Question: Hi Im a beginner java user and I have to compute a program that give you married status. -it must be case insensitive meaning that

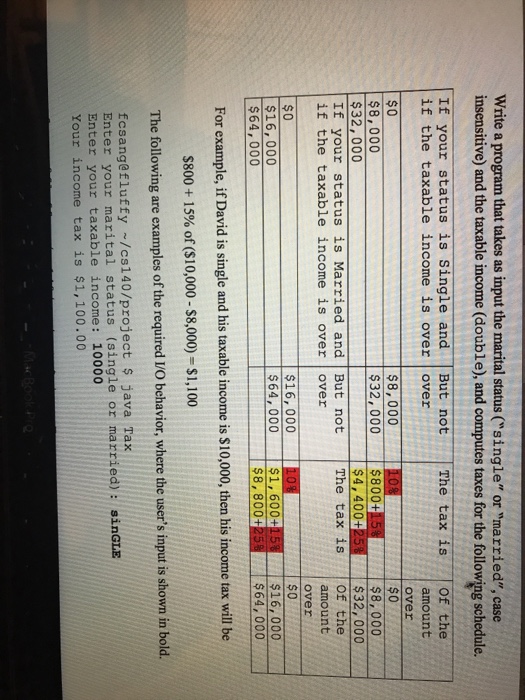

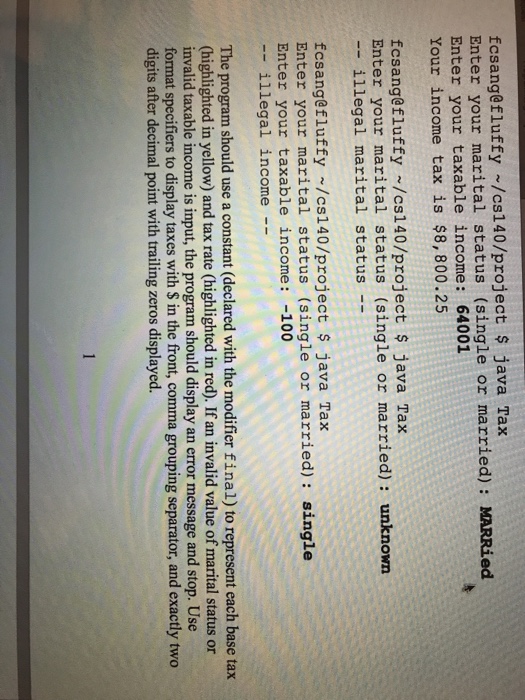

Write a program that takes as input the marital status ("single" or "married", case insensitive) and the taxable income (double), and computes taxes for the following schedule. If your status is Single and But not The tax isOf the if the taxable income is over over S0 $8,000 $32,000 If your status is Married and But not The tax is of the if the taxable income is over over amount over $0 $8,000 $32,000 8, 000 32,000$800+ $4,400+ amount over $0 $0 $16, 000 $64, 000 $16, 000 $64, 000 $1,600+ $8,800+ 16,000 $64, 000 For example, if David is single and his taxable income is $10,000, then his income tax will be $800 + 15% of ($10,000-$8,000)-$1,100 The following are examples of the required /O behavior, where the user's input is shown in bold. fcsang@fluffy ~/cs140/project $ java Tax Enter your marital status (single or married): sinGLE Enter your taxable income: 10000 Your income tax is $1,100.00 Write a program that takes as input the marital status ("single" or "married", case insensitive) and the taxable income (double), and computes taxes for the following schedule. If your status is Single and But not The tax isOf the if the taxable income is over over S0 $8,000 $32,000 If your status is Married and But not The tax is of the if the taxable income is over over amount over $0 $8,000 $32,000 8, 000 32,000$800+ $4,400+ amount over $0 $0 $16, 000 $64, 000 $16, 000 $64, 000 $1,600+ $8,800+ 16,000 $64, 000 For example, if David is single and his taxable income is $10,000, then his income tax will be $800 + 15% of ($10,000-$8,000)-$1,100 The following are examples of the required /O behavior, where the user's input is shown in bold. fcsang@fluffy ~/cs140/project $ java Tax Enter your marital status (single or married): sinGLE Enter your taxable income: 10000 Your income tax is $1,100.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts