Question: hi need help with this question need it done asap please. also please make sure you complete all the questions parts abcd and question 2

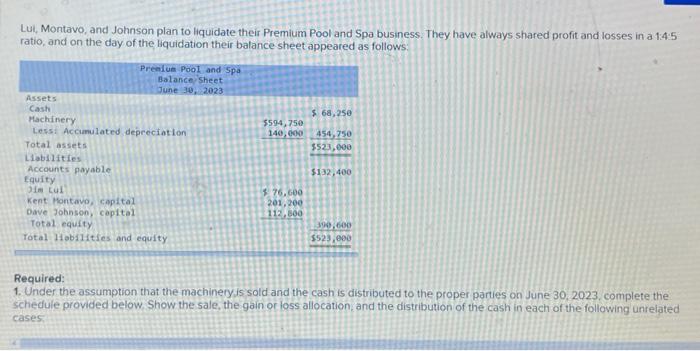

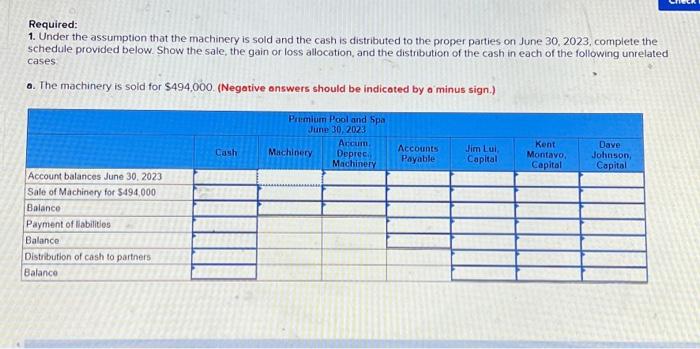

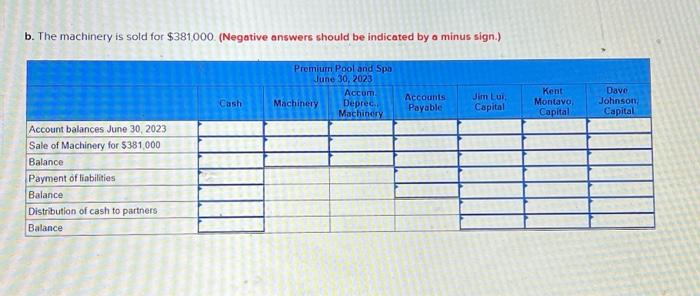

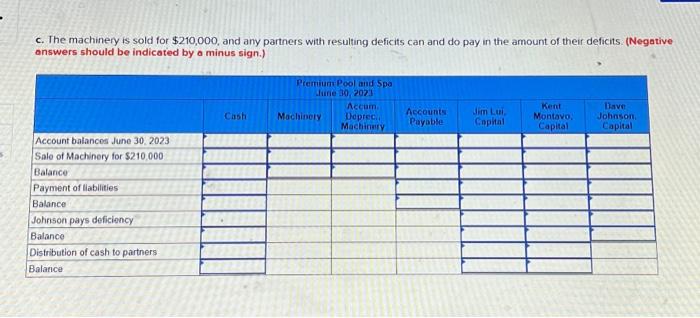

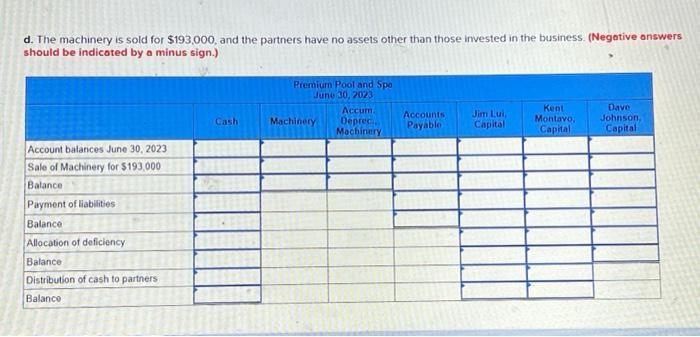

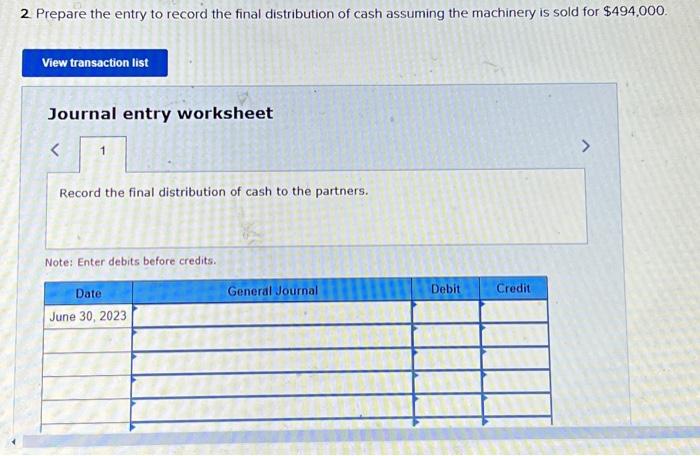

Lui, Montavo, and Johnson plan to liquidate their Premium Pool and Spa business. They have always shared profit and losses in a 1.4:5 ratio, and on the day of the liquidation their balance sheet appeared as follows: Required: 1. Under the assumption that the machinery, is sold and the cash is distributed to the proper parties on June 30, 2023, complete the schedule provided below Show the sale, the gain or loss allocation, and the distribution of the cash in each of the following unrelated cases. Required: 1. Under the assumption that the machinery is sold and the cash is distributed to the proper parties on June 30,2023, complete the schedule provided below. Show the sale, the gain or loss allocation, and the distribution of the cash in each of the following unrelated cases a. The machinery is sold for $494,000. (Negative onswers should be indicated by o minus sign.) b. The machinery is sold for $381,000. (Negative answers should be indicated by a minus sign.) c. The machinery is sold for $210,000, and any partners with resulting deficits can and do pay in the amount of their deficits. (Negative answers should be indicated by a minus sign.) d. The machinery is sold for $193,000, and the partners have no assets other than those invested in the business. (Negotive onswers should be indicoted by a minus sign.) 2. Prepare the entry to record the final distribution of cash assuming the machinery is sold for $494,000. Journal entry worksheet Record the final distribution of cash to the partners. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts