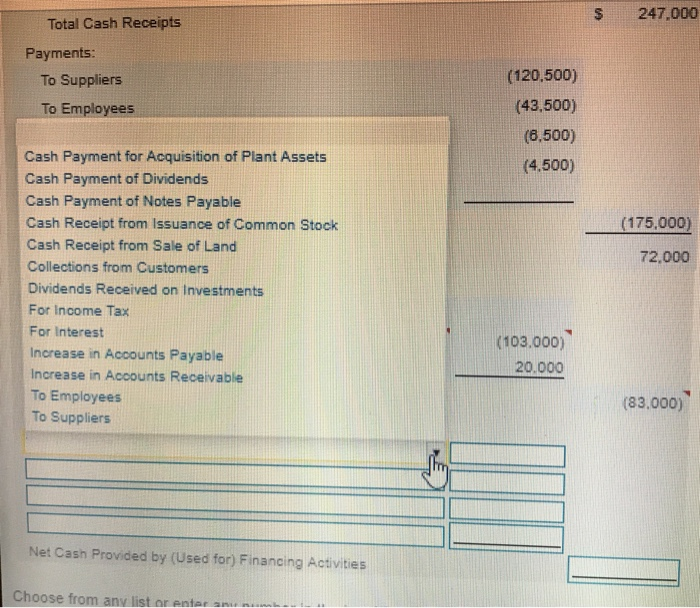

Question: Hi, I'm requesting your help. Cash flows from Financing Activities: Thank you, Michelle S 247,000 Total Cash Receipts Payments: (120.500) To Suppliens (43,500) To Employees

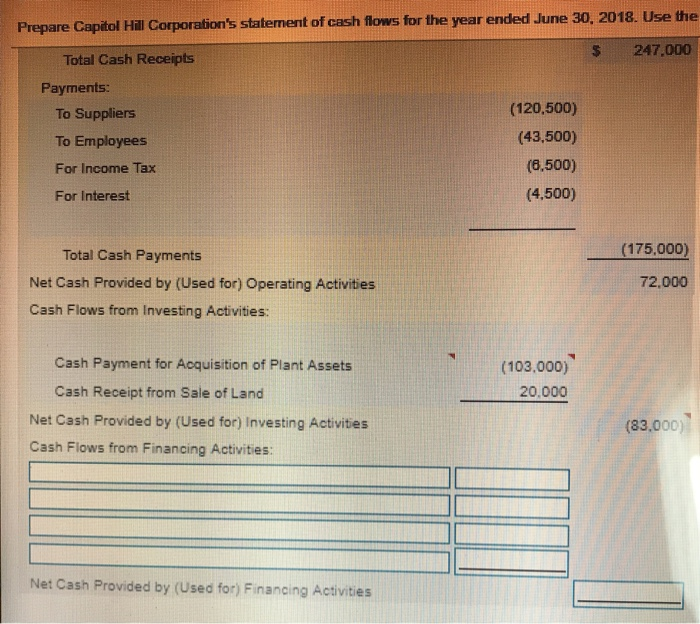

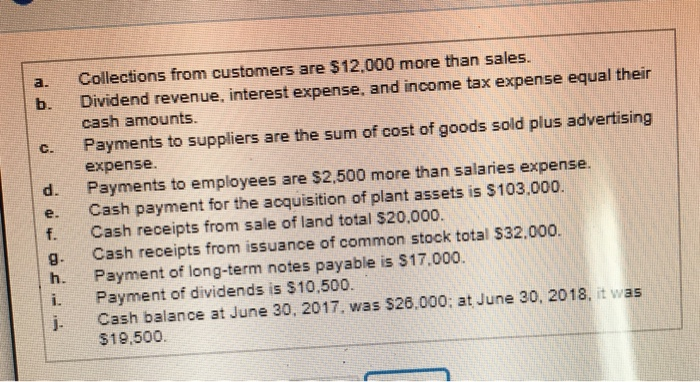

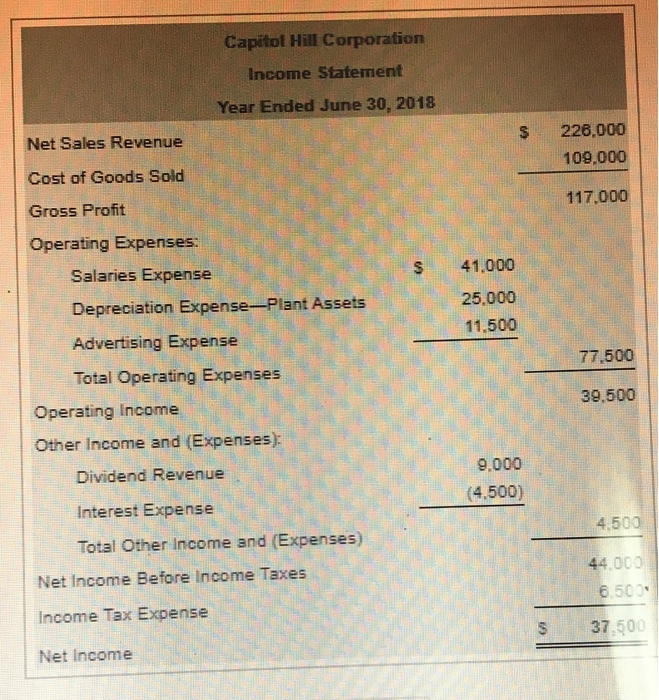

S 247,000 Total Cash Receipts Payments: (120.500) To Suppliens (43,500) To Employees (6.500) Cash Payment for Acquisition of Plant Assets (4.500) Cash Payment of Dividends Cash Payment of Notes Payable Cash Receipt from Issuance of Common Stock (175,000) Cash Receipt from Sale of Land 72,000 Collections from Customers Dividends Received on Investments For Income Tax For Interest (103,000) Increase in Accounts Payable 20.000 Increase in Accounts Receivable To Employees (83.000) To Suppliers Net Cash Provided by (Used for) Financing Activities Choose from anv list nr Antar ani n..wk-:-.. Prepare Captol Hill Corporation's statenent of cash flows for the year ended June 30, 2018. Use the S 247.000 Total Cash Receipts Payments: (120,500) To Suppliers (43,500) To Employees (8,500) For Income Tax (4,500) For Interest (175.000) Total Cash Payments 72,000 Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: Cash Payment for Acquisition of Plant Assets (103,000) Cash Receipt from Sale of Land 20,000 Net Cash Provided by (Used for) Investing Activites (83,000) Cash Flows from Financing Activities: Net Cash Provided by (Used for) Financing Activities a. Collections from customers are $12,000 more than sales. b. Dividend revenue, interest expense, and income tax expense equal their cash amounts. Payments to suppliers are the sum of cost of goods sold plus advertising c. expense. d. Payments to employees are $2,500 more than salaries expense. e. Cash payment for the acquisition of plant assets is $103,000. f. Cash receipts from sale of land total $20,000. g. Cash receipts from issuance of common stock total 532.000. h. Payment of long-term notes payable is $17.000. i. Payment of dividends is $10,500. j Cash balance at June 30, 2017, was $26,000; at June 30, 2018, it was $19,500. Capitol Hill Corporation Income Statement Year Ended June 30, 2018 s 226,000 Net Sales Revenue 109,000 Cost of Goods Sold 117.000 Gross Profit Operating Expenses: Salaries Expense S 41.000 Depreciation Expense-Plant Assets 25.000 11.500 Advertising Expense 77.500 Total Operating Expenses 39,500 Operating Income Other Income and (Expenses) 9.000 Dividend Revenue (4.500) Interest Expense 4,500 Total Other Income and (Expenses) 44, 0 Net Income Before Income Taxes 6.500 Income Tax Expense S 37,500 Net Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts