Question: Hi please help to answer this question and all the parts You want to create a price-weighted index consisting of the following three stocks. At

Hi please help to answer this question and all the parts

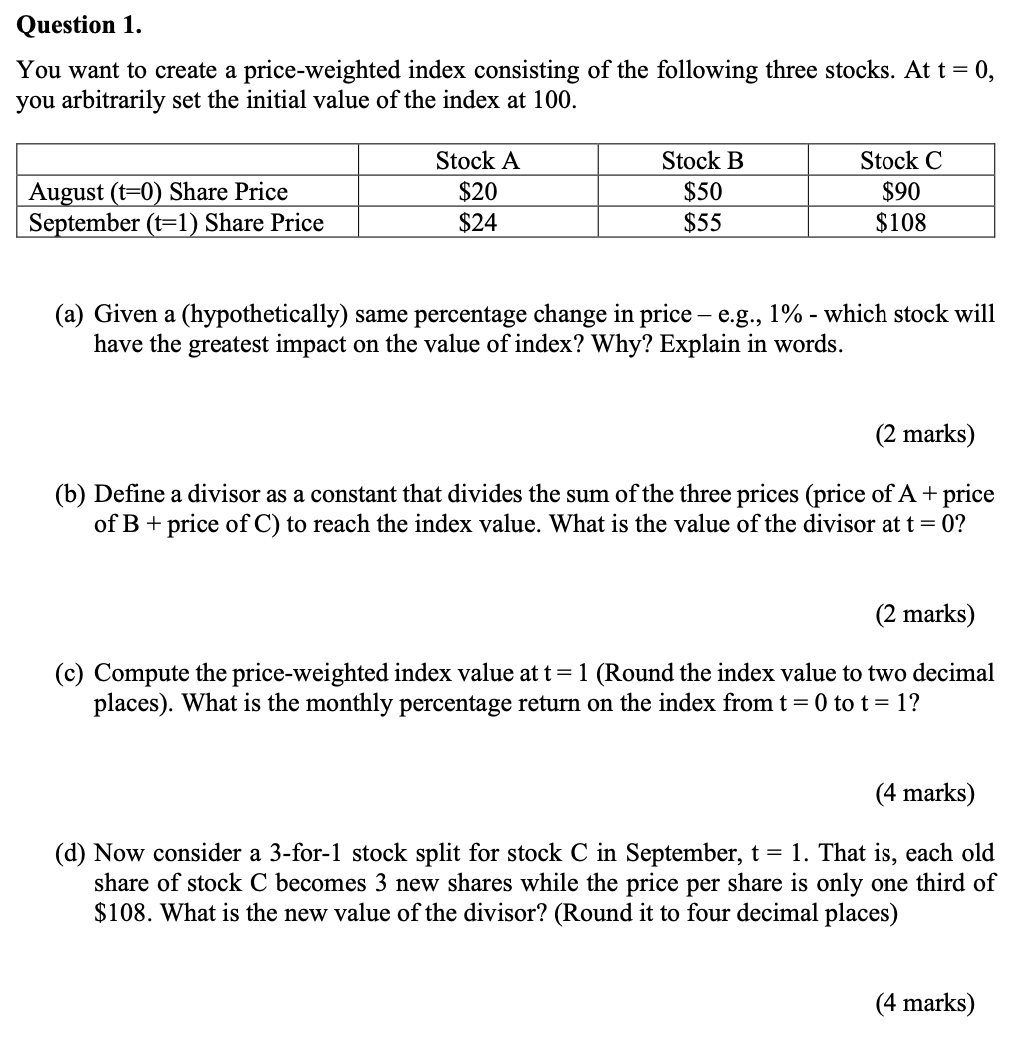

You want to create a price-weighted index consisting of the following three stocks. At t=0, you arbitrarily set the initial value of the index at 100 . \begin{tabular}{|c} A \\ \hline S \\ \hline \end{tabular} (a) Given a (hypothetically) same percentage change in price - e.g., 1\% - which stock will have the greatest impact on the value of index? Why? Explain in words. (2 marks) (b) Define a divisor as a constant that divides the sum of the three prices (price of A+ price of B+ price of C ) to reach the index value. What is the value of the divisor at t=0 ? (2 marks) (c) Compute the price-weighted index value at t=1 (Round the index value to two decimal places). What is the monthly percentage return on the index from t=0 to t=1 ? (4 marks) (d) Now consider a 3-for-1 stock split for stock C in September, t=1. That is, each old share of stock C becomes 3 new shares while the price per share is only one third of $108. What is the new value of the divisor? (Round it to four decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts