Question: hi Please answer the question in bold. For this board, visit the interactive exercise Altius Golf Ball Positioning which is linked in to page 12

hi Please answer the question in bold.

For this board, visit the interactive exercise "Altius Golf Ball Positioning" which is linked in to page 12 of this week's reading.

Notice that there are 3 "models" or scenarios, represented as buttons to the left, bottom. Each one is like a different simulation of reality, operating on different assumptions. Choose Model 1 (the default) and then drag the A3 ball into the perceptual map space. Drag the ball around and you'll see different impacts on Market Share and Margins. See if you can achieve a suitable performance outcome along both those lines.

Then repeat for the Model 2 scenario. (Model 3 is a middle ground scenario, a blend of models 1 & 2).

For discussion:

What general implications for product line management emerge from your interaction with the models? What do you find interesting about the exercise, or about the models themselves? What do you find is missing -- i.e., limitations in terms of applicability.

Remember: these are models, built upon assumptions. So you might think about the kinds of assumptions that have been input to the model, or you might think about how you'd like the model to be set up for another purpose, etc. The goal here is not to get wrapped up in the technical aspects of the models, but rather to consider the relevance to managerial practice.

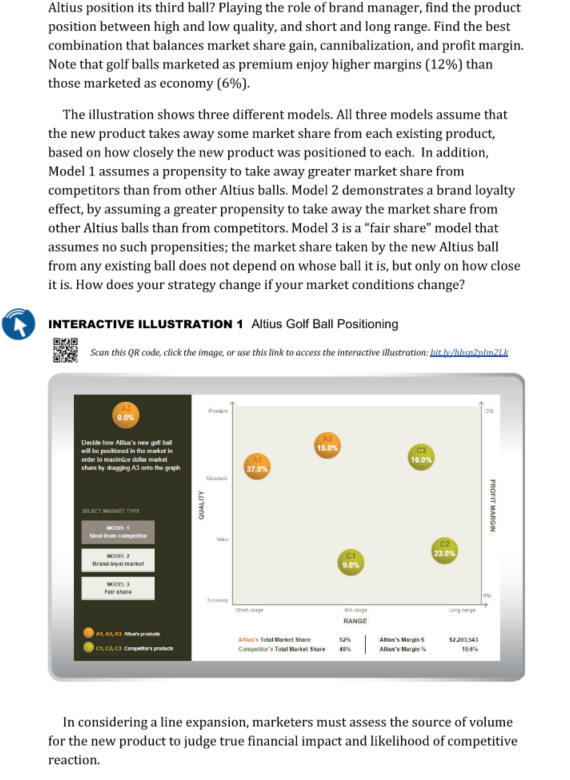

HARVARD Altius Golf Ball Positioning BUSINESS PUBLISHING A3 Premium 12% 0.0% A2 Decide how Altius's new golf ball will be positioned in the market in order 15.0% C3 to maximize dollar market share by A1 16.0% dragging A3 onto the graph. 37.0% Standard PROFIT MARGIN QUALITY SELECT MARKET TYPE MODEL 1 Steal from competitor Value C2 23.0% MODEL 2 C1 Brand-loyal market 9.0% MODEL 3 Fair share Economy Short-range Mid-range Long-range RANGE A1, A2, A3 Altius's products Altius's Total Market Share 52% Altius's Margin $ $2,203,543 C1, C2, C3 Competitor's products Competitor's Total Market Share 48% Altius's Margin % 10.6% @ 2015 Harvard Business School Publishing. Harvard Business Publishing is an affiliate of Harvard Business School.6. Net Impact on the Company's Own Margins Conceptually, a unit sale for a new item can come from one of the following three places: (1) an expansion of the category, (2) taking away a sale that would otherwise have been made by a competitor, or (3) taking away a sale that otherwise would have gone to an existing item in a company's line, that is, cannibalization of sales of a company's own items. Cannibalization is typically an issue in the case of a trade-down product line extension (an extension to a less expensive version of an existing product), since such products typically offer a lower margin than the existing elements of the line. Thus, any cannibalized units represent a decline in the sales margin that is generated. Explore the effect of positioning on cannibalization and margins in Interactive Illustration 1. Altius is a golf ball manufacturer that plans to extend its product line. In the illustration, Altius already has two types of balls on the market. Balls are differentiated on two dimensions. The vertical dimension is overall quality, extending from economy to premium. The horizontal axis is distance, extending from short-range to long-range (referring to the distance a golfer could potentially hit the particular ball). Compared to those of competitors generally, Altius balls-shown at positions Al and A2 in the illustration-are of relatively high quality and have a short range. Where shouldAltius position its third ball? Playing the role of brand manager, find the product position between high and low quality, and short and long range. Find the best combination that balances market share gain, cannibalization, and profit margin. Note that golf balls marketed as premium enjoy higher margins (12%) than those marketed as economy (6%). The illustration shows three different models. All three models assume that the new product takes away some market share from each existing product, based on how closely the new product was positioned to each. In addition, Model 1 assumes a propensity to take away greater market share from competitors than from other Altius balls. Model 2 demonstrates a brand loyalty effect, by assuming a greater propensity to take away the market share from other Altius balls than from competitors. Model 3 is a "fair share" model that assumes no such propensities; the market share taken by the new Altius ball from any existing ball does not depend on whose ball it is, but only on how close it is. How does your strategy change if your market conditions change? INTERACTIVE ILLUSTRATION 1 Altius Golf Ball Positioning Scan this QR code, click the image, or use this link to access the interactive illustration: hit hulabenznim2LA 0.0%% Decide how Allow's new got ball A2 wil be positioned in the market in 15.0% C3 ode to minke cola markvel AT 16.0% shied by dragging Al arlo tha graph TOX PROFIT MARGIN QUALIT HILECT MARKET TYPE C2 C1 23.03 hominy RANGE Aman's Total Market Shair 52.210.543 Competitor's Total Markel thane Allion's Margins In considering a line expansion, marketers must assess the source of volume for the new product to judge true financial impact and likelihood of competitive reaction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts