Question: hi ive in included the data table needed please help me solve this correctly and I will rate thumbs up thank you! (Corporate Income tax)

hi ive in included the data table needed please help me solve this correctly and I will rate thumbs up thank you!

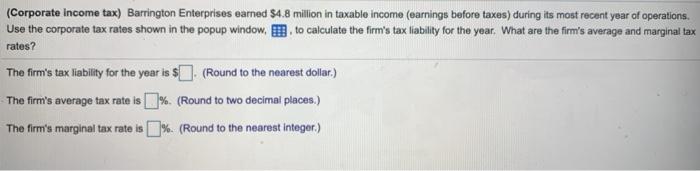

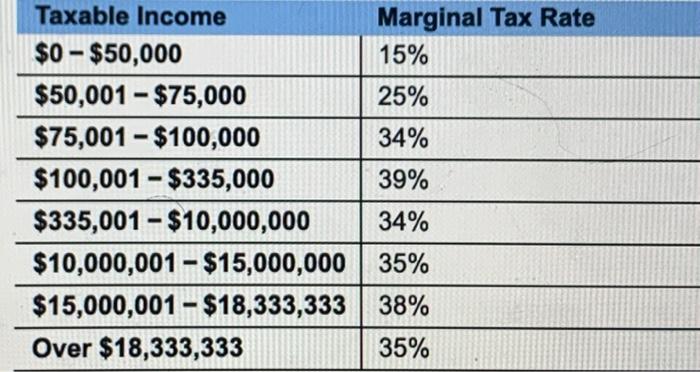

hi ive in included the data table needed please help me solve this correctly and I will rate thumbs up thank you!(Corporate Income tax) Barrington Enterprises earned $4.8 million in taxable income (earnings before taxes) during its most recent year of operations. Use the corporate tax rates shown in the popup window, to calculate the firm's tax liability for the year. What are the firm's average and marginal tax rates? The firm's tax liability for the year is (Round to the nearest dollar.) The firm's average tax rate is 1%. (Round to two decimal places.) The firm's marginal tax rate is 1%. (Round to the nearest Integer) Taxable income Marginal Tax Rate $0 - $50,000 15% $50,001 - $75,000 25% $75,001 - $100,000 34% $100,001 - $335,000 39% $335,001 - $10,000,000 34% $10,000,001 - $15,000,000 35% $15,000,001 - $18,333,333 38% Over $18,333,333 35%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts