Question: Johanna Strauss had worked for more than 25 years as the executive assistant of top managers in large Canadian corporations. After retirement she decided

![]()

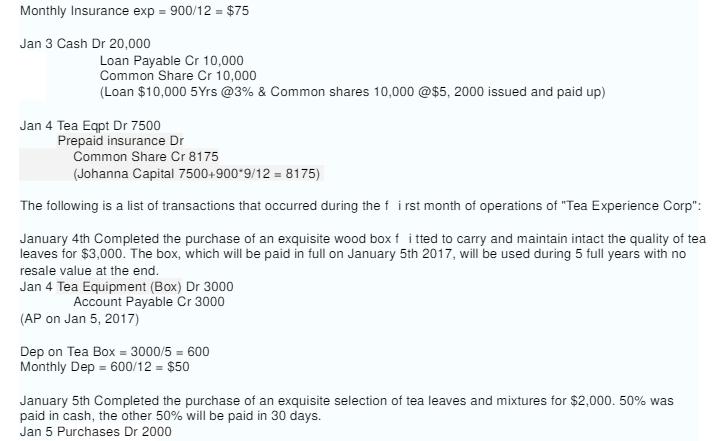

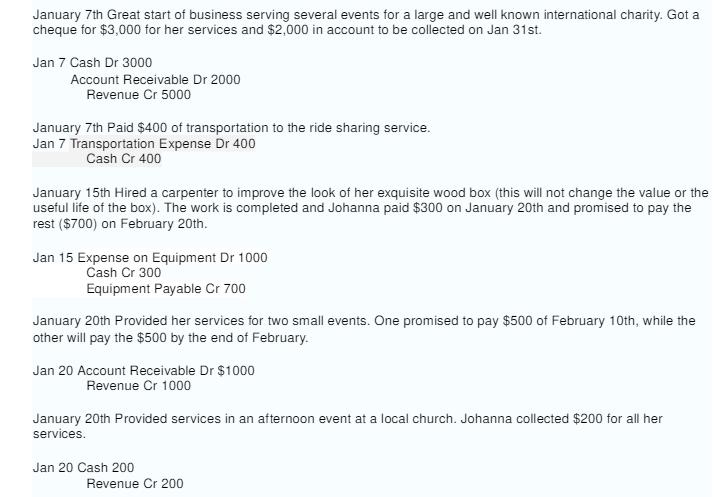

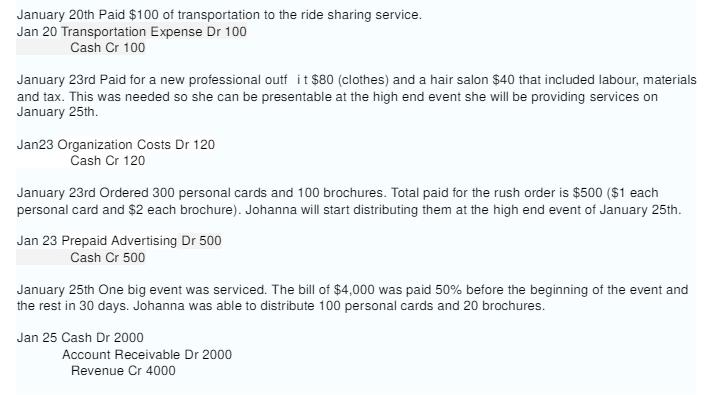

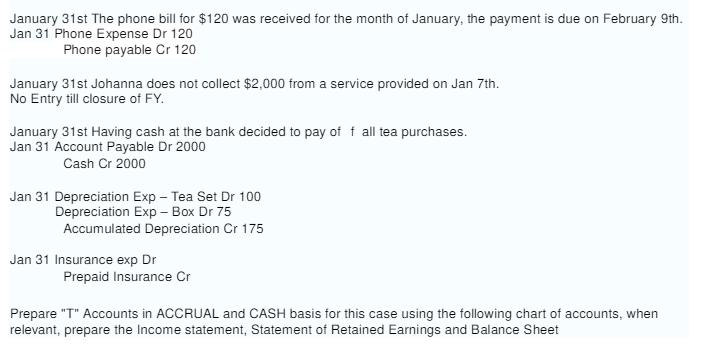

Johanna Strauss had worked for more than 25 years as the executive assistant of top managers in large Canadian corporations. After retirement she decided to go on a trip around the world until she gets bored or drops dead. After 20 months in her 'voyage' Johanna decided to return to Toronto due to a complicated health condition. After the initial treatment was completed Johanna needed to have regular check ups and not being conf i dent in herself as before she decided to stay in Toronto all the time. Johanna has been always extremely active and in this new stage of her life she couldn't sit still. At this stage she was not interested in working for others as her health made her not very reliable, so she decided to start her own business with a passion she discovered in her 'voyage': prepare and serve tea as it should be done. Her target market or audiences are selected meetings organized by top executives or their partners in their houses. On January 1st 2016 Johanna or Lady Leaf as she wanted to be called set up a company to formalize the tea service she has been experiencing with her friends and acquaintances. A friend help her to prepare a business plan that was ready to be presented at her friend's bank so she can get some extra financing if needed, in the meantime this friend was so sure about Johanna's idea that decided to lend her $10,000 for 5 years with an interest rate of 3% per year. On January 2nd Johanna sets up her company: Tea Experience with a capital of 10,000 shares valued at $5 each. A lawyer produced all the needed paperwork. On January 3rd Johanna opens a bank account under the name of Tea Experience Corp. depositing the $10,000 from her plus the $10,000 loaned by her friend. On January 4th Johanna transfers ownership of her sets of tea equipment to the company. All of her tea equipment is high end while one is very rare and exclusive. The equipment has a fair market value of $7,500 and is estimated to last for 5 years and then, if not broken, can be sold for $1,500. She also made sure to transfer the insurance contract for her tea equipment from her to the company as well, the contract started on October 1st 2015. The insurance premium is $900 per year and it was paid in full when signed on October 1st 2015. On the same day Johanna signs in for the services of a ride sharing app that would allow her to call a car to go and come back from the places of the customers that hire her. Dep Exp (7500-1500)/5 = $1200 So Monthly Dep = 1200/12 = $100 Monthly Insurance exp = 900/12 = $75 Jan 3 Cash Dr 20,000 Loan Payable Cr 10,000 Common Share Cr 10,000 (Loan $10,000 5 Yrs @3% & Common shares 10,000 @$5, 2000 issued and paid up) Jan 4 Tea Eqpt Dr 7500 Prepaid insurance Dr Common Share Cr 8175 (Johanna Capital 7500+900*9/12=8175) The following is a list of transactions that occurred during the first month of operations of "Tea Experience Corp": January 4th Completed the purchase of an exquisite wood box fitted to carry and maintain intact the quality of tea leaves for $3,000. The box, which will be paid in full on January 5th 2017, will be used during 5 full years with no resale value at the end. Jan 4 Tea Equipment (Box) Dr 3000 Account Payable Cr 3000 (AP on Jan 5, 2017) Dep on Tea Box = 3000/5 = 600 Monthly Dep 600/12 = $50 January 5th Completed the purchase of an exquisite selection of tea leaves and mixtures for $2,000. 50% was paid in cash, the other 50% will be paid in 30 days. Jan 5 Purchases Dr 2000 Cash Cr 1000 Account Payable Cr 1000 January 7th Great start of business serving several events for a large and well known international charity. Got a cheque for $3,000 for her services and $2,000 in account to be collected on Jan 31st. Jan 7 Cash Dr 3000 Account Receivable Dr 2000 Revenue Cr 5000 January 7th Paid $400 of transportation to the ride sharing service. Jan 7 Transportation Expense Dr 400 Cash Cr 400 January 15th Hired a carpenter to improve the look of her exquisite wood box (this will not change the value or the useful life of the box). The work is completed and Johanna paid $300 on January 20th and promised to pay the rest ($700) on February 20th. Jan 15 Expense on Equipment Dr 1000 Cash Cr 300 Equipment Payable Cr 700 January 20th Provided her services for two small events. One promised to pay $500 of February 10th, while the other will pay the $500 by the end of February. Jan 20 Account Receivable Dr $1000 Revenue Cr 1000 January 20th Provided services in an afternoon event at a local church. Johanna collected $200 for all her services. Jan 20 Cash 200 Revenue Cr 200 January 20th Paid $100 of transportation to the ride sharing service. Jan 20 Transportation Expense Dr 100 Cash Cr 100 January 23rd Paid for a new professional outfit $80 (clothes) and a hair salon $40 that included labour, materials and tax. This was needed so she can be presentable at the high end event she will be providing services on January 25th. Jan23 Organization Costs Dr 120 Cash Cr 120 January 23rd Ordered 300 personal cards and 100 brochures. Total paid for the rush order is $500 ($1 each personal card and $2 each brochure). Johanna will start distributing them at the high end event of January 25th. Jan 23 Prepaid Advertising Dr 500 Cash Cr 500 January 25th One big event was serviced. The bill of $4,000 was paid 50% before the beginning of the event and the rest in 30 days. Johanna was able to distribute 100 personal cards and 20 brochures. Jan 25 Cash Dr 2000 Account Receivable Dr 2000 Revenue Cr 4000 Jan 25 Advertising Expense Dr 140 Prepaid Advertising Cr 140 (100 Cards@$1 + 20 Brochures@$2) January 29th Received the bill from the lawyer that helped her to set up the company for $900 payable by February 15th. Jan 29 Organization Costs Dr 900 Organization Costs Payable Cr 900 January 30th Received a deposit of $800 for servicing a mid afternoon get together on February 29th. The group wanted to reserve the date to do something special in her house as it only happens once every 4 years. Jan 30 Cash Dr 800 Advances from customers Cr 800 January 31st Having consumed 75% of the tea at hand she purchases on account more tea for $1,000. Tea Purchased on Jan 5 for $2000. 75% consumed. So CGS = 75%*2000 = 1500 So Balance $500 Jan 31 Purchases Dr 1000 Account Payable Cr 1000 Additional information January 31st The online bank statement for the month of January shows bank fees of $25. Jan 31 Bank Fee Dr 25 January 31st The phone bill for $120 was received for the month of January, the payment is due on February 9th. Jan 31 Phone Expense Dr 120 Phone payable Cr 120 January 31st Johanna does not collect $2,000 from a service provided on Jan 7th. No Entry till closure of FY. January 31st Having cash at the bank decided to pay off all tea purchases. Jan 31 Account Payable Dr 2000 Cash Cr 2000 Jan 31 Depreciation Exp - Tea Set Dr 100 Depreciation Exp - Box Dr 75 Accumulated Depreciation Cr 175 Jan 31 Insurance exp Dr Prepaid Insurance Cr Prepare "T" Accounts in ACCRUAL and CASH basis for this case using the following chart of accounts, when relevant, prepare the Income statement, Statement of Retained Earnings and Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

1 Prepare T Accounts A T account is a visual representation of individual accounts that helps in recording debits and credits Chart of Accounts Used Cash Prepaid Advertising Advertising Expense Organi... View full answer

Get step-by-step solutions from verified subject matter experts