Question: hi please help!! possible Bond value and changing required returns Midland Utilities has a bond issue outstanding that will mature to its $1,000 par value

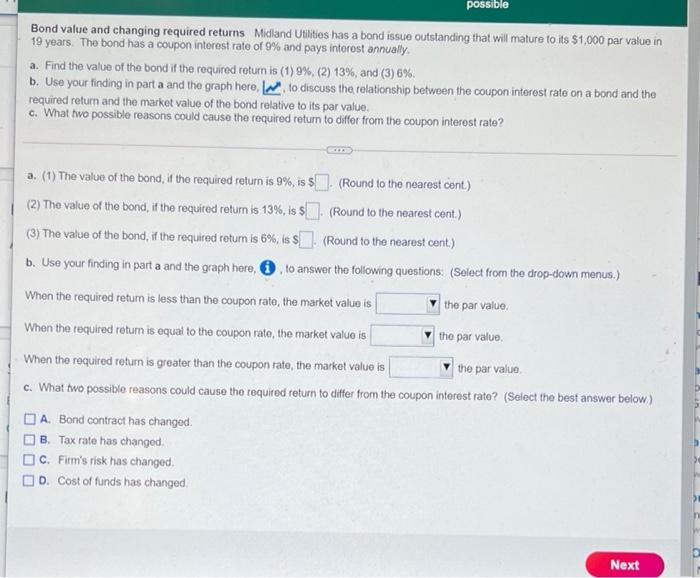

possible Bond value and changing required returns Midland Utilities has a bond issue outstanding that will mature to its $1,000 par value in 19 years. The bond has a coupon interest rate of 9% and pays interest annually. a. Find the value of the bond if the required return is (1)9%, (2) 13%, and (3) 6% b. Use your finding in part a and the graph hero w to discuss the relationship between the coupon interest rate on a bond and the required return and the market value of the bond relative to its par value c. What two possible reasons could cause the required return to differ from the coupon interest rate? a. (1) The value of the bond, if the required return is 9%, is $. (Round to the nearest cent.) (2) The value of the bond, if the required return is 13%, is $. (Round to the nearest cent.) (3) The value of the bond, if the required return is 6%, is $. (Round to the nearest cent) b. Use your finding in part a and the graph here, to answer the following questions: (Select from the drop-down menus.) When the required retum is less than the coupon rato, the market value is the par value When the required return is equal to the coupon rate, the market value is the par value When the required return is greater than the coupon rate, the market value is the par value c. What two possible reasons could cause the required return to differ from the coupon interest rate? (Select the best answer below) A. Bond contract has changed B. Tax rate has changed C. Firm's risk has changed, D. Cost of funds has changed E Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts