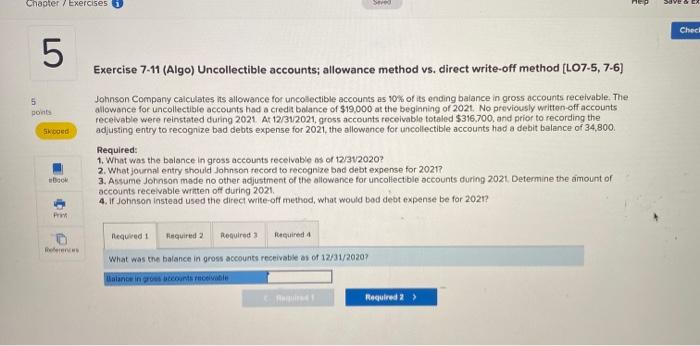

Question: Hi. Please answer all! type answers clearly! Chapter / Exercises Sere Cheel 5 Exercise 7-11 (Algo) Uncollectible accounts; allowance method vs. direct write-off method (L07-5,

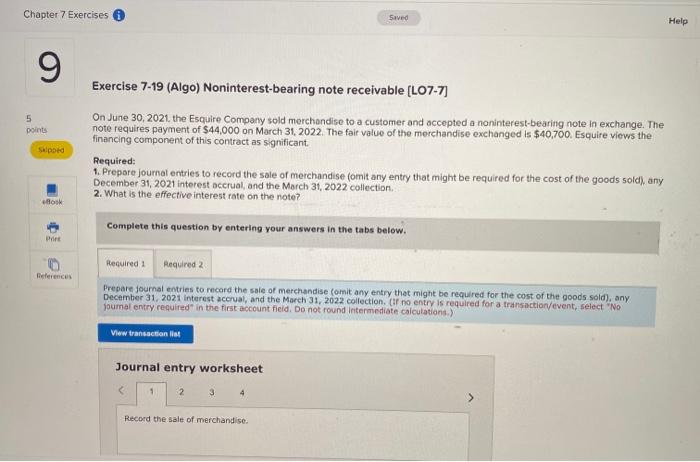

Chapter / Exercises Sere Cheel 5 Exercise 7-11 (Algo) Uncollectible accounts; allowance method vs. direct write-off method (L07-5, 7-6) 5 points Sood Johnson Company calculates its allowance for uncollectible accounts as 10% of its ending balance in gross accounts receivable. The allowance for uncollectible accounts had a credit balance of $19,000 at the beginning of 2021. No previously written off accounts receivable were reinstated during 2021 At 12/312021. gross accounts receivable totaled $316,700, and prior to recording the adjusting entry to recognize bad debts expense for 2021, the allowance for uncollectible accounts had a debit balance of 34,800. Required: 1. What was the balance in gross accounts receivable as of 12/312020? 2. What journal entry should Johnson record to recognize bad debt expense for 20217 3. Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2021 Determine the amount of accounts receivable written off during 2021 4. It Johnson instead used the direct write-off method, what would bad debt expense be for 2021? bo Pri Required! Required 2 Required Required 4 What was the balance in gross accounts receivable as of 12/31/2020 Galant ingros bons movible Required 2) Chapter 7 Exercises Seved Help 9 5 points Exercise 7-19 (Algo) Noninterest-bearing note receivable (L07-7] On June 30, 2021. the Esquire Company sold merchandise to a customer and accepted a noninterest-bearing note in exchange. The note requires payment of $44,000 on March 31, 2022. The fair value of the merchandise exchanged is $40,700. Esquire views the financing component of this contract as significant Required: 1. Prepare journal entries to record the sale of merchandise (omit any entry that might be required for the cost of the goods sold), any December 31, 2021 interest accrual, and the March 31, 2022 collection 2. What is the effective interest rate on the note? Spoed Book Complete this question by entering your answers in the tabs below. Print o Required: Required 2 References Prepare journal entries to record the sale of merchandise comit any entry that might be required for the cost of the goods sold), any December 31, 2021 Interest accrual, and the March 31, 2022 collection. (If no entry is required for a transaction/event, select "No jouma entry required in the first account field. Do not round intermediate calculations.) View transactions Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts