Question: Hi, please help me with this problem, I've been struggling with this for a while, thank you!! Audi Manufacturing In December 2020, Joe Biden, President,

Hi, please help me with this problem, I've been struggling with this for a while, thank you!!

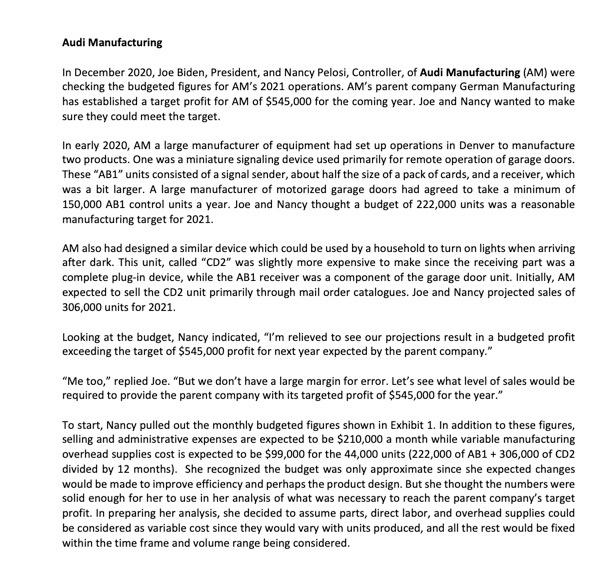

Audi Manufacturing In December 2020, Joe Biden, President, and Nancy Pelosi, Controller, of Audi Manufacturing (AM) were checking the budgeted figures for AM's 2021 operations. AM's parent company German Manufacturing has established a target profit for AM of $545,000 for the coming year. Joe and Nancy wanted to make sure they could meet the target. In early 2020, AM a large manufacturer of equipment had set up operations in Denver to manufacture two products. One was a miniature signaling device used primarily for remote operation of garage doors. These "AB1" units consisted of a signal sender, about half the size of a pack of cards, and a receiver, which was a bit larger. A large manufacturer of motorized garage doors had agreed to take a minimum of 150,000 AB1 control units a year. Joe and Nancy thought a budget of 222,000 units was a reasonable manufacturing target for 2021. AM also had designed a similar device which could be used by a household to turn on lights when arriving after dark. This unit, called "CD2" was slightly more expensive to make since the receiving part was a complete plug-in device, while the AB1 receiver was a component of the garage door unit. Initially, AM expected to sell the CD2 unit primarily through mail order catalogues. Joe and Nancy projected sales of 306,000 units for 2021 Looking at the budget, Nancy indicated, "I'm relieved to see our projections result in a budgeted profit exceeding the target of $545,000 profit for next year expected by the parent company." "Me too," replied Joe. "But we don't have a large margin for error. Let's see what level of sales would be required to provide the parent company with its targeted profit of $545,000 for the year." To start, Nancy pulled out the monthly budgeted figures shown in Exhibit 1. In addition to these figures, selling and administrative expenses are expected to be $210,000 a month while variable manufacturing overhead supplies cost is expected to be $99,000 for the 44,000 units (222,000 of AB1 + 306,000 of CD2 divided by 12 months). She recognized the budget was only approximate since she expected changes would be made to improve efficiency and perhaps the product design. But she thought the numbers were solid enough for her to use in her analysis of what was necessary to reach the parent company's target profit. In preparing her analysis, she decided to assume parts, direct labor, and overhead supplies could be considered as variable cost since they would vary with units produced, and all the rest would be fixed within the time frame and volume range being considered. (Multiple product breakeven). What is the monthly breakeven in sales and units of AB1 and CD2 given the original monthly budget information? Create a contribution income statement to proof your answer. (10 points). (Hint: You can also use the following formula (in units or percent) in finding the weighted CM to compute your answer: (Sales mix of AB1 * CM of AB1) + (Sales mix of CD2 * CM of CD2). (Multiple product breakeven). What is the total monthly number of units and monthly sales dollars which would provide the profit target specified by the parent company of $545,000 for the year? Create a contribution margin statement to proof your answer. (10 points) (Hint: You need the weighted CM from question 7 to compute your answer) Audi Manufacturing In December 2020, Joe Biden, President, and Nancy Pelosi, Controller, of Audi Manufacturing (AM) were checking the budgeted figures for AM's 2021 operations. AM's parent company German Manufacturing has established a target profit for AM of $545,000 for the coming year. Joe and Nancy wanted to make sure they could meet the target. In early 2020, AM a large manufacturer of equipment had set up operations in Denver to manufacture two products. One was a miniature signaling device used primarily for remote operation of garage doors. These "AB1" units consisted of a signal sender, about half the size of a pack of cards, and a receiver, which was a bit larger. A large manufacturer of motorized garage doors had agreed to take a minimum of 150,000 AB1 control units a year. Joe and Nancy thought a budget of 222,000 units was a reasonable manufacturing target for 2021. AM also had designed a similar device which could be used by a household to turn on lights when arriving after dark. This unit, called "CD2" was slightly more expensive to make since the receiving part was a complete plug-in device, while the AB1 receiver was a component of the garage door unit. Initially, AM expected to sell the CD2 unit primarily through mail order catalogues. Joe and Nancy projected sales of 306,000 units for 2021 Looking at the budget, Nancy indicated, "I'm relieved to see our projections result in a budgeted profit exceeding the target of $545,000 profit for next year expected by the parent company." "Me too," replied Joe. "But we don't have a large margin for error. Let's see what level of sales would be required to provide the parent company with its targeted profit of $545,000 for the year." To start, Nancy pulled out the monthly budgeted figures shown in Exhibit 1. In addition to these figures, selling and administrative expenses are expected to be $210,000 a month while variable manufacturing overhead supplies cost is expected to be $99,000 for the 44,000 units (222,000 of AB1 + 306,000 of CD2 divided by 12 months). She recognized the budget was only approximate since she expected changes would be made to improve efficiency and perhaps the product design. But she thought the numbers were solid enough for her to use in her analysis of what was necessary to reach the parent company's target profit. In preparing her analysis, she decided to assume parts, direct labor, and overhead supplies could be considered as variable cost since they would vary with units produced, and all the rest would be fixed within the time frame and volume range being considered. (Multiple product breakeven). What is the monthly breakeven in sales and units of AB1 and CD2 given the original monthly budget information? Create a contribution income statement to proof your answer. (10 points). (Hint: You can also use the following formula (in units or percent) in finding the weighted CM to compute your answer: (Sales mix of AB1 * CM of AB1) + (Sales mix of CD2 * CM of CD2). (Multiple product breakeven). What is the total monthly number of units and monthly sales dollars which would provide the profit target specified by the parent company of $545,000 for the year? Create a contribution margin statement to proof your answer. (10 points) (Hint: You need the weighted CM from question 7 to compute your answer)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts