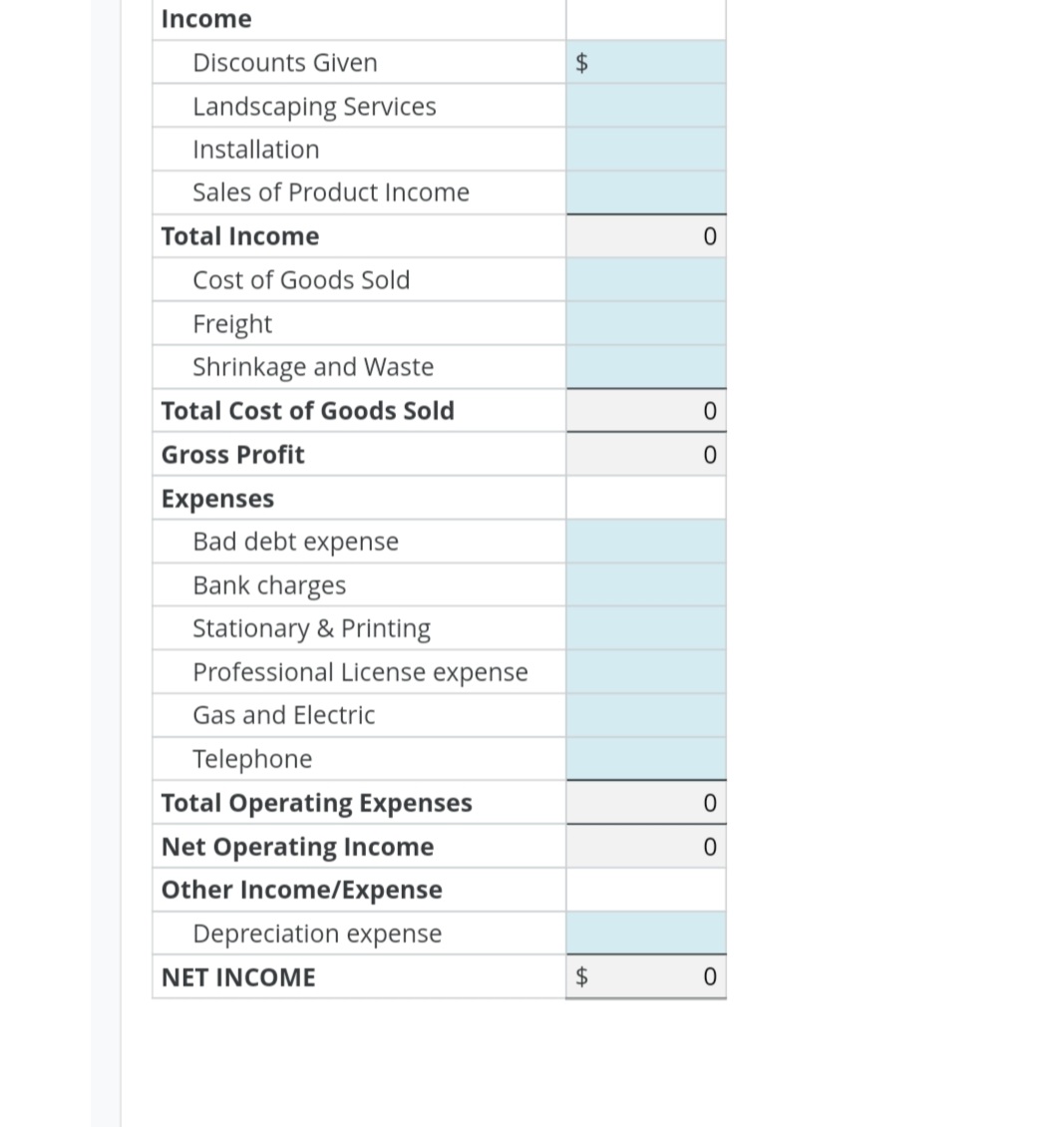

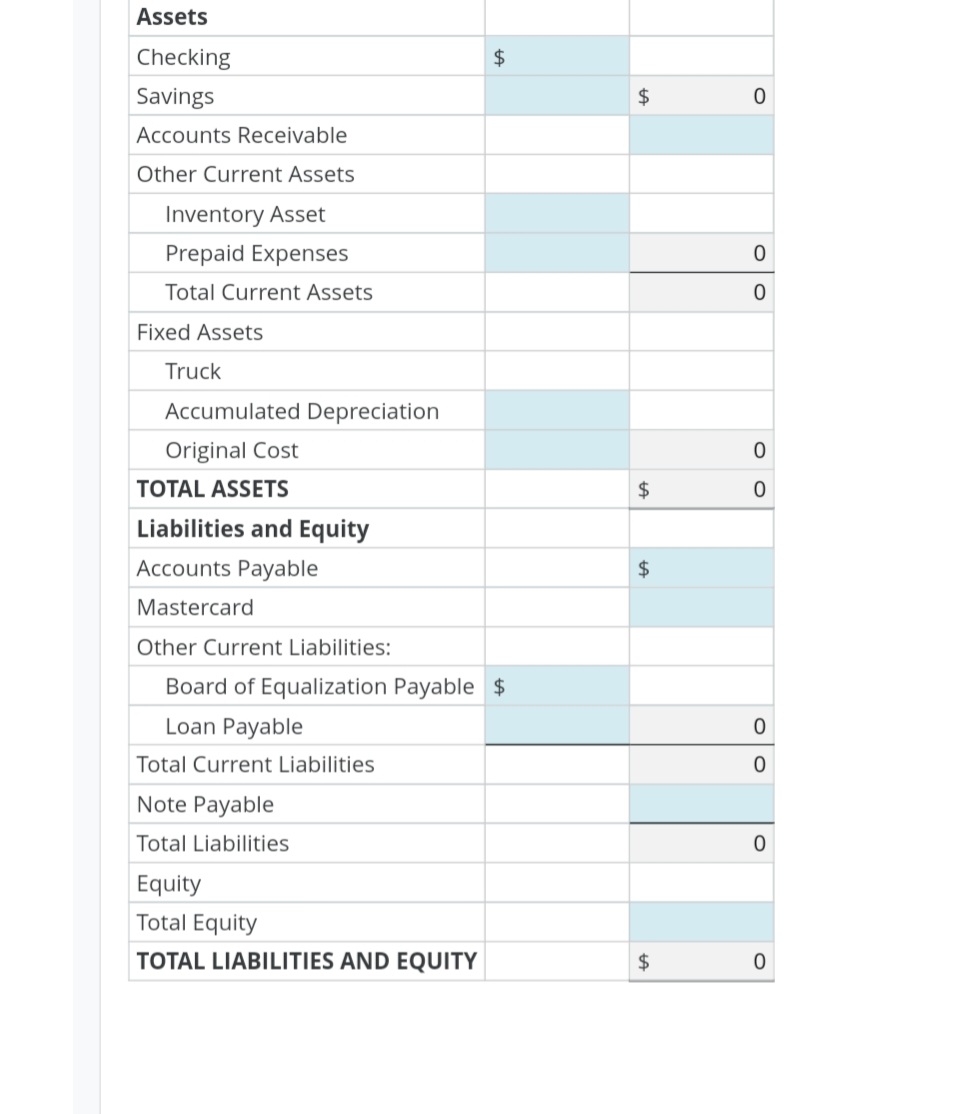

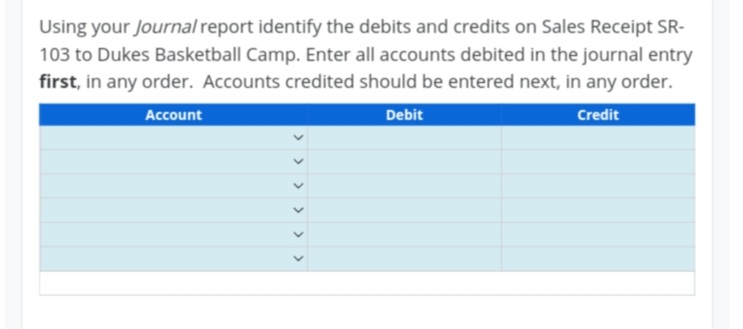

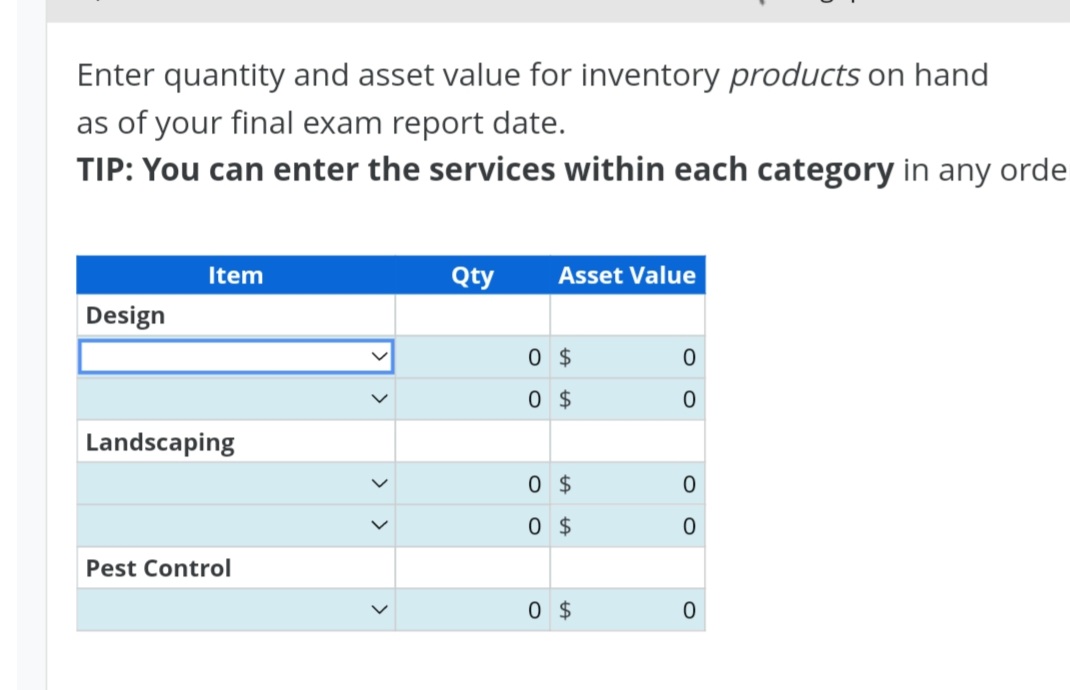

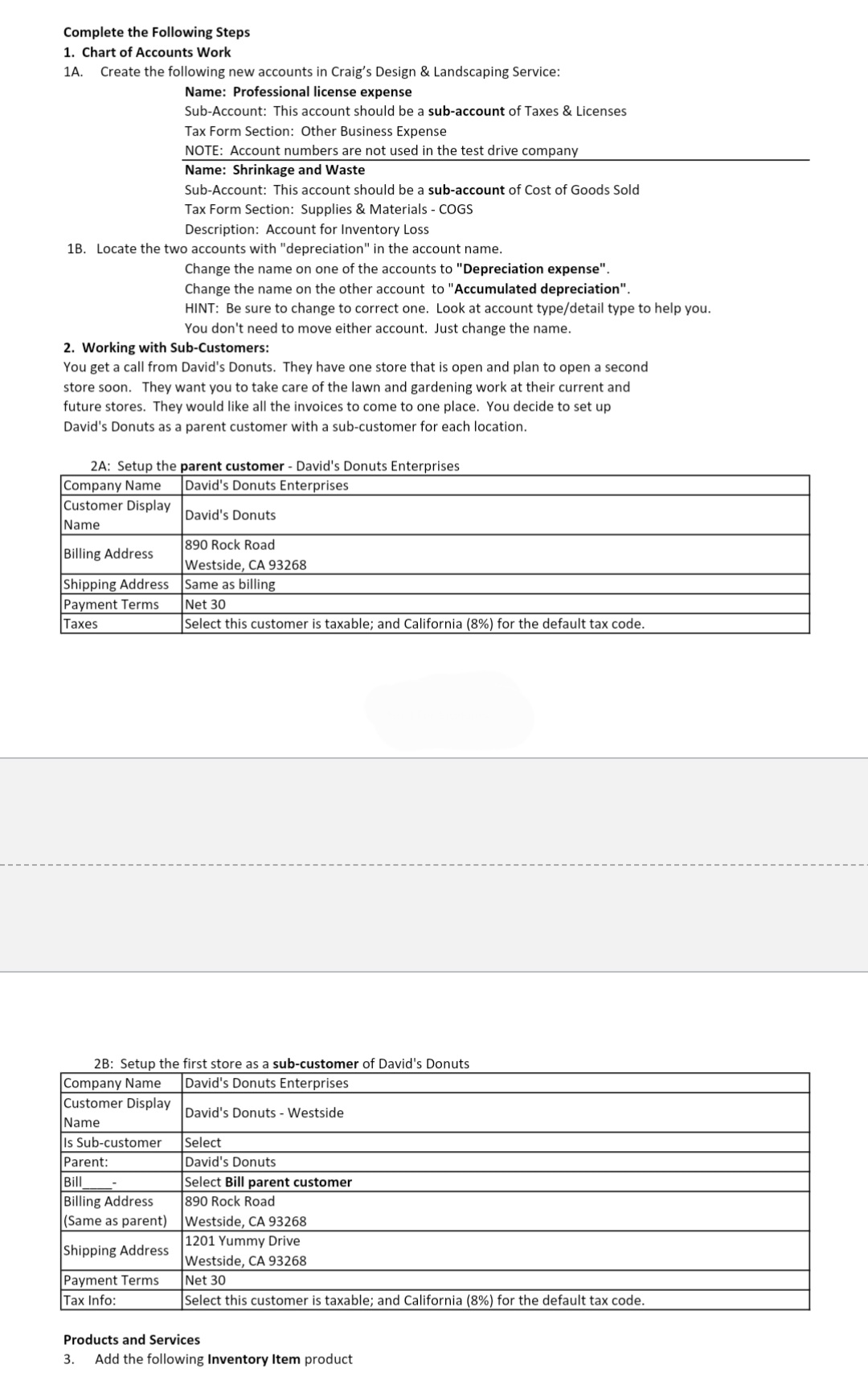

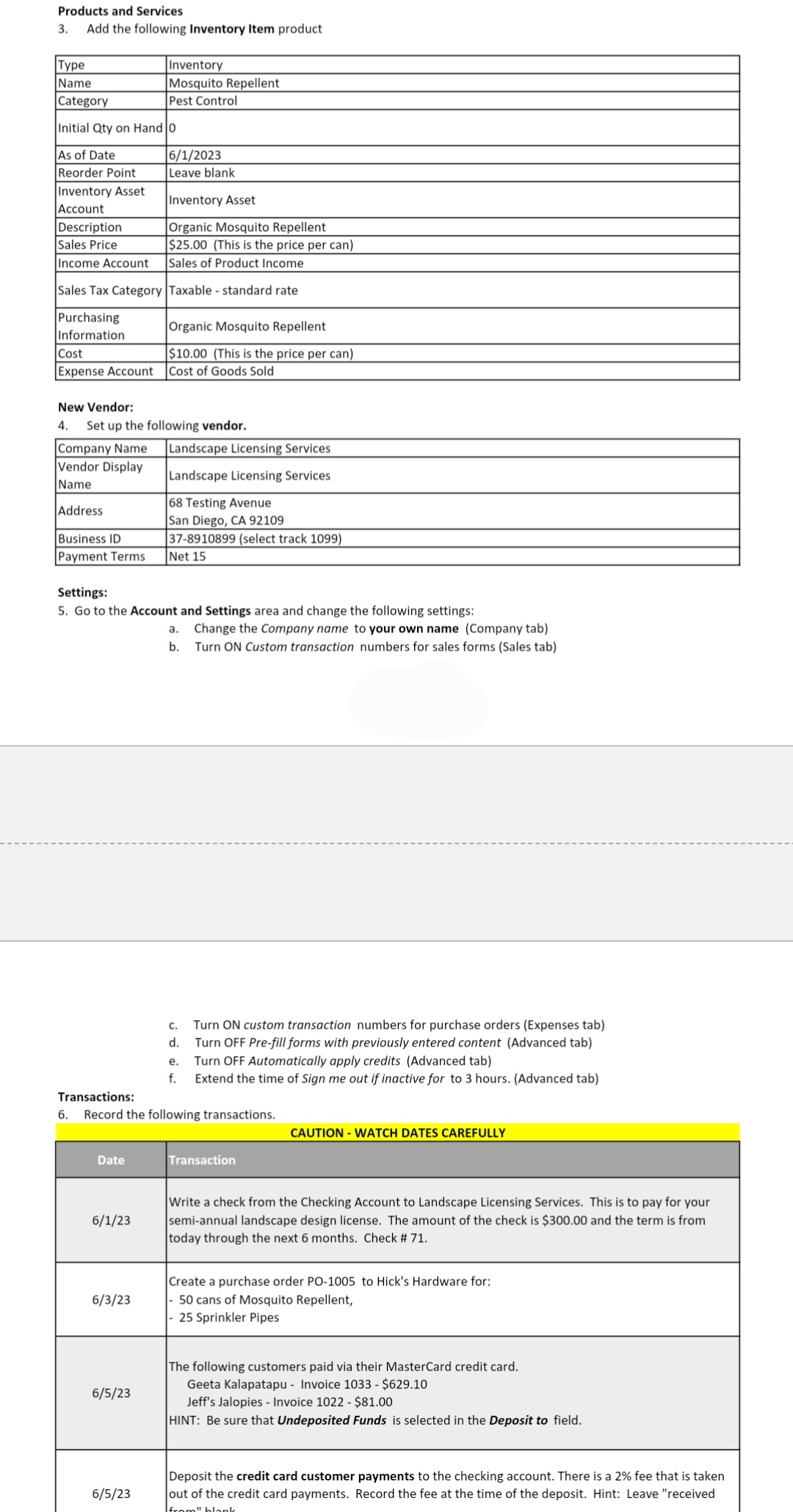

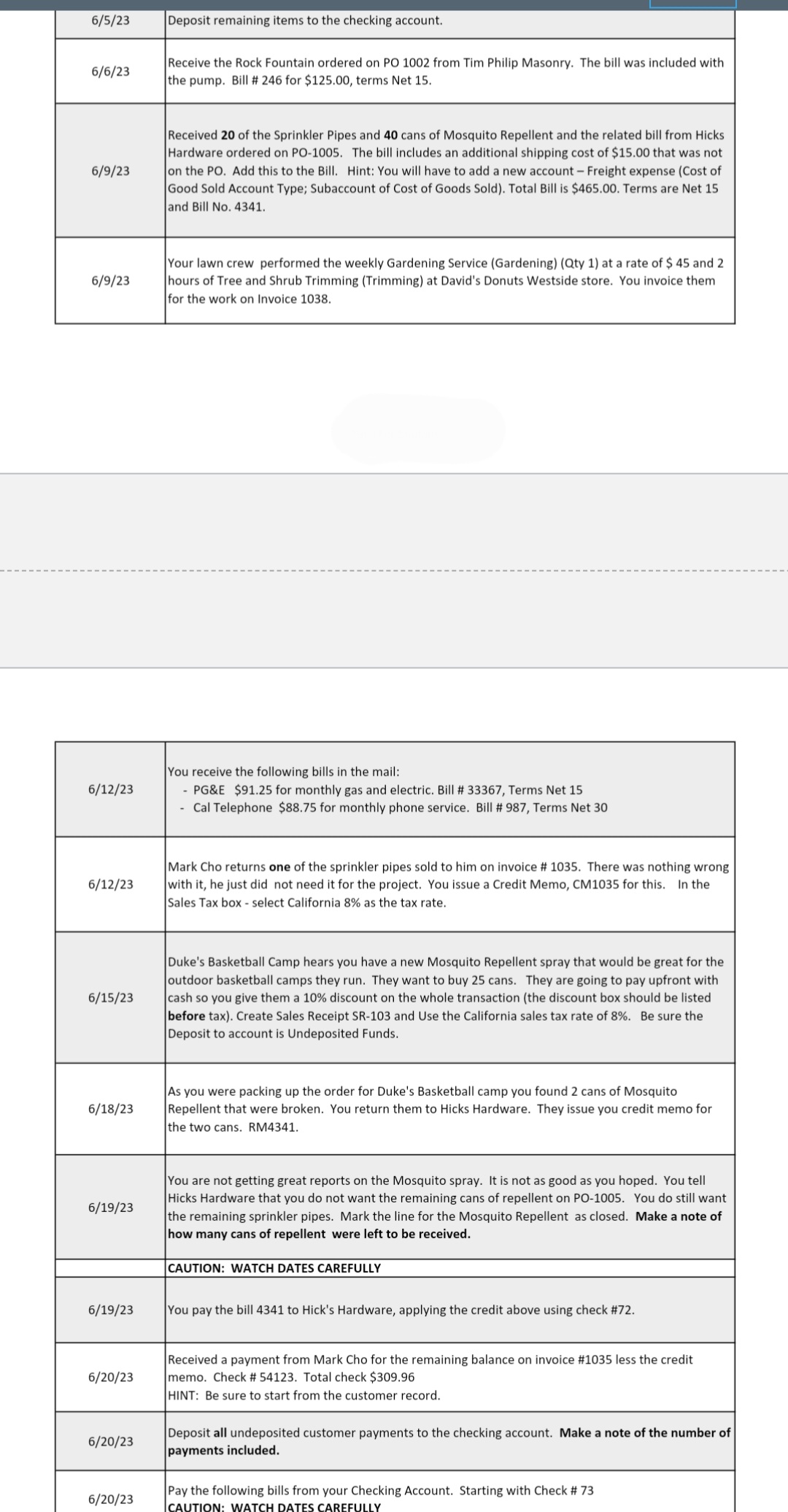

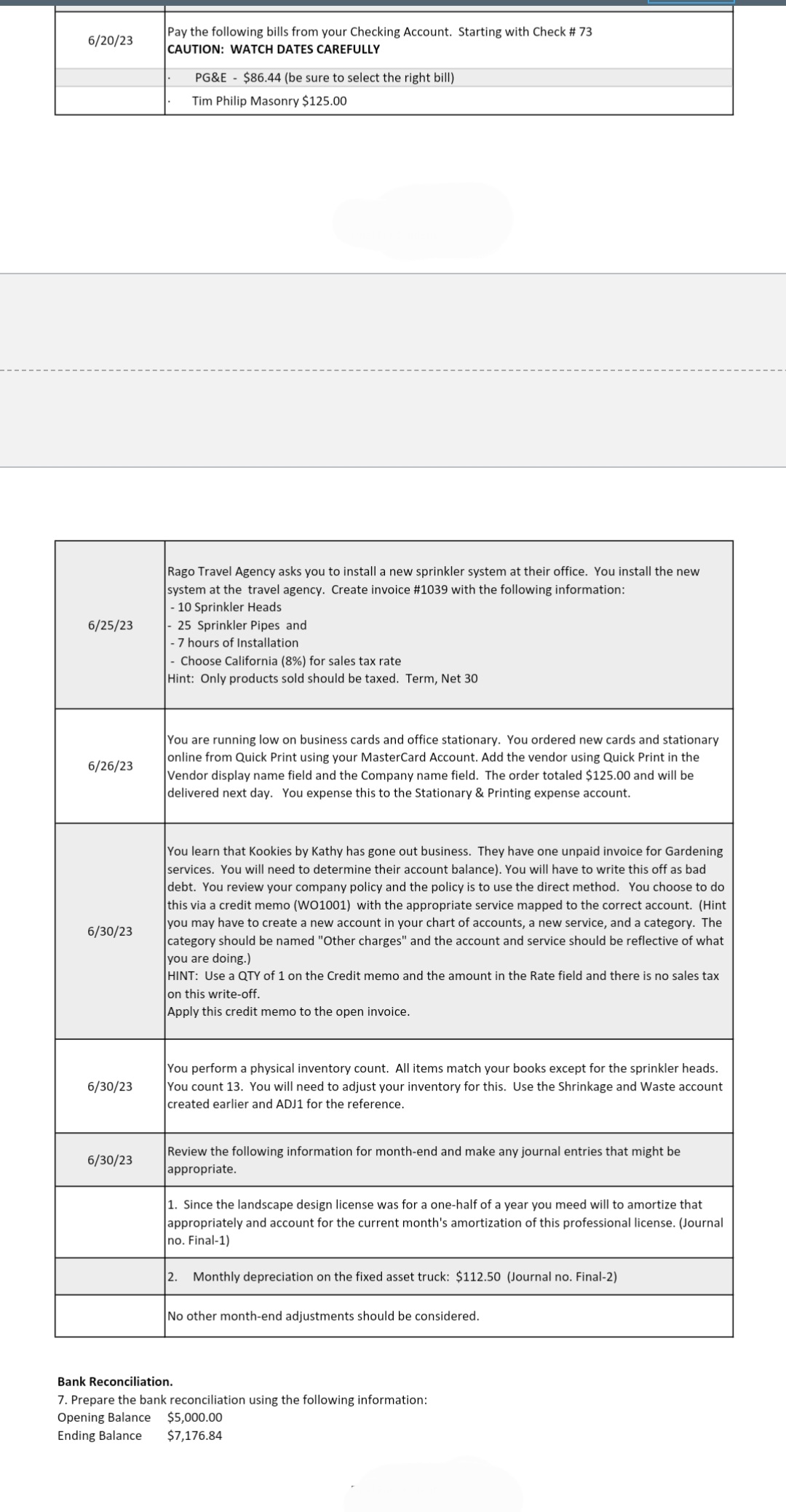

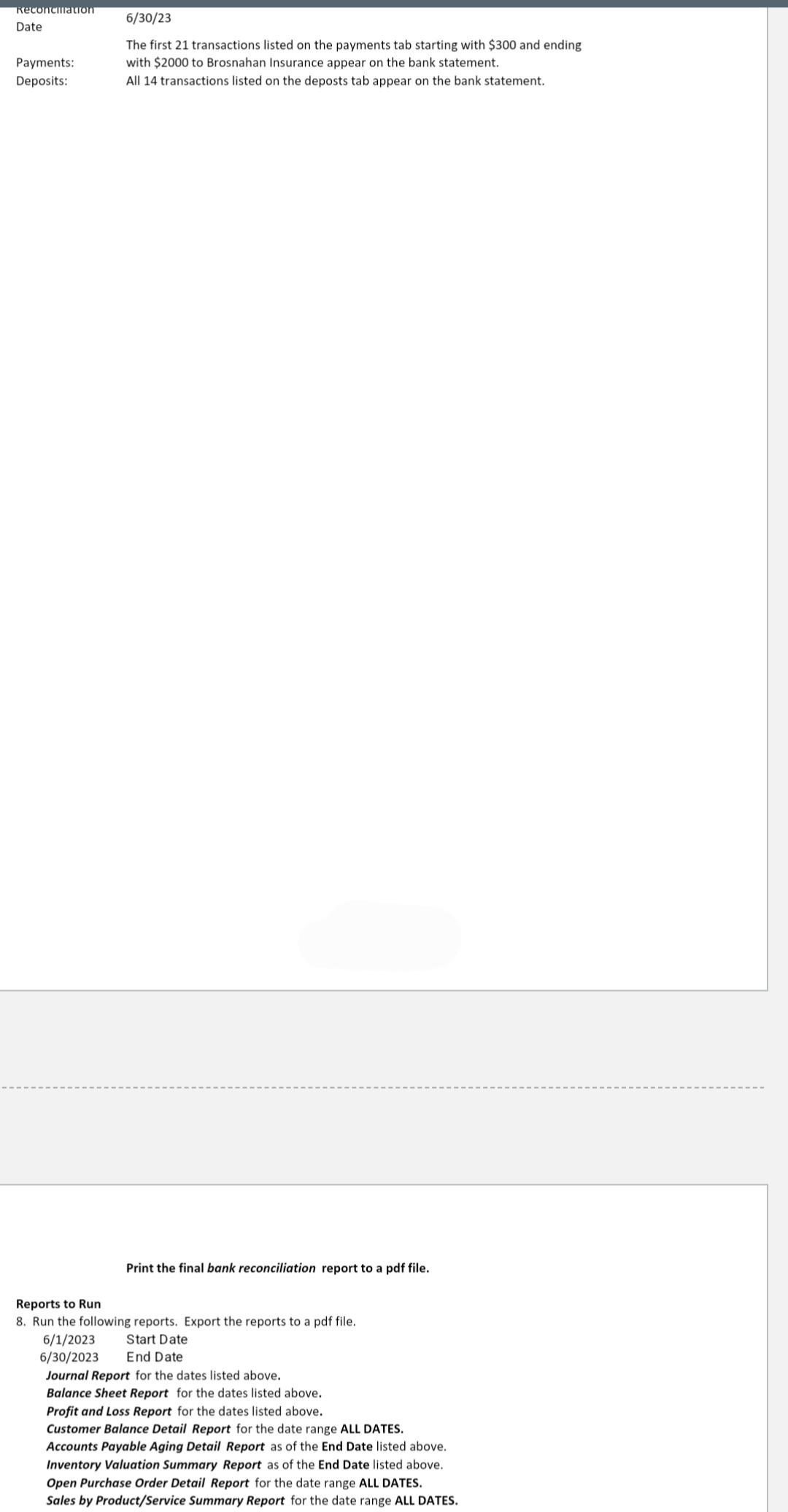

Question: Hi, need help with this homework. I know thos might be lengthy. Would be great to get a balance sheet and Profit loss (SS Below)

Hi, need help with this homework. I know thos might be lengthy. Would be great to get a balance sheet and Profit loss (SS Below)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock