Question: Hi, I'm having trouble figuring out how to do Q5 and Q6 on my homework. Could someone give me a pointer or hint? Provided below

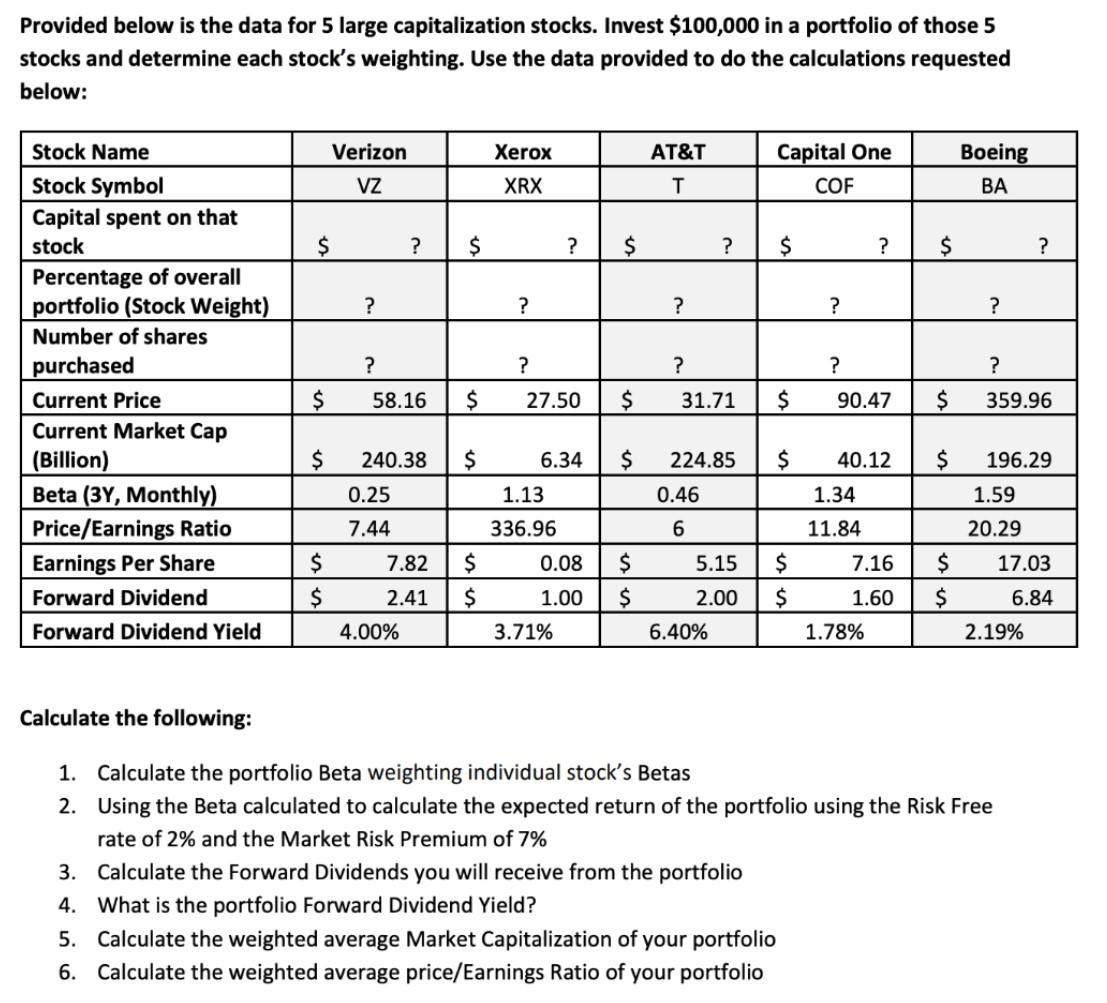

Hi, I'm having trouble figuring out how to do Q5 and Q6 on my homework. Could someone give me a pointer or hint?

Provided below is the data for 5 large capitalization stocks. Invest $100,000 in a portfolio of those 5 stocks and determine each stock's weighting. Use the data provided to do the calculations requested below: Verizon AT&T Xerox XRX Capital One COF Boeing BA VZ T $ ? $ ? $ ? $ ? $ ? ? ? ? ? ? ? ? ? ? ? Stock Name Stock Symbol Capital spent on that stock Percentage of overall portfolio (Stock Weight) Number of shares purchased Current Price Current Market Cap (Billion) Beta (3Y, Monthly) Price/Earnings Ratio Earnings Per Share Forward Dividend Forward Dividend Yield $ 58.16 $ 27.50 $ 31.71 $ 90.47 $ 359.96 $ 240.38 $ 6.34 $ $ 40.12 $ 196.29 224.85 0.46 0.25 1.13 1.34 1.59 7.44 336.96 6 11.84 20.29 17.03 7.82 0.08 5.15 7.16 $ $ $ $ $ $ $ $ $ 2.41 1.60 $ 1.00 3.71% 2.00 6.40% 6.84 2.19% 4.00% 1.78% Calculate the following: 1. Calculate the portfolio Beta weighting individual stock's Betas 2. Using the Beta calculated to calculate the expected return of the portfolio using the Risk Free rate of 2% and the Market Risk Premium of 7% 3. Calculate the Forward Dividends you will receive from the portfolio 4. What is the portfolio Forward Dividend Yield? 5. Calculate the weighted average Market Capitalization of your portfolio 6. Calculate the weighted average price/Earnings Ratio of your portfolio Provided below is the data for 5 large capitalization stocks. Invest $100,000 in a portfolio of those 5 stocks and determine each stock's weighting. Use the data provided to do the calculations requested below: Verizon AT&T Xerox XRX Capital One COF Boeing BA VZ T $ ? $ ? $ ? $ ? $ ? ? ? ? ? ? ? ? ? ? ? Stock Name Stock Symbol Capital spent on that stock Percentage of overall portfolio (Stock Weight) Number of shares purchased Current Price Current Market Cap (Billion) Beta (3Y, Monthly) Price/Earnings Ratio Earnings Per Share Forward Dividend Forward Dividend Yield $ 58.16 $ 27.50 $ 31.71 $ 90.47 $ 359.96 $ 240.38 $ 6.34 $ $ 40.12 $ 196.29 224.85 0.46 0.25 1.13 1.34 1.59 7.44 336.96 6 11.84 20.29 17.03 7.82 0.08 5.15 7.16 $ $ $ $ $ $ $ $ $ 2.41 1.60 $ 1.00 3.71% 2.00 6.40% 6.84 2.19% 4.00% 1.78% Calculate the following: 1. Calculate the portfolio Beta weighting individual stock's Betas 2. Using the Beta calculated to calculate the expected return of the portfolio using the Risk Free rate of 2% and the Market Risk Premium of 7% 3. Calculate the Forward Dividends you will receive from the portfolio 4. What is the portfolio Forward Dividend Yield? 5. Calculate the weighted average Market Capitalization of your portfolio 6. Calculate the weighted average price/Earnings Ratio of your portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts