Question: hi, please help me complete a profit and loss statement QUESTION 5 (20 Marks; 36 Minutes) Assume a value-added tax (VAT) rate of 15%. Furniture

hi, please help me complete a profit and loss statement

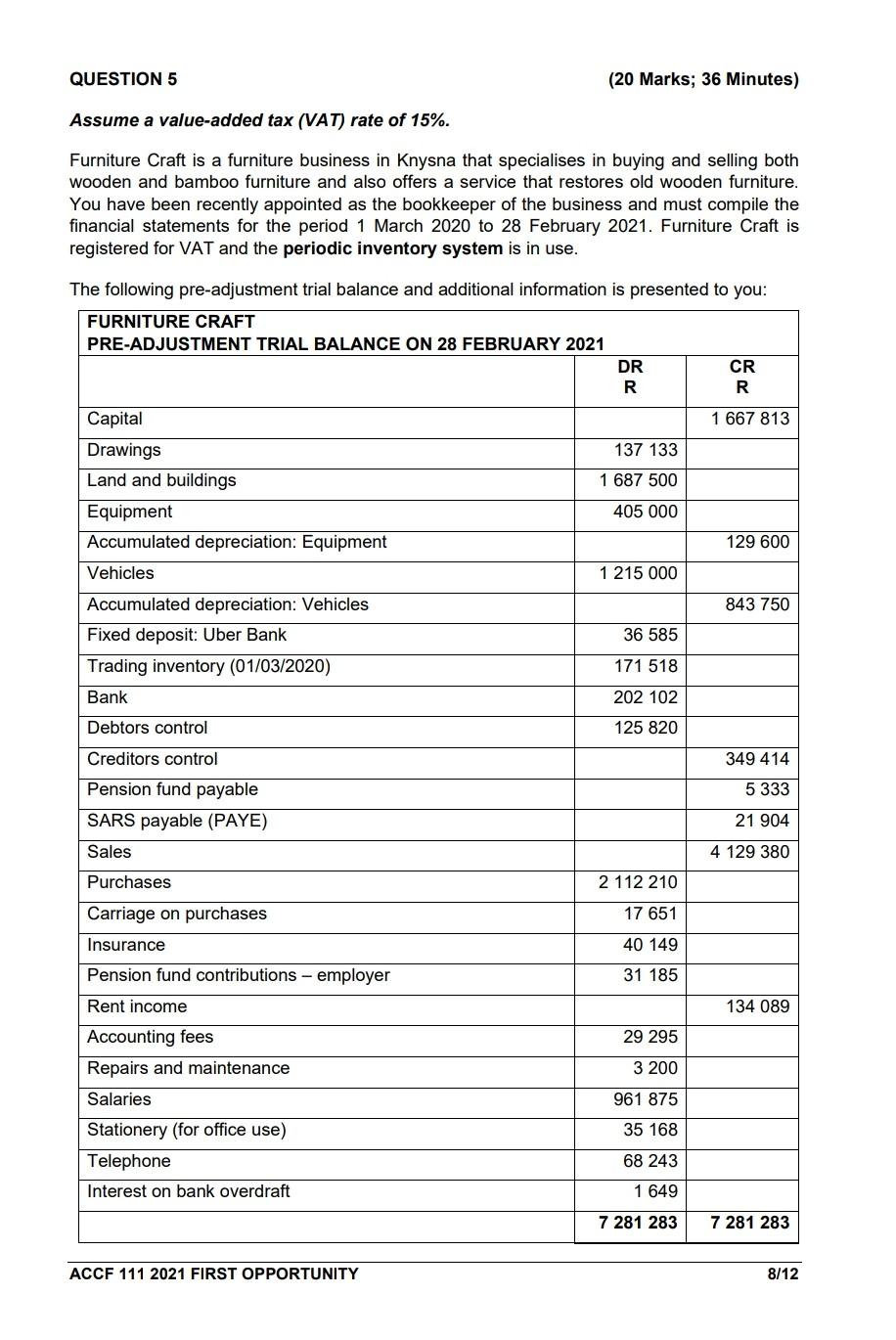

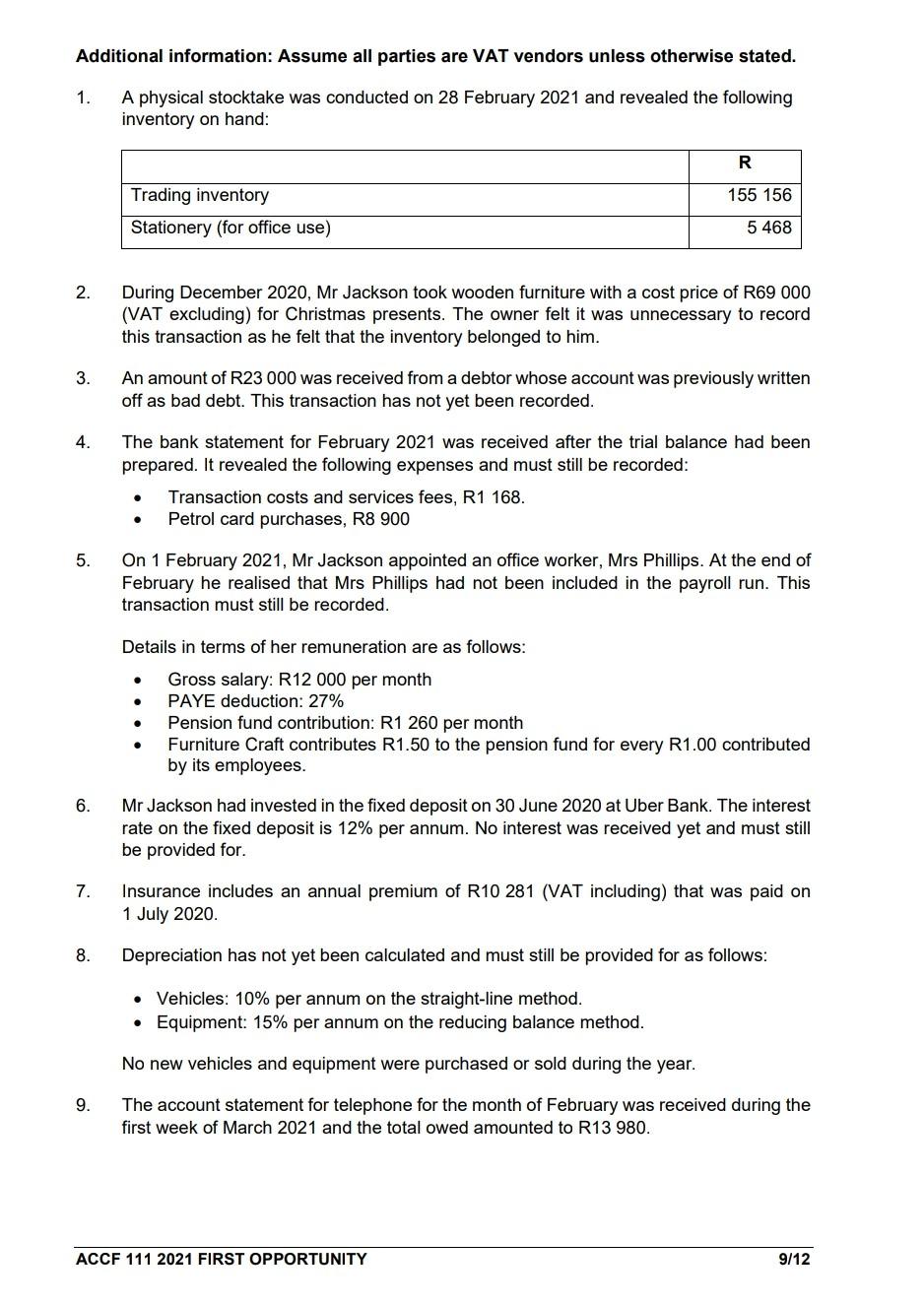

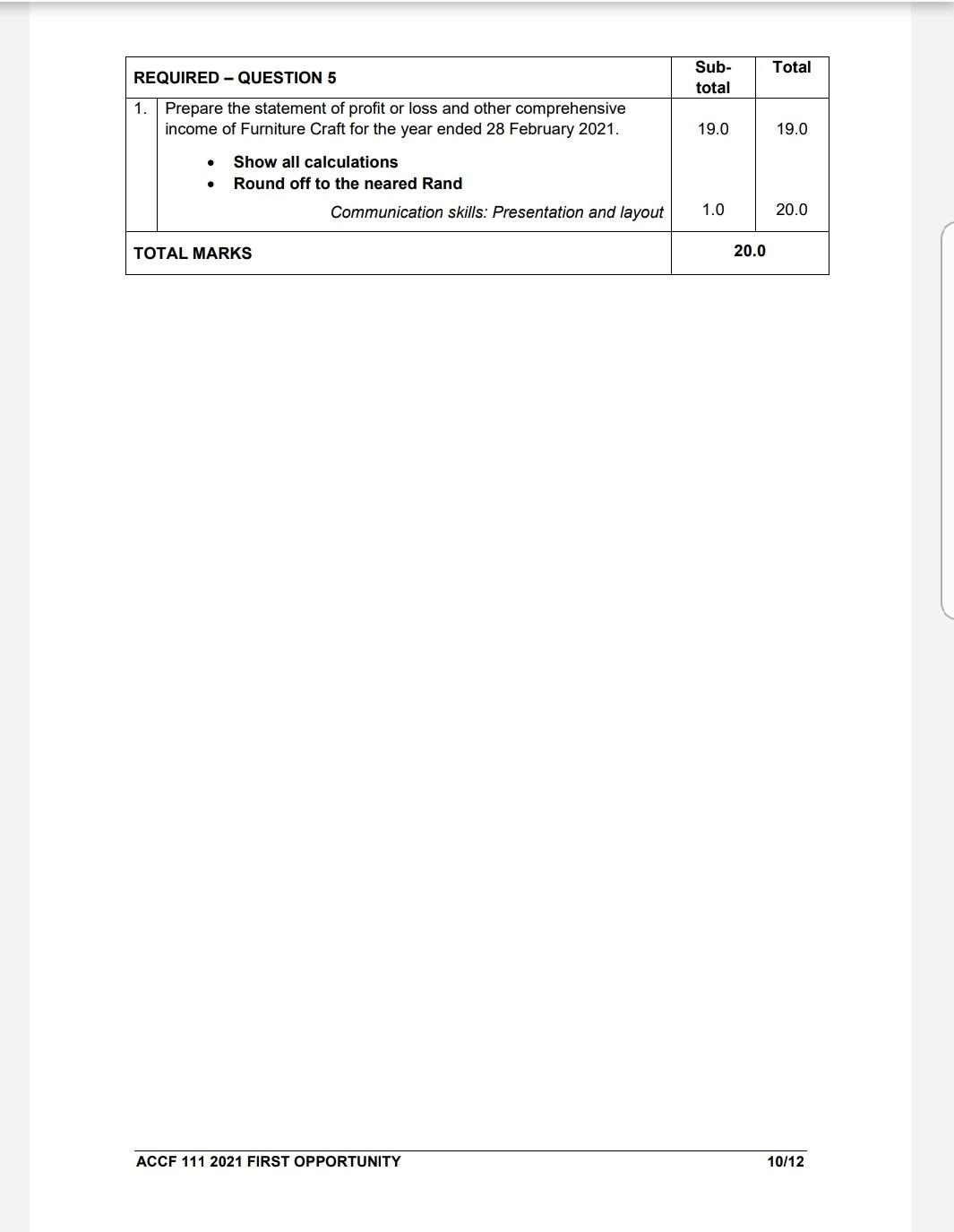

QUESTION 5 (20 Marks; 36 Minutes) Assume a value-added tax (VAT) rate of 15%. Furniture Craft is a furniture business in Knysna that specialises in buying and selling both wooden and bamboo furniture and also offers a service that restores old wooden furniture. You have been recently appointed as the bookkeeper of the business and must compile the financial statements for the period 1 March 2020 to 28 February 2021. Furniture Craft is registered for VAT and the periodic inventory system is in use. The following pre-adjustment trial balance and additional information is presented to you: FURNITURE CRAFT PRE-ADJUSTMENT TRIAL BALANCE ON 28 FEBRUARY 2021 DR CR R R Capital 1 667 813 Drawings 137 133 Land and buildings 1 687 500 Equipment 405 000 Accumulated depreciation: Equipment 129 600 Vehicles 1 215 000 Accumulated depreciation: Vehicles 843 750 Fixed deposit: Uber Bank 36 585 Trading inventory (01/03/2020) 171 518 Bank 202 102 Debtors control 125 820 Creditors control 349 414 5 333 Pension fund payable SARS payable (PAYE) 21 904 Sales 4 129 380 Purchases 2 112 210 Carriage on purchases 17 651 Insurance 40 149 Pension fund contributions - employer 31 185 Rent income 134 089 29 295 3 200 961 875 Accounting fees Repairs and maintenance Salaries Stationery (for office use) Telephone Interest on bank overdraft 35 168 68 243 1 649 7 281 283 7 281 283 ACCF 111 2021 FIRST OPPORTUNITY 8/12 Additional information: Assume all parties are VAT vendors unless otherwise stated. 1. A physical stocktake was conducted on 28 February 2021 and revealed the following inventory on hand: R 155 156 Trading inventory Stationery (for office use) 5 468 2. During December 2020, Mr Jackson took wooden furniture with a cost price of R69 000 (VAT excluding) for Christmas presents. The owner felt it was unnecessary to record this transaction as he felt that the inventory belonged to him. 3. An amount of R23 000 was received from a debtor whose account was previously written off as bad debt. This transaction has not yet been recorded. 4. The bank statement for February 2021 was received after the trial balance had been prepared. It revealed the following expenses and must still be recorded: Transaction costs and services fees, R1 168. Petrol card purchases, R8 900 5. On 1 February 2021, Mr Jackson appointed an office worker, Mrs Phillips. At the end of February he realised that Mrs Phillips had not been included in the payroll run. This transaction must still be recorded. Details in terms of her remuneration are as follows: Gross salary: R12 000 per month PAYE deduction: 27% Pension fund contribution: R1 260 per month Furniture Craft contributes R1.50 to the pension fund for every R1.00 contributed by its employees. 6. Mr Jackson had invested in the fixed deposit on 30 June 2020 at Uber Bank. The interest rate on the fixed deposit is 12% per annum. No interest was received yet and must still be provided for. 7. Insurance includes an annual premium of R10 281 (VAT including) that was paid on 1 July 2020. 8. Depreciation has not yet been calculated and must still be provided for as follows: Vehicles: 10% per annum on the straight-line method. Equipment: 15% per annum on the reducing balance method. . No new vehicles and equipment were purchased or sold during the year. 9. The account statement for telephone for the month of February was received during the first week of March 2021 and the total owed amounted to R13 980. ACCF 111 2021 FIRST OPPORTUNITY 9/12 Total REQUIRED - QUESTION 5 Sub- total 1. Prepare the statement of profit or loss and other comprehensive income of Furniture Craft for the year ended 28 February 2021. 19.0 19.0 . Show all calculations Round off to the neared Rand Communication skills: Presentation and layout 1.0 20.0 TOTAL MARKS 20.0 ACCF 111 2021 FIRST OPPORTUNITY 10/12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts