Question: Hi, please check if part A is correct and help me with part B Exercise 11-28 (Algorithmic) (L0. 3) Lucy sells her partnership interestr a

Hi, please check if part A is correct and help me with part B

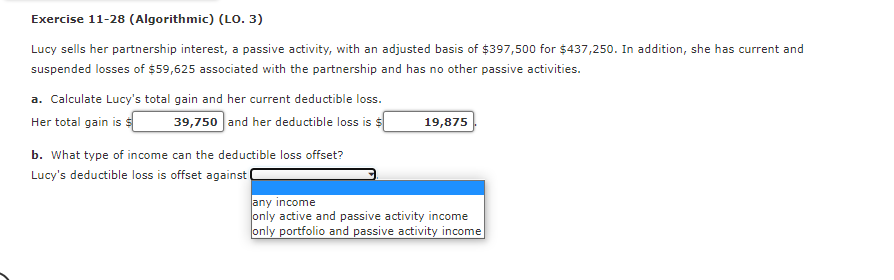

Exercise 11-28 (Algorithmic) (L0. 3) Lucy sells her partnership interestr a passive actiyity, with an adjusted basis of $397,500 for 543?,250. In addition, she has current and suspended losses of 559525 associated with the partnership and has no other passive activities. 3. Calculate Lucy's total gain and her current deductible loss. Her total gain is - 39,?50 and her deductible loss is 5 19,8?5 . b. What type of income can the deductible loss offset? Lucy's deductible loss is offset against any income only active and passive activity income only portfolio and passive activity income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts