Question: Hi please explain. I like previous answer. Im not getting why is answer wronge. 00 redit to Paid-in Capital in Excess of Par Value, Common

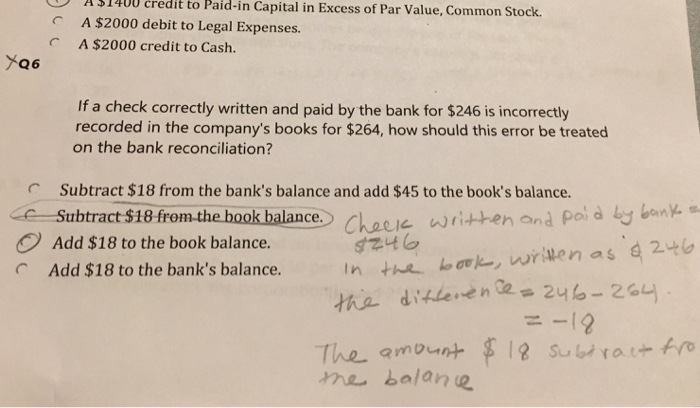

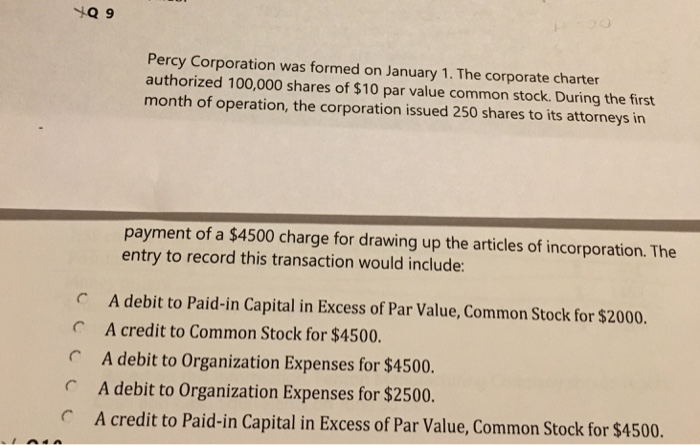

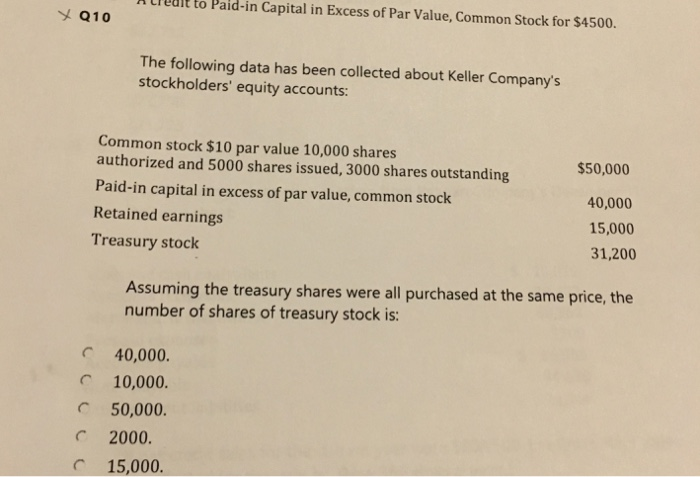

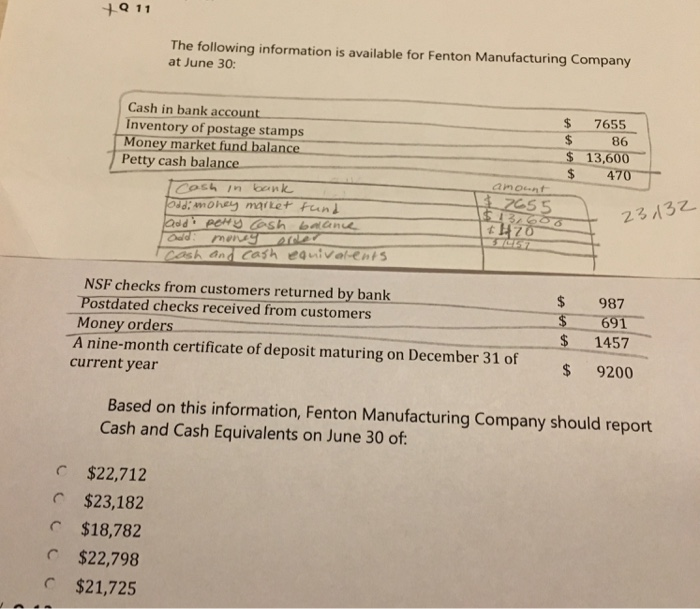

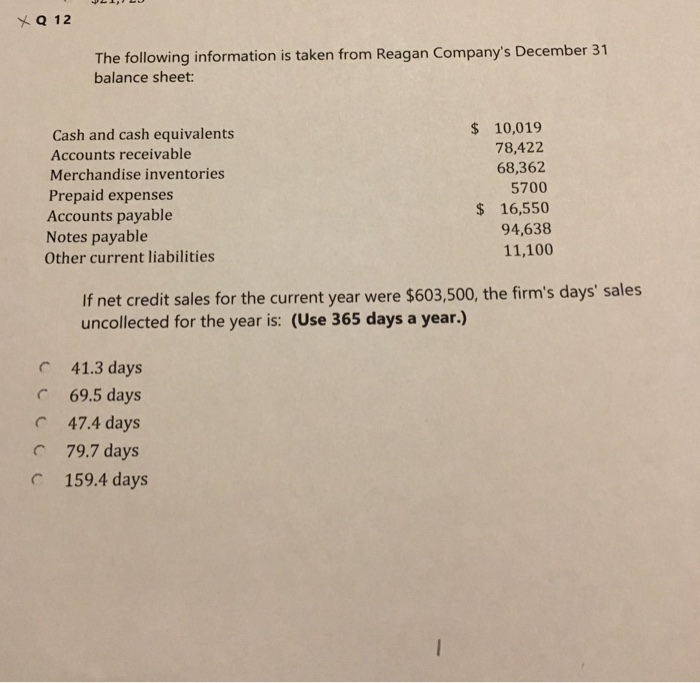

00 redit to Paid-in Capital in Excess of Par Value, Common Stock. A $2000 debit to Legal Expenses. A $2000 credit to Cash. If a check correctly written and paid by the bank for $246 is incorrectly recorded in the company's books for $264, how should this error be treated on the bank reconciliation? Subtract $18 from the bank's balance and add $45 to the book's balance Subtract $18 from-the book balance. Add $18 to the book balance. Add $18 to the bank's balance. n Percy Corporation was formed on January 1. The corporate charter authorized 100,000 shares of $10 par value common stock. During the first month of operation, the corporation issued 250 shares to its attorneys in payment of a $4500 charge for drawing up the articles of incorporation. The entry to record this transaction would include: A debit to Paid-in Capital in Excess of Par Value, Common Stock for $2000. A credit to Common Stock for $4500. A debit to Organization Expenses for $4500. A debit to Organization Expenses for $2500. A credit to Paid-in Capital in Excess of Par Value, Common Stock for $4500. C A thealt to Paid-in Capital in Excess of Par Value, Common Stock for $4500. YQ10 The following data has been collected about Keller Company's stockholders' equity accounts: Common stock $10 par value 10,000 shares authorized and 5000 shares issued, 3000 shares outstanding Paid-in capital in excess of par value, common stock Retained earnings Treasury stock $50,000 40,000 15,000 31,200 Assuming the treasury shares were all purchased at the same price, the number of shares of treasury stock is: 40,000. 10,000. C 50,000. 2000 15,000 The following information is available for Fenton Manufacturing Company at June 30 Cash in bank account Inventory of postage stamps $ 7655 86 Money market fund balance $ 13,600 470 Petty cash balance 5 23 132 mend Cash and Cash eauival-ents NSF checks from customers returned by bank Postdated checks received from customers $987 $ 1457 $ 9200 A nine-month certificate of deposit maturing on December 31 of current year Based on this information, Fenton Manufacturing Company should report Cash and Cash Equivalents on June 30 of $22,712 $23,182 $18,782 $22,798 $21,725 YQ12 The following information is taken from Reagan Company's December 31 balance sheet: Cash and cash equivalents Accounts receivable Merchandise inventories Prepaid expenses Accounts payable Notes payable Other current liabilities $10,019 78,422 68,362 5700 $16,550 94,638 11,100 If net credit sales for the current year were $603,500, the firm's days' sales uncollected for the year is: (Use 365 days a year.) C 41.3 days C 69.5 days 47.4 days C 797 days C 159.4 days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts