Question: Hi! i really need some help! thank you! 1. Using the cost schedules provided (appendices A-1 through A-4), identify the following information about the costs

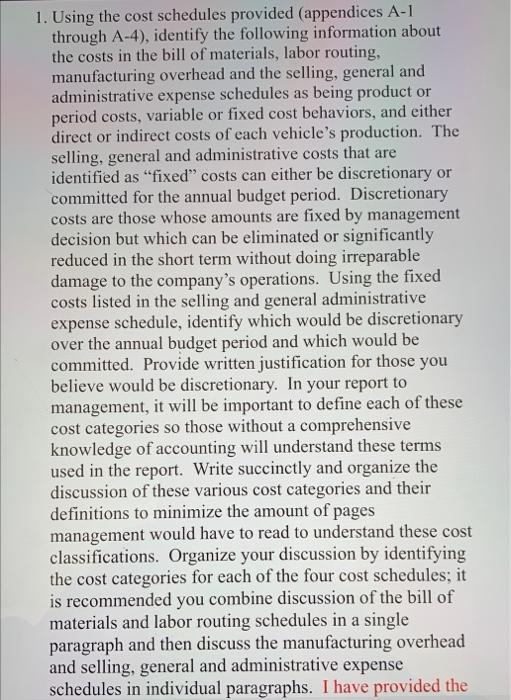

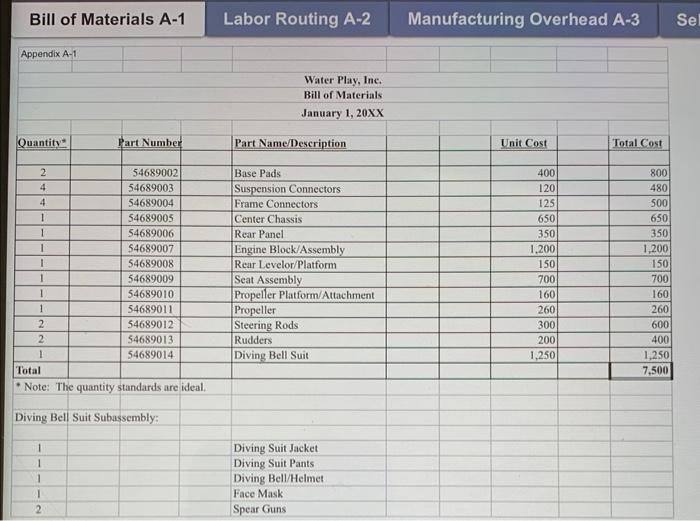

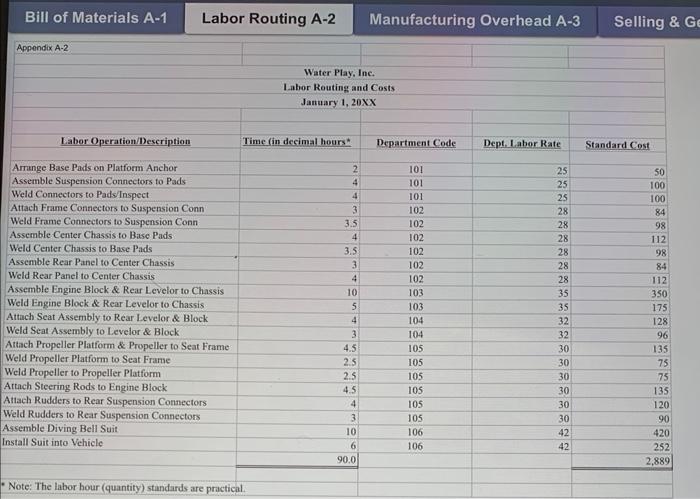

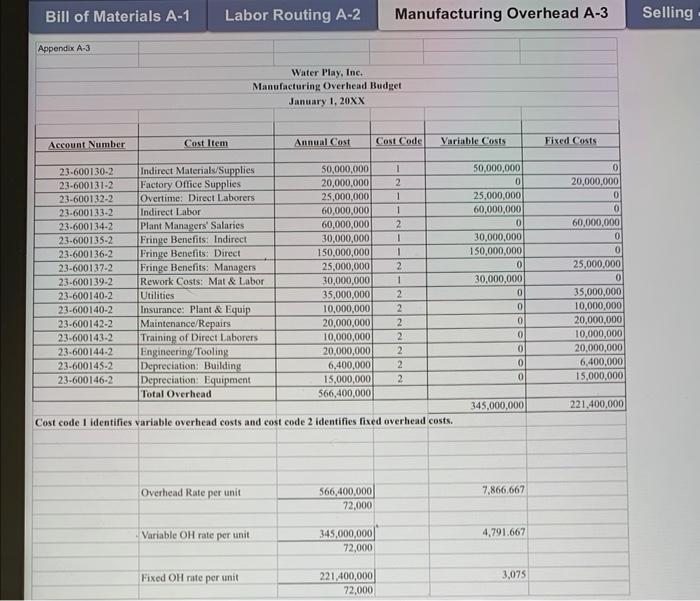

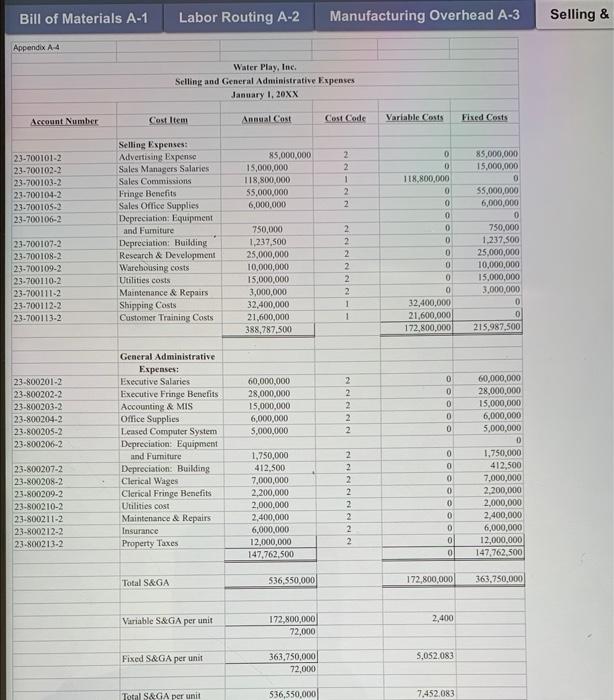

1. Using the cost schedules provided (appendices A-1 through A-4), identify the following information about the costs in the bill of materials, labor routing, manufacturing overhead and the selling, general and administrative expense schedules as being product or period costs, variable or fixed cost behaviors, and either direct or indirect costs of each vehicle's production. The selling, general and administrative costs that are identified as "fixed" costs can either be discretionary or committed for the annual budget period. Discretionary costs are those whose amounts are fixed by management decision but which can be eliminated or significantly reduced in the short term without doing irreparable damage to the company's operations. Using the fixed costs listed in the selling and general administrative expense schedule, identify which would be discretionary over the annual budget period and which would be committed. Provide written justification for those you believe would be discretionary. In your report to management, it will be important to define each of these cost categories so those without a comprehensive knowledge of accounting will understand these terms used in the report. Write succinctly and organize the discussion of these various cost categories and their definitions to minimize the amount of pages management would have to read to understand these cost classifications. Organize your discussion by identifying the cost categories for each of the four cost schedules; it is recommended you combine discussion of the bill of materials and labor routing schedules in a single paragraph and then discuss the manufacturing overhead and selling, general and administrative expense schedules in individual paragraphs. I have provided the Bill of Materials A-1 Labor Routing A-2 Appendix A-1 - Note: The labor hour (quantity) standards are practical. Cost code 1 identifies variable overhead costs and cost code 2 identifies fixed overhead costs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts