Question: Hi, I would like to get some help with these multiple choice questions. Please give some intuition Question 5. Which of the following does not

Hi, I would like to get some help with these multiple choice questions. Please give some intuition

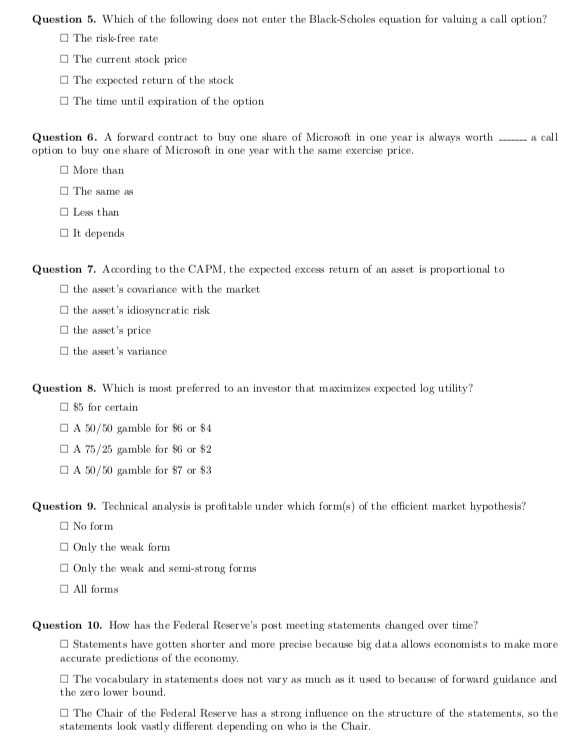

Question 5. Which of the following does not enter the Black-Scholes equation for valuing a call option? The risk-free rate The current stock price The expected return of the stock The time until expiration of the option Question 6. A forward contract to buy one share of Microsoft one year is always worth option to buy one share of Microsoft in one year with the same exercise price. a call More than The same s Less than It depends Question 7. According to the CAPM, the expected excess return of an asset is proportional to the illet's covariance with the nuirket a the asset's idiosyncratic risk the asset's price the aRiet's variance Question 8. Which is most preferred to an investor that maximizes expected log utility? 85 for certain A 50/50 gamble for $6 or $4 O A 75/25 gamble for $6 or S:2 A 50/50 gamble for $7 or 83 Question 9. Technical analysis is profitable under which form(s) of the efficient market hypothesis? ON form Only the weak form Only the weak and semi-strong forms All forms Question 1 ow has the Federal Reserve's post meet ing statements changed over time? Statements have gotten shorter and more precise because big data allows economists to make more The vocabulary in statements does not vary as muchait used to because of for ward guidance and The Chair of the Federal Reserve has a strong influence on the structure of the statements, so the accurate predictions of the economy the zero lower bound statements look vastly different depending on who is the Chair Question 5. Which of the following does not enter the Black-Scholes equation for valuing a call option? The risk-free rate The current stock price The expected return of the stock The time until expiration of the option Question 6. A forward contract to buy one share of Microsoft one year is always worth option to buy one share of Microsoft in one year with the same exercise price. a call More than The same s Less than It depends Question 7. According to the CAPM, the expected excess return of an asset is proportional to the illet's covariance with the nuirket a the asset's idiosyncratic risk the asset's price the aRiet's variance Question 8. Which is most preferred to an investor that maximizes expected log utility? 85 for certain A 50/50 gamble for $6 or $4 O A 75/25 gamble for $6 or S:2 A 50/50 gamble for $7 or 83 Question 9. Technical analysis is profitable under which form(s) of the efficient market hypothesis? ON form Only the weak form Only the weak and semi-strong forms All forms Question 1 ow has the Federal Reserve's post meet ing statements changed over time? Statements have gotten shorter and more precise because big data allows economists to make more The vocabulary in statements does not vary as muchait used to because of for ward guidance and The Chair of the Federal Reserve has a strong influence on the structure of the statements, so the accurate predictions of the economy the zero lower bound statements look vastly different depending on who is the Chair

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts