Question: Hi, please help me to solve this question. Question 8 O out of 1 points This question deals with merger arbitrage. Suppose that a merger

Hi, please help me to solve this question.

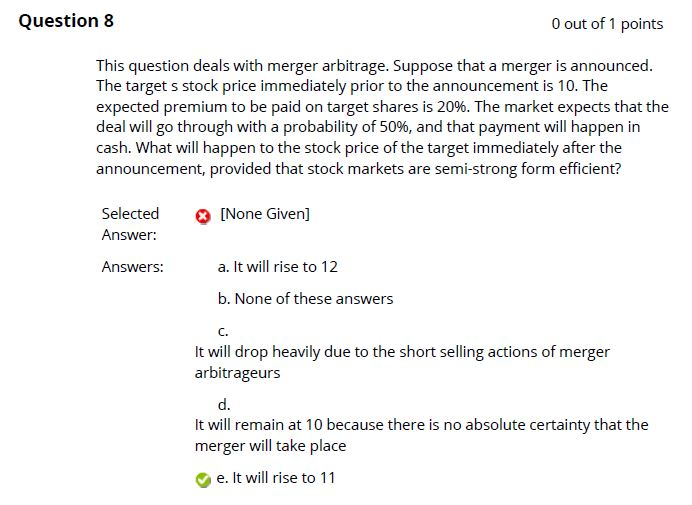

Question 8 O out of 1 points This question deals with merger arbitrage. Suppose that a merger is announced. The target s stock price immediately prior to the announcement is 10. The expected premium to be paid on target shares is 20%. The market expects that the deal will go through with a probability of 50%, and that payment will happen in cash. What will happen to the stock price of the target immediately after the announcement, provided that stock markets are semi-strong form efficient? [None Given] Selected Answer: Answers: a. It will rise to 12 b. None of these answers C. It will drop heavily due to the short selling actions of merger arbitrageurs d. It will remain at 10 because there is no absolute certainty that the merger will take place e. It will rise to 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts