Question: hi please help step by step 10. A trader owns 50 000 units of a particular asset and decides to hedge the value of her

hi please help step by step

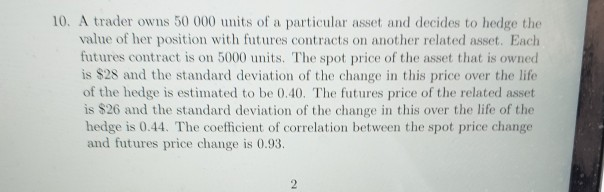

10. A trader owns 50 000 units of a particular asset and decides to hedge the value of her position with futures contracts on another related asset. Each futures contract is on 5000 units. The spot price of the asset that is owned is $28 and the standard deviation of the change in this price over the life of the hedge is estimated to be 0.40. The futures price of the related asset is $26 and the standard deviation of the change in this over the life of the hedge is 0.44. The coefficient of correlation between the spot price change and futures price change is 0.93

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts