Question: Hi, I prepared the journal entries in part A, I just need help with part B making the balance sheet and P&L. I filled out

Hi,

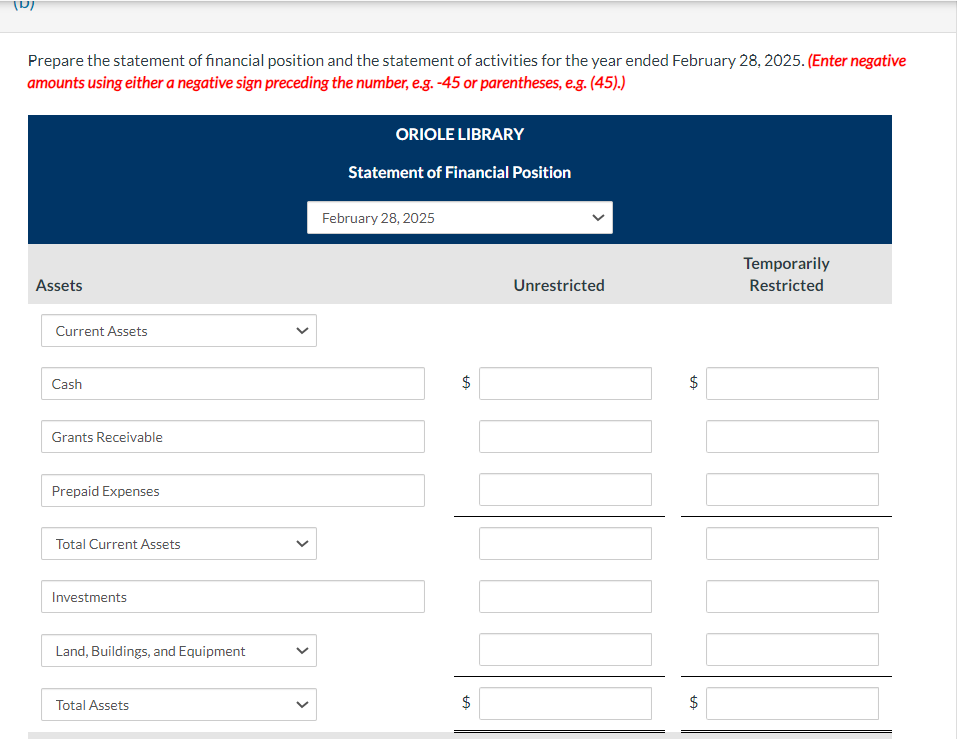

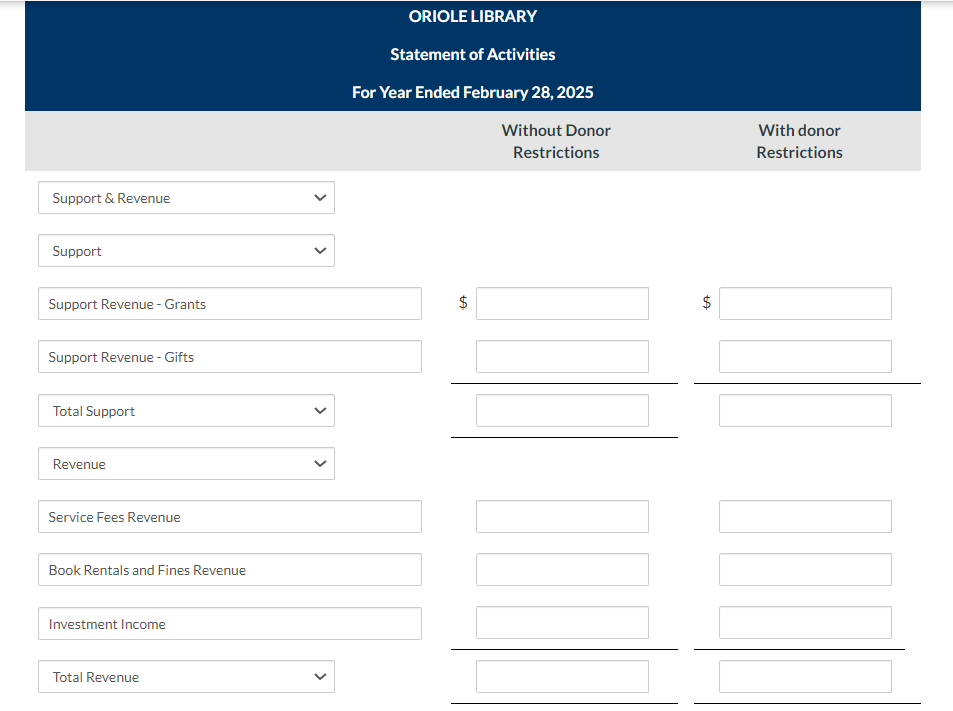

I prepared the journal entries in part A, I just need help with part B making the balance sheet and P&L. I filled out all of the categories in part B (Except for the one underneath revenues, not sure what that one is for), need help with the numbers they are looking for. I posted all of the info along with the journal entries I made below. Please show work so I can follow and learn.

((For the one above, You will see that the two cash is in red for #8, that was supposed to be Cash-unrestricted))

BELOW is what I need help with:

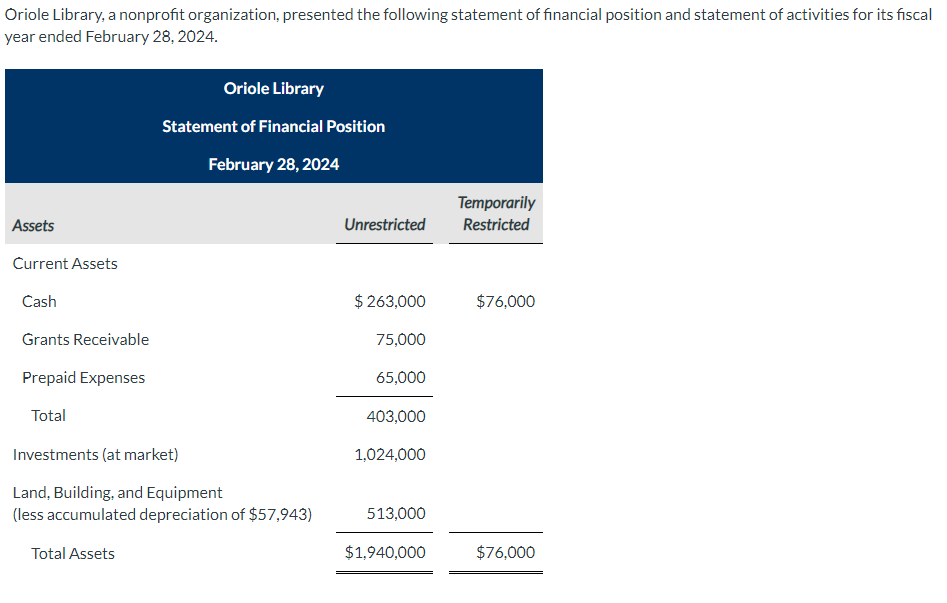

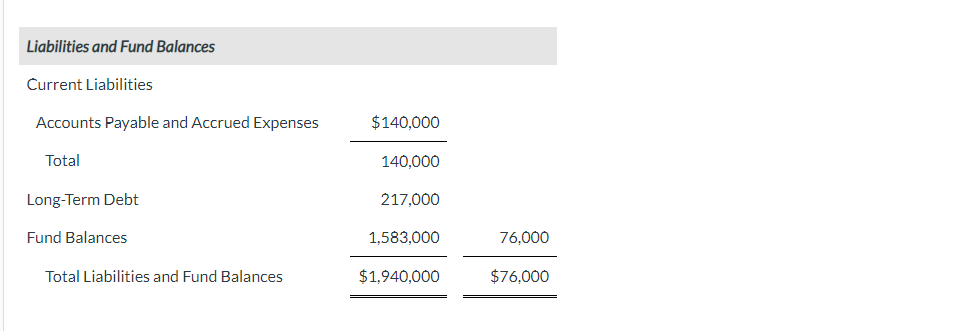

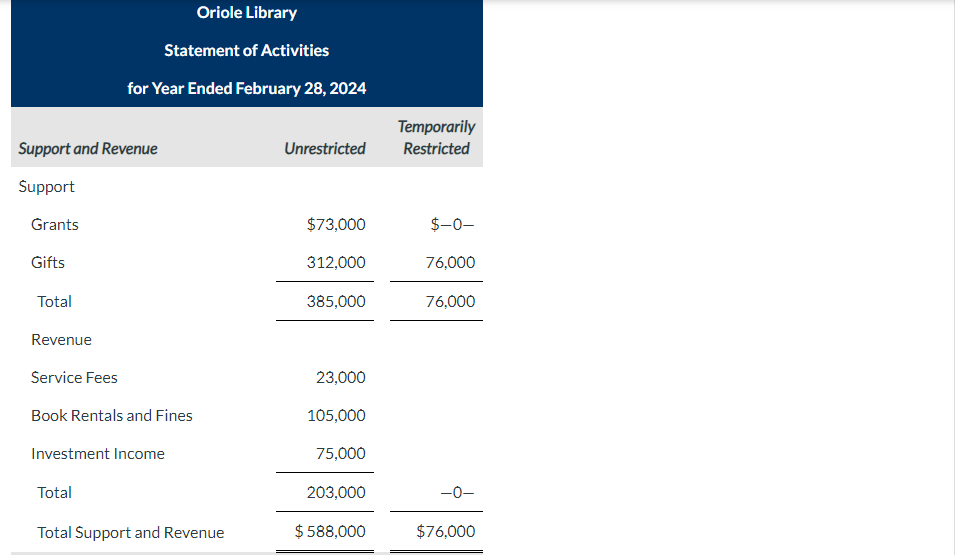

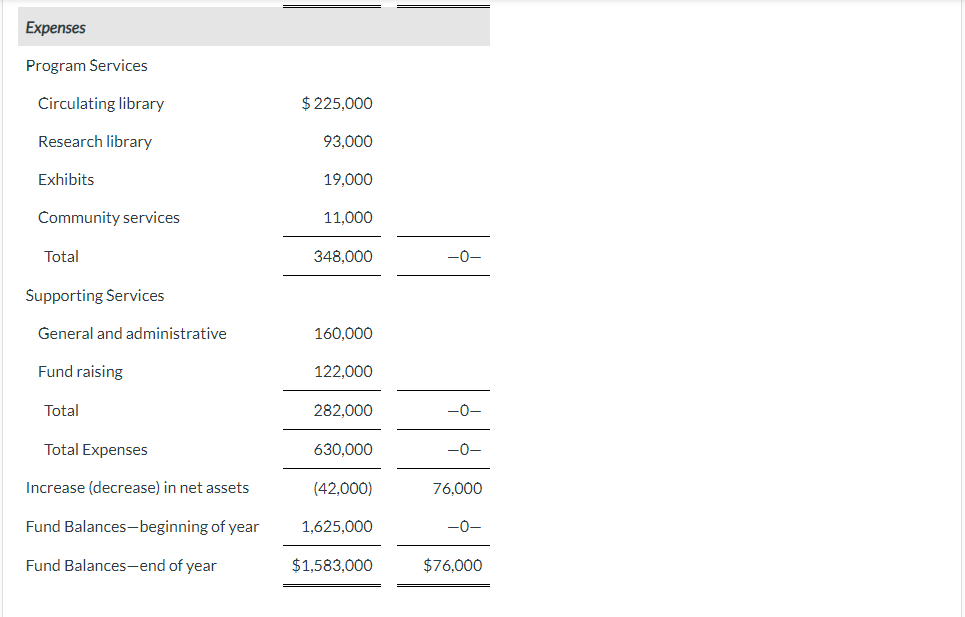

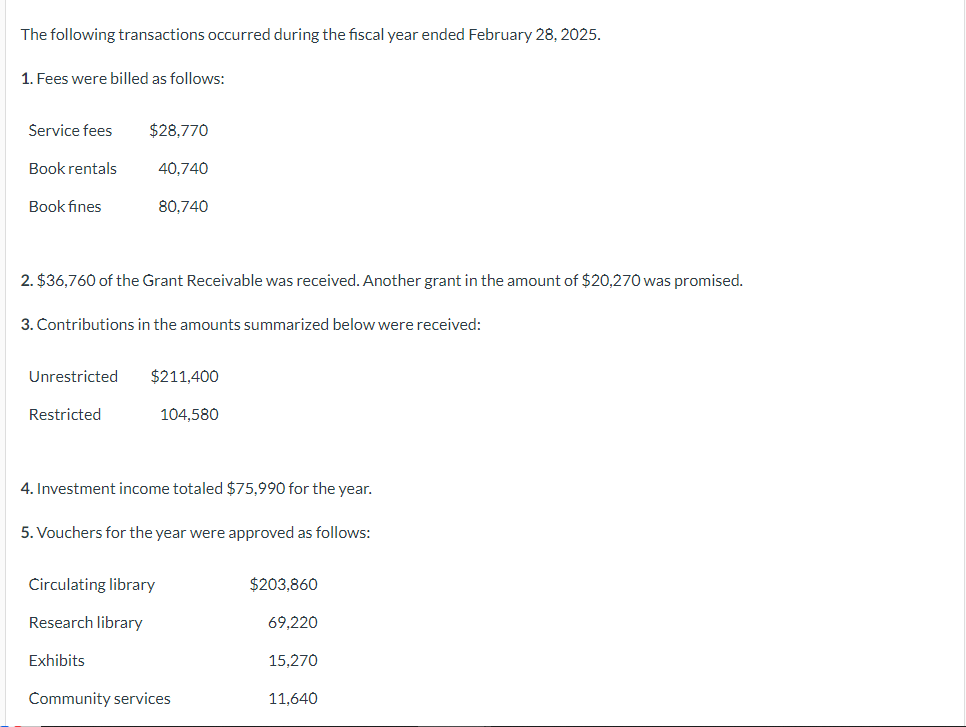

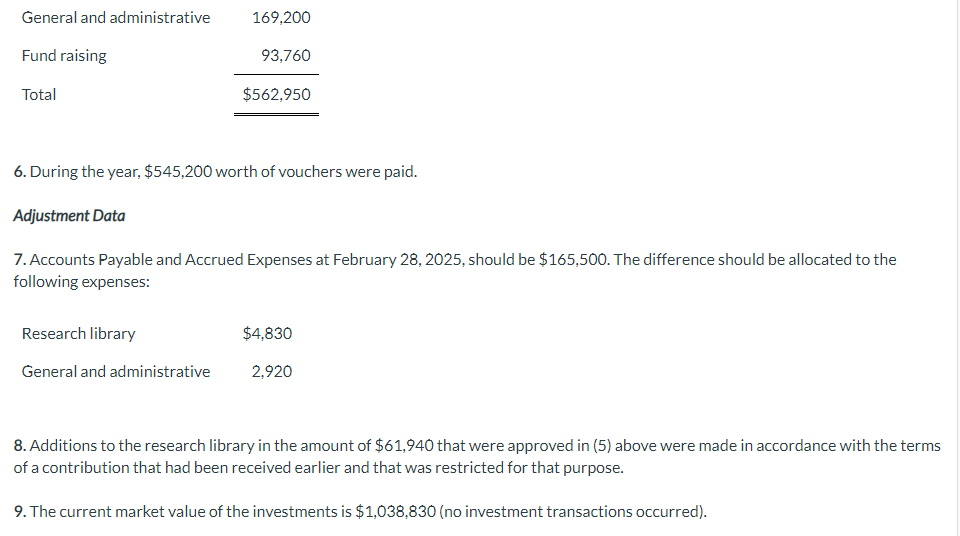

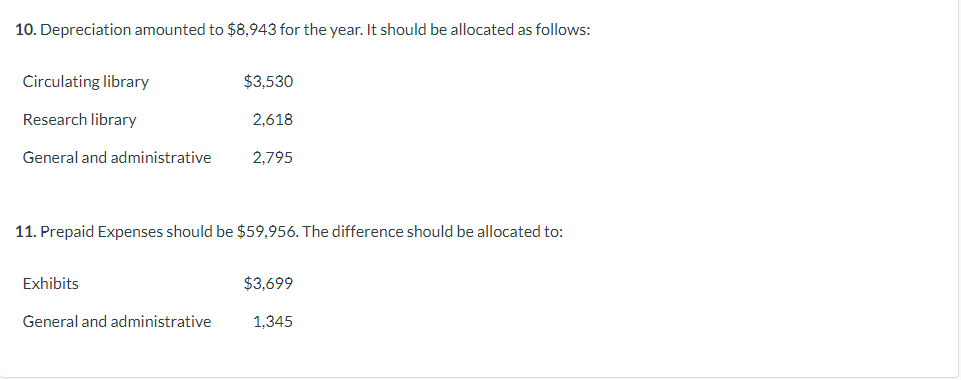

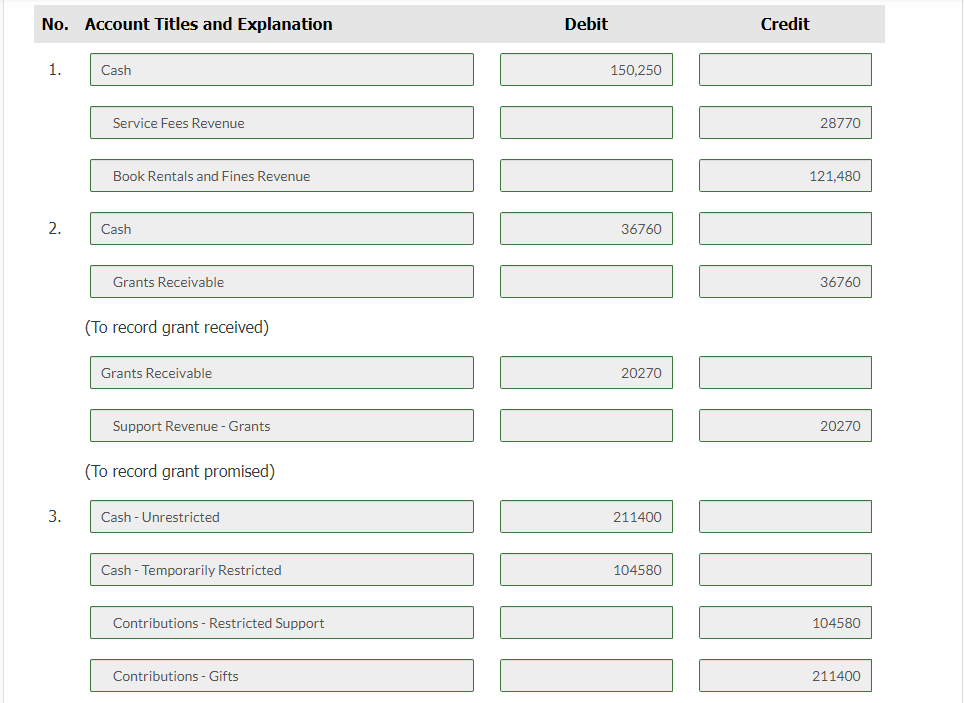

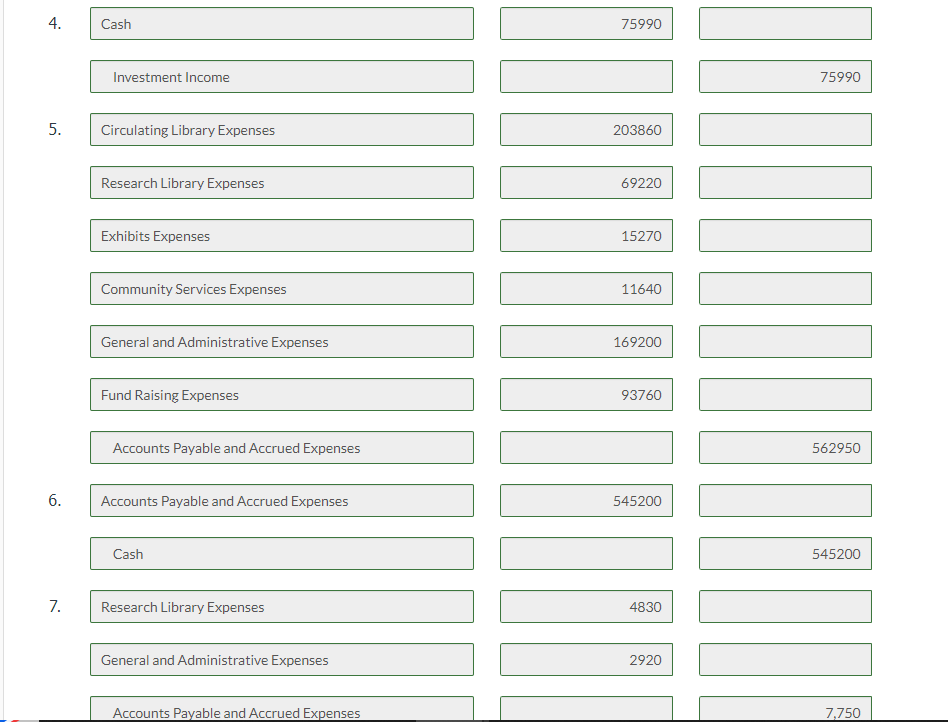

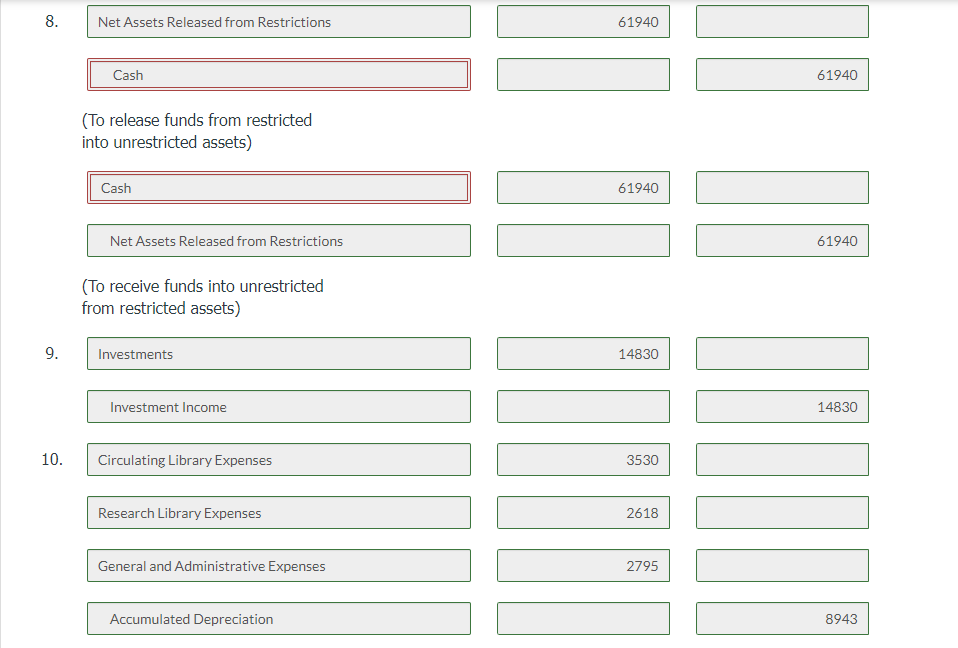

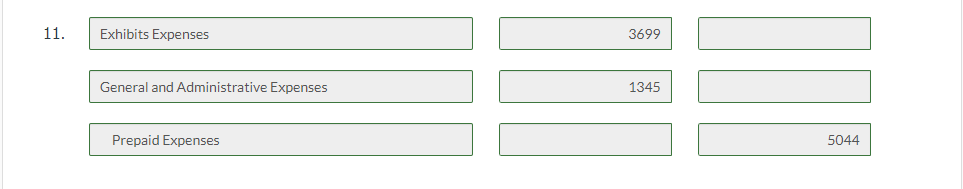

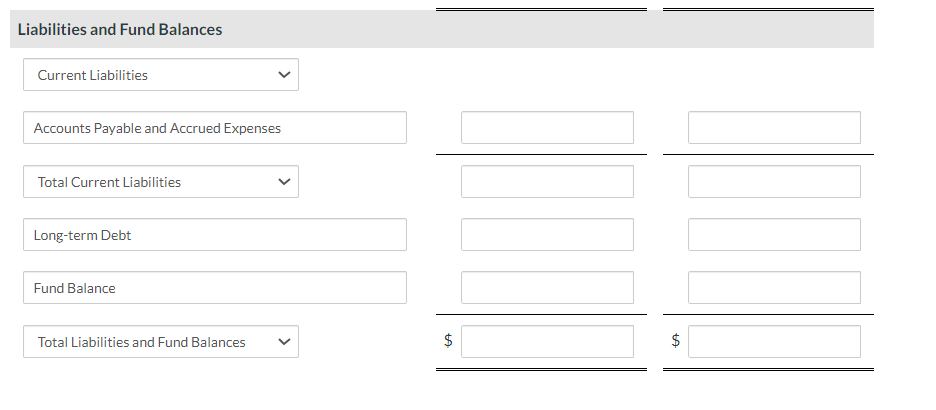

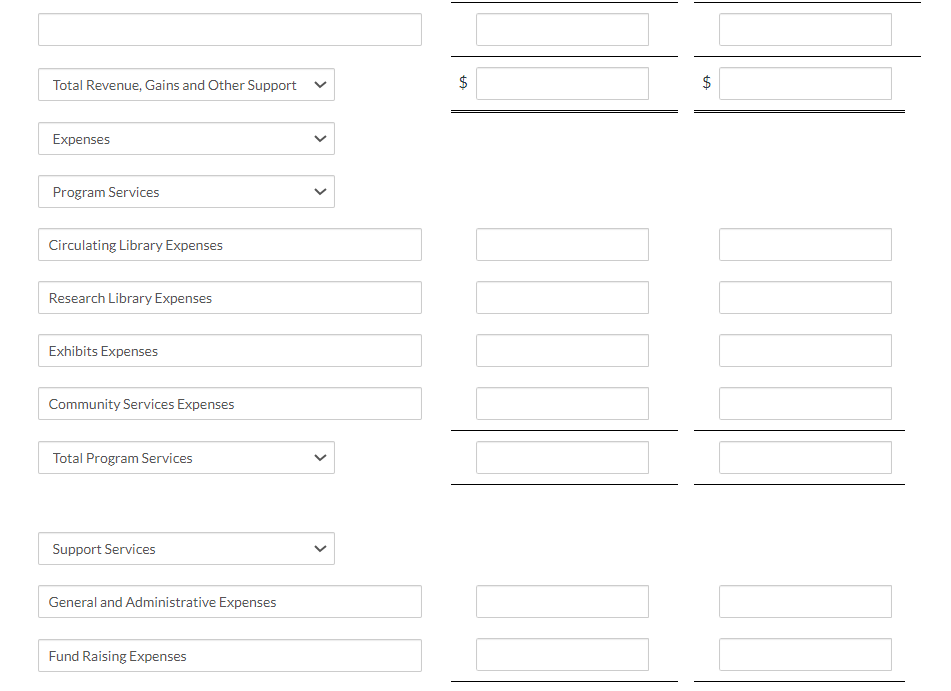

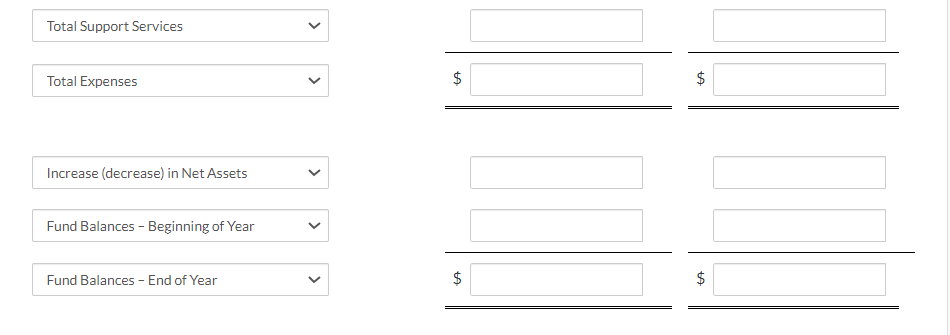

Oriole Library, a nonprofit organization, presented the following statement of financial position and statement of activities for its fiscal year ended February 28, 2024. Liabilities and Fund Balances Current Liabilities Oriole Library Statement of Activities for Year Ended February 28, 2024 Expenses Program Services \begin{tabular}{lrr} Circulating library & $225,000 \\ Research library & 93,000 \\ Exhibits & 19,000 \\ Community services & 11,000 & \\ \( {348,000} &{-0-} \\ {\hline \text { Total }} &{ } \) \end{tabular} Supporting Services The following transactions occurred during the fiscal year ended February 28, 2025. 1. Fees were billed as follows: 2. $36,760 of the Grant Receivable was received. Another grant in the amount of $20,270 was promised. 3. Contributions in the amounts summarized below were received: 4. Investment income totaled $75,990 for the year. 5. Vouchers for the year were approved as follows: 6. During the year, $545,200 worth of vouchers were paid. Adjustment Data 7. Accounts Payable and Accrued Expenses at February 28, 2025, should be $165,500. The difference should be allocated to the following expenses: 8. Additions to the research library in the amount of $61,940 that were approved in (5) above were made in accordance with the term of a contribution that had been received earlier and that was restricted for that purpose. 9. The current market value of the investments is $1,038,830 (no investment transactions occurred). 10. Depreciation amounted to $8,943 for the year. It should be allocated as follows: 11. Prepaid Expenses should be $59,956. The difference should be allocated to: No. Account Titles and Explanation 1. Cash Service Fees Revenue Book Rentals and Fines Revenue 2. Cash Grants Receivable (To record grant received) Grants Receivable Support Revenue - Grants (To record grant promised) 3. Cash-Unrestricted Cash - Temporarily Restricted Contributions - Restricted Support Contributions - Gifts Debit 211400 Credit 211400 4. Investment Income 5. Circulating Library Expenses 203860 Research Library Expenses 69220 Exhibits Expenses 15270 Community Services Expenses General and Administrative Expenses 169200 Fund Raising Expenses 93760 Accounts Payable and Accrued Expenses 6. Accounts Payable and Accrued Expenses 545200 Cash 7. Research Library Expenses 2920 General and Administrative Expenses Accounts Payable and Accrued Expenses 8. Net Assets Released from Restrictions Cash 61940 (To release funds from restricted into unrestricted assets) Net Assets Released from Restrictions (To receive funds into unrestricted from restricted assets) 9. Investments Investment Income 10. Circulating Library Expenses Research Library Expenses General and Administrative Expenses Accumulated Depreciation 3530 11. Exhibits Expenses 3699 General and Administrative Expenses 1345 Prepaid Expenses 5044 Prepare the statement of financial position and the statement of activities for the year ended February 28, 2025. (Enter negative Liabilities and Fund Balances Current Liabilities Accounts Payable and Accrued Expenses Total Current Liabilities Long-term Debt Fund Balance Total Liabilities and Fund Balances $ $ ORIOLE LIBRARY Statement of Activities For Year Ended February 28, 2025 Without Donor Restrictions With donor Restrictions Support \& Revenue Support Support Revenue - Grants Support Revenue - Gifts Total Support $ Revenue Service Fees Revenue Book Rentals and Fines Revenue Investment Income Total Revenue Total Revenue, Gains and Other Support Expenses Program Services Circulating Library Expenses Research Library Expenses Exhibits Expenses Community Services Expenses Total Program Services Support Services General and Administrative Expenses Fund Raising Expenses Total Support Services Total Expenses $ $ Increase (decrease) in Net Assets Fund Balances - Beginning of Year Fund Balances - End of Year $ $ Oriole Library, a nonprofit organization, presented the following statement of financial position and statement of activities for its fiscal year ended February 28, 2024. Liabilities and Fund Balances Current Liabilities Oriole Library Statement of Activities for Year Ended February 28, 2024 Expenses Program Services \begin{tabular}{lrr} Circulating library & $225,000 \\ Research library & 93,000 \\ Exhibits & 19,000 \\ Community services & 11,000 & \\ \( {348,000} &{-0-} \\ {\hline \text { Total }} &{ } \) \end{tabular} Supporting Services The following transactions occurred during the fiscal year ended February 28, 2025. 1. Fees were billed as follows: 2. $36,760 of the Grant Receivable was received. Another grant in the amount of $20,270 was promised. 3. Contributions in the amounts summarized below were received: 4. Investment income totaled $75,990 for the year. 5. Vouchers for the year were approved as follows: 6. During the year, $545,200 worth of vouchers were paid. Adjustment Data 7. Accounts Payable and Accrued Expenses at February 28, 2025, should be $165,500. The difference should be allocated to the following expenses: 8. Additions to the research library in the amount of $61,940 that were approved in (5) above were made in accordance with the term of a contribution that had been received earlier and that was restricted for that purpose. 9. The current market value of the investments is $1,038,830 (no investment transactions occurred). 10. Depreciation amounted to $8,943 for the year. It should be allocated as follows: 11. Prepaid Expenses should be $59,956. The difference should be allocated to: No. Account Titles and Explanation 1. Cash Service Fees Revenue Book Rentals and Fines Revenue 2. Cash Grants Receivable (To record grant received) Grants Receivable Support Revenue - Grants (To record grant promised) 3. Cash-Unrestricted Cash - Temporarily Restricted Contributions - Restricted Support Contributions - Gifts Debit 211400 Credit 211400 4. Investment Income 5. Circulating Library Expenses 203860 Research Library Expenses 69220 Exhibits Expenses 15270 Community Services Expenses General and Administrative Expenses 169200 Fund Raising Expenses 93760 Accounts Payable and Accrued Expenses 6. Accounts Payable and Accrued Expenses 545200 Cash 7. Research Library Expenses 2920 General and Administrative Expenses Accounts Payable and Accrued Expenses 8. Net Assets Released from Restrictions Cash 61940 (To release funds from restricted into unrestricted assets) Net Assets Released from Restrictions (To receive funds into unrestricted from restricted assets) 9. Investments Investment Income 10. Circulating Library Expenses Research Library Expenses General and Administrative Expenses Accumulated Depreciation 3530 11. Exhibits Expenses 3699 General and Administrative Expenses 1345 Prepaid Expenses 5044 Prepare the statement of financial position and the statement of activities for the year ended February 28, 2025. (Enter negative Liabilities and Fund Balances Current Liabilities Accounts Payable and Accrued Expenses Total Current Liabilities Long-term Debt Fund Balance Total Liabilities and Fund Balances $ $ ORIOLE LIBRARY Statement of Activities For Year Ended February 28, 2025 Without Donor Restrictions With donor Restrictions Support \& Revenue Support Support Revenue - Grants Support Revenue - Gifts Total Support $ Revenue Service Fees Revenue Book Rentals and Fines Revenue Investment Income Total Revenue Total Revenue, Gains and Other Support Expenses Program Services Circulating Library Expenses Research Library Expenses Exhibits Expenses Community Services Expenses Total Program Services Support Services General and Administrative Expenses Fund Raising Expenses Total Support Services Total Expenses $ $ Increase (decrease) in Net Assets Fund Balances - Beginning of Year Fund Balances - End of Year $ $

Step by Step Solution

There are 3 Steps involved in it

To prepare the statement of financial position and statement of activities lets analyze the given data and calculate the necessary figures Ill guide y... View full answer

Get step-by-step solutions from verified subject matter experts