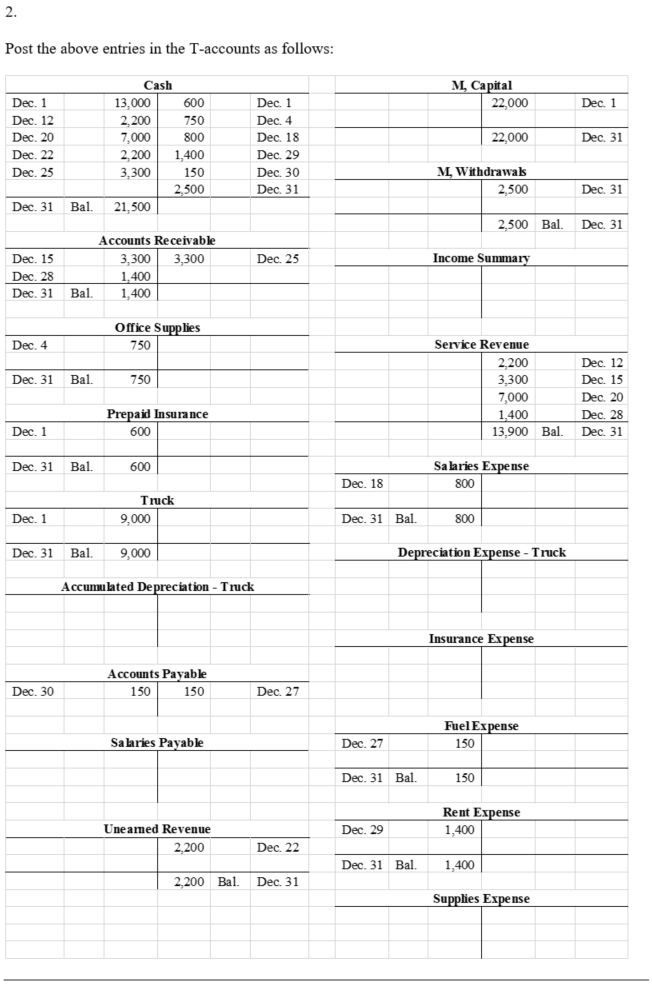

2.

Post the transactions in the T-accounts.

-----------------------------------------------------------------------

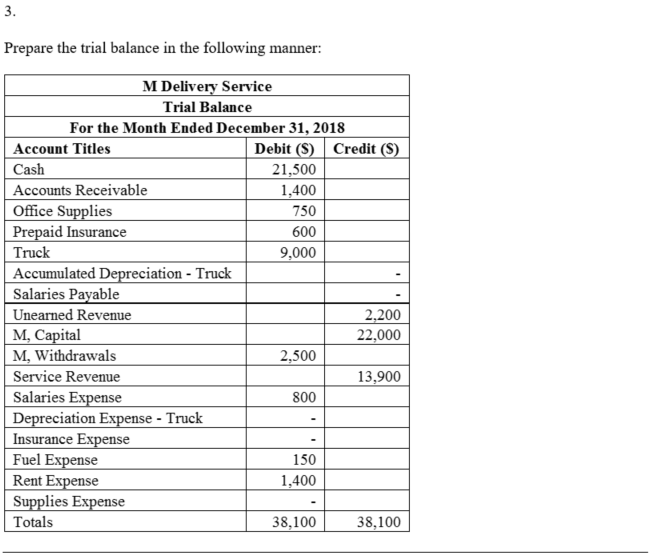

3.

Prepare an unadjusted trial balance as of December 31 , 2018.

----------------------------------------

4.

Prepare a worksheet as of December 31 ,2018.

-------------------------------

5.

Journalize the adjusting entries using the following adjustment data and also by reviewing the journal entries prepared in Requirement 1. Post adjusting entries to the T-accounts.

Adjustment data:

| a. | Accrued Salaries Expense, $ 800. |

| b. | Depreciation was recorded on the truck using the straight-line method. Assume a useful life of 5 years and a salvage value of$3,000. |

| c. | Prepaid Insurance for the month has expired. |

| d. | Office Supplies on hand, $ 450 |

| e. | Unearned Revenue earned during the month, $ 700 |

| f. | Accrued Service Revenue, $ 450 |

6.

Prepare an adjusted trial balance as of

December 31 ,2018

7.

Prepare Murphy Delivery Service's income statement and statement of retained earnings for the month ended December 31 2018

and the classified balance sheet on that date.On the income statement, list expenses in decreasing order by

amountthat is, the largest expense first, the smallest expense last.

8.

Journalize the closing entries and post to the T-accounts.

9.

Prepare a post-closing trial balance as of

The following journal entries should be prepared to record the given transactions: Debit (S) Credit (S) Date Dec. Cash Account Titles and Explanation 13,000 9,000 Truck M, Capital To record investment by M 22,000 Dec. 1 600 Cash To record payment for insurance pol 600 Dec. 4Office Supplies 750 Cash 750 To record purchase of office supplies. Dec. 12 Cash 200 Service Revenue 2,200 To record revenue earned and received Dec. 15 Accounts Receivable Service Revenue To record reveue earned and receivable. Dec. 18Salaries Expense 800 Cash To record payment of sal 800 Dec. 20 Cash 7,000 Service Revenue To record revenue earned and received 7,000 Dec. 22 Cash 2.200 Unearned Revenue 2,200 To record cash received in advance Dec. 25 Cash 3,300 Accounts Receivable To record collection on account 3,300 Dec. 27 Fuel Expense Accounts Payable 150 To record purchase on accont Dec. 28Accounts Receivable Service Revenue 1,400 To record revenue earned and receivable. Dec. 29 Rent E 1,400 Cash To record payment of rent 1,400 Dec. 30| Accounts Payable 150 Cash To record payment on account 150 Dec. 31 M, Withdrawals 2,500 Cash To record withdrawals by owner. Post the above entries in the T-accounts as follows: Cash M, Capital Dec. 1 Dec. 12 Dec. 20 Dec. 22 Dec. 25 Dec. 1 Dec. 4 Dec. 18 Dec. 29 Dec. 30 Dec. 31 13,000 600 22,000 22,000 M, Withdrawaks Dec. 1 2,200 750 7,000 2,200 1,400 3,300 800 Dec. 31 150 500 2,500 Dec. 31 Dec. 31 Bal. 21,500 2,500 Ba. Dec. 31 Accounts Receivable 3,300 3,300 Income Summan Dec. 15 Dec. 28 Dec. 25 1.400 Dec. 31 Bal. 1,400 Office Supplies Dec. 4 Service Revenue 2,200 3,300 7,000 1,400 750 Dec. 12 Dec. 15 Dec. 20 Dec. 28 13,900 Ba. Dec. 31 Dec. 3 Bal. 750 aid Insurance 600 Dec. 1 Dec. 31 Bal 600 Salaries Expense Dec. 18 800 Truck Dec. 1 9,000 Dec. 31 Bal. 800 Dec. 31 B 9,000 ciation E Truck Accumulated Depreciation Truck Insurance Expense Accounts Pavable Dec. 30 150 150 Dec. 27 Fuel Expense Salaries Payable 150 150 Rent Ex Dec. 27 Dec. 31 Bal. Uneamed Revenue Dec. 29 1,400 2,200 Dec. 22 Dec. 31 Bal. 1,400 ,200 Bal. Dec. 31 Supplies Expense Prepare the trial balance in the following manner: M Delivery Service Trial Balance For the Month Ended December 31,2018 Account Titles Cash Accounts Receivable Office Supplies Debit (S)Credit (S) 21,500 1,400 750 600 9.000 aid Insurance Truck Accumulated Salaries Pavable Unearned Revenue ciation - Truck 2.200 22,000 Capital M, Withdrawals Service Revenue Salaries Ex 2,500 13,900 800 ciation - Truck Insurance Fuel Expense Rent Expense Supplies Ex Totals se 150 1,400 38,100 38,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts