Question: hi please help check a) and b) i) ii) correct or not and please finish b iii) and c 02 Expected return perty (KL) 4

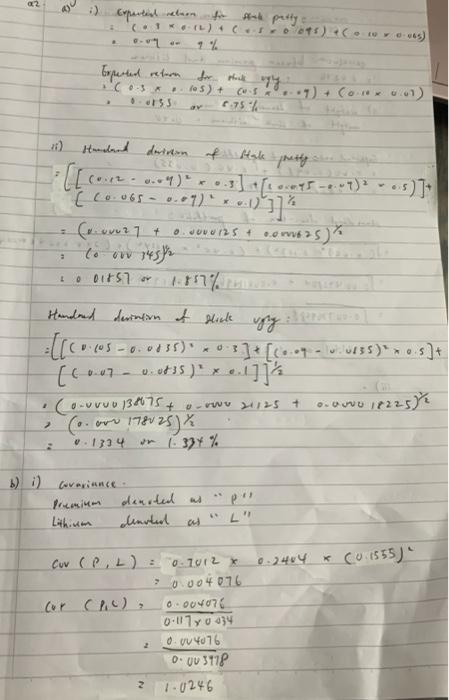

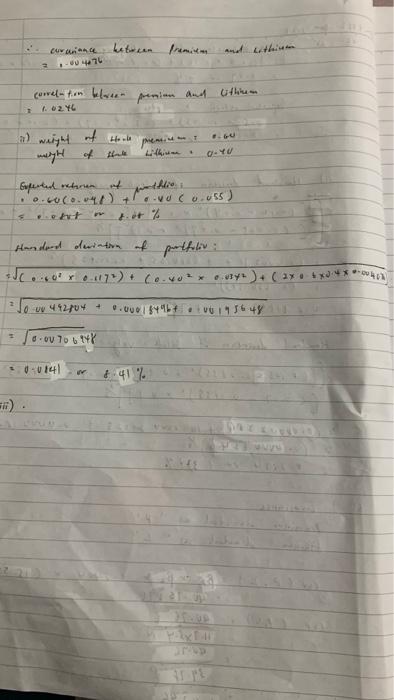

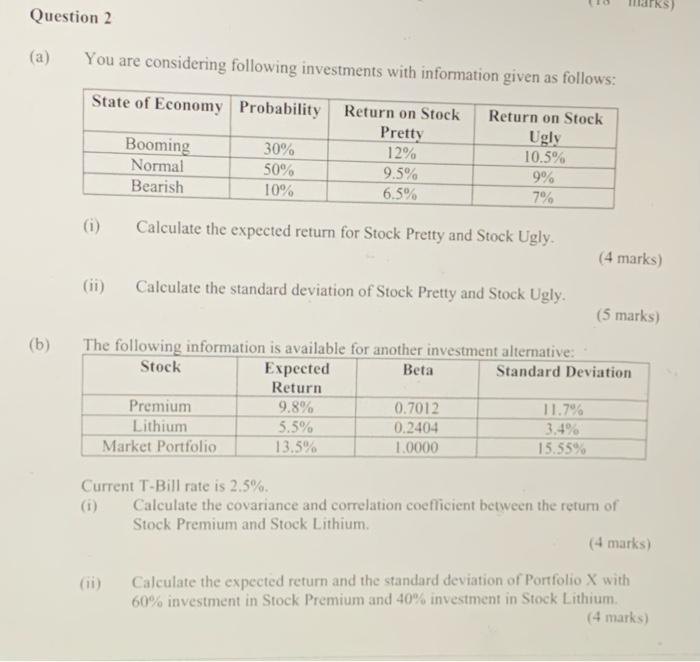

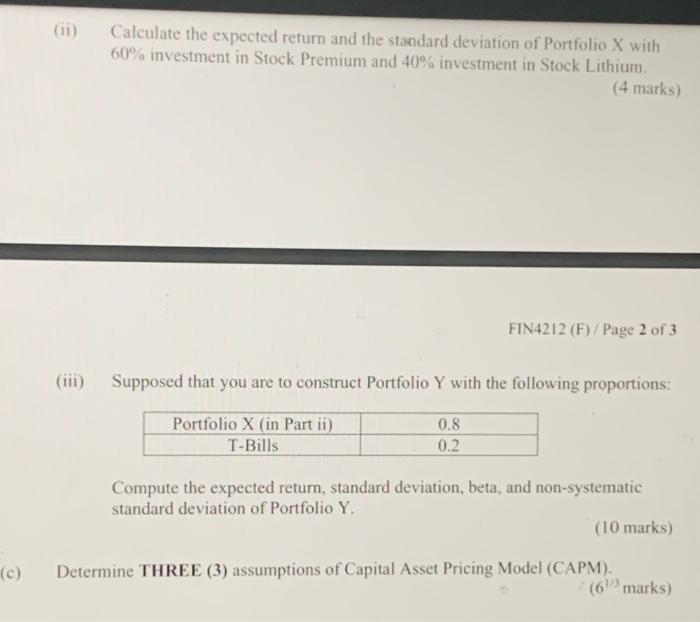

02 Expected return perty (KL) 4 (ISO) (0) 6. 1 % Experted return for COS 15) + Cis...1) + CORE ! 155 0.75 tak pretty ..5 O. JOU/254 Handand drinon of [[con. s)] ( [20.065-0-61) ]] 1) (e. 27 8. 6 25 ) Co on 145 01757 177% Hundred durinn af slick (160.1os-o. 3]+[C... 135)]+ [10.17 0.035)' x Couruu 138675 + o now 21125 + ouro 1822581 Coorr 178025) 0.1334 W 334 % . > b) :) Leverance Besim Lithium denoted as densted L" Cor (PL) : 0.7012 0-2464 CM 1555) ;0.004076 Cor CPL), 0.00076 0.11780034 0 V4076 0.00 3118 11.0246 2 ww between Premium and withium a -424 correlation between pension and Withinen 1.2.4G a) weight of Healt weight of premium 0-40 Experted nehren 0.0.47) + peddline VOC 0.08 ) Handard deviation of portfolio: COPY.17) + Co.). (ax****** 2 Jo w 41204 0.00018447 U5448 . 0.00 70 6147 0-14 w & 41% ti) Question 2 (a) You are considering following investments with information given as follows: State of Economy Probability Return on Stock Pretty Booming 30% 12% Normal 50% 9.5% Bearish 10% 6.5% Return on Stock Ugly 10.5% 9% 7% (b) (i) Calculate the expected return for Stock Pretty and Stock Ugly. (4 marks) (11) Calculate the standard deviation of Stock Pretty and Stock Ugly. (5 marks) The following information is available for another investment alternative: Stock Expected Beta Standard Deviation Return Premium 9.8% 0.7012 11.7% Lithium 5.5% 0.2404 3.4% Market Portfolio 13.5% 1.0000 15.55% Current T-Bill rate is 2.5%. Calculate the covariance and correlation coeflicient between the return of Stock Premium and Stock Lithium (4 marks) Calculate the expected return and the standard deviation of Portfolio X with 60% investment in Stock Premium and 40% investment in Stock Lithium (4 marks) Calculate the expected return and the standard deviation of Portfolio X with 60% investment in Stock Premium and 40% investment in Stock Lithium. (4 marks) FIN4212 (F)/Page 2 of 3 (iii) Supposed that you are to construct Portfolio Y with the following proportions: Portfolio X (in Part ii) T-Bills 0.8 0.2 Compute the expected return, standard deviation, beta, and non-systematic standard deviation of Portfolio Y. (10 marks) (c) Determine THREE (3) assumptions of Capital Asset Pricing Model (CAPM). (61% marks) 02 Expected return perty (KL) 4 (ISO) (0) 6. 1 % Experted return for COS 15) + Cis...1) + CORE ! 155 0.75 tak pretty ..5 O. JOU/254 Handand drinon of [[con. s)] ( [20.065-0-61) ]] 1) (e. 27 8. 6 25 ) Co on 145 01757 177% Hundred durinn af slick (160.1os-o. 3]+[C... 135)]+ [10.17 0.035)' x Couruu 138675 + o now 21125 + ouro 1822581 Coorr 178025) 0.1334 W 334 % . > b) :) Leverance Besim Lithium denoted as densted L" Cor (PL) : 0.7012 0-2464 CM 1555) ;0.004076 Cor CPL), 0.00076 0.11780034 0 V4076 0.00 3118 11.0246 2 ww between Premium and withium a -424 correlation between pension and Withinen 1.2.4G a) weight of Healt weight of premium 0-40 Experted nehren 0.0.47) + peddline VOC 0.08 ) Handard deviation of portfolio: COPY.17) + Co.). (ax****** 2 Jo w 41204 0.00018447 U5448 . 0.00 70 6147 0-14 w & 41% ti) Question 2 (a) You are considering following investments with information given as follows: State of Economy Probability Return on Stock Pretty Booming 30% 12% Normal 50% 9.5% Bearish 10% 6.5% Return on Stock Ugly 10.5% 9% 7% (b) (i) Calculate the expected return for Stock Pretty and Stock Ugly. (4 marks) (11) Calculate the standard deviation of Stock Pretty and Stock Ugly. (5 marks) The following information is available for another investment alternative: Stock Expected Beta Standard Deviation Return Premium 9.8% 0.7012 11.7% Lithium 5.5% 0.2404 3.4% Market Portfolio 13.5% 1.0000 15.55% Current T-Bill rate is 2.5%. Calculate the covariance and correlation coeflicient between the return of Stock Premium and Stock Lithium (4 marks) Calculate the expected return and the standard deviation of Portfolio X with 60% investment in Stock Premium and 40% investment in Stock Lithium (4 marks) Calculate the expected return and the standard deviation of Portfolio X with 60% investment in Stock Premium and 40% investment in Stock Lithium. (4 marks) FIN4212 (F)/Page 2 of 3 (iii) Supposed that you are to construct Portfolio Y with the following proportions: Portfolio X (in Part ii) T-Bills 0.8 0.2 Compute the expected return, standard deviation, beta, and non-systematic standard deviation of Portfolio Y. (10 marks) (c) Determine THREE (3) assumptions of Capital Asset Pricing Model (CAPM). (61% marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts