Question: Hi, please help with question 2.1 Additional information: - All property is depreciated on the straight-line basis. - All valuations were done by a professional

Hi, please help with question 2.1

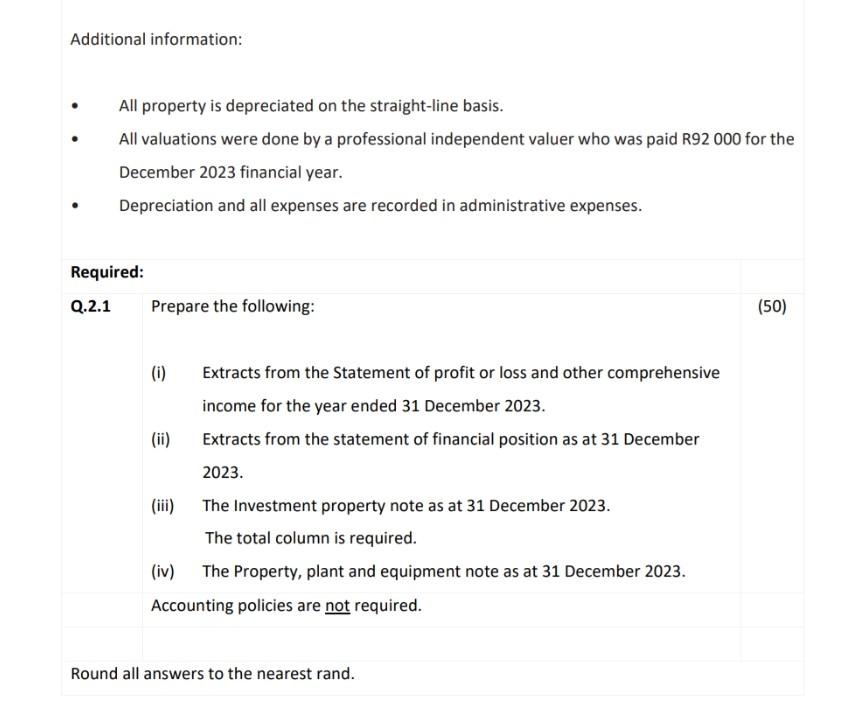

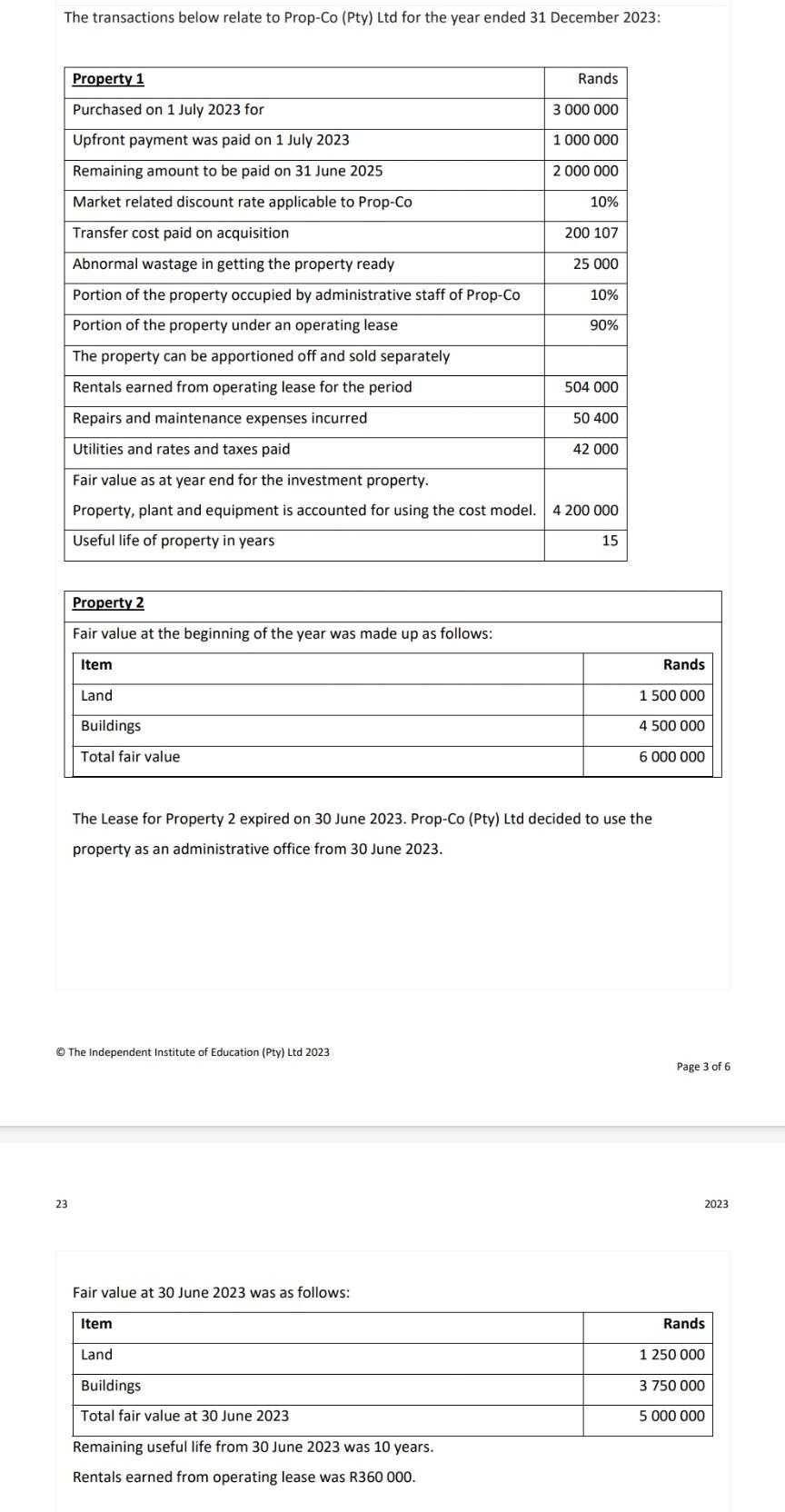

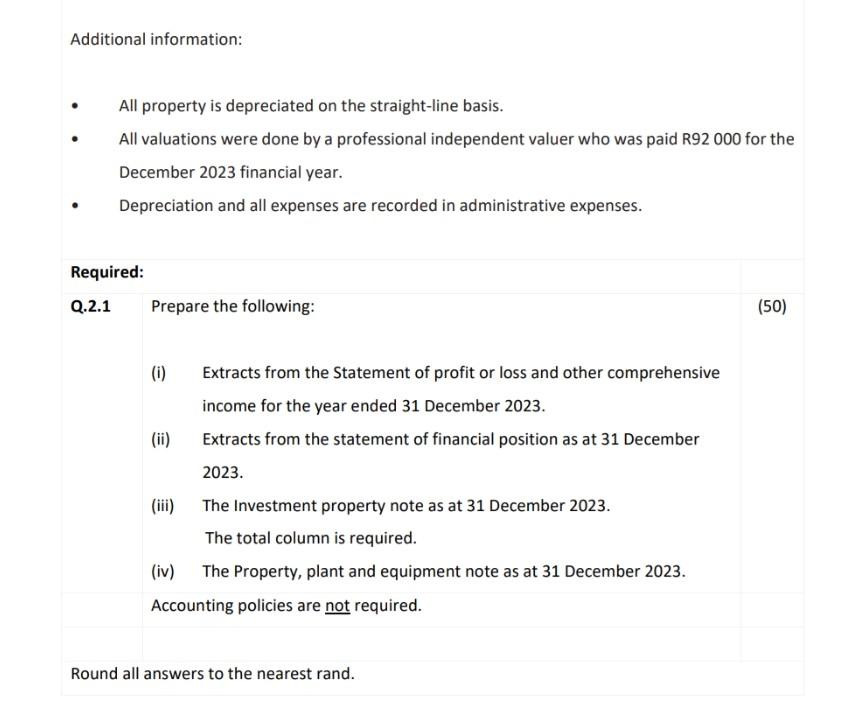

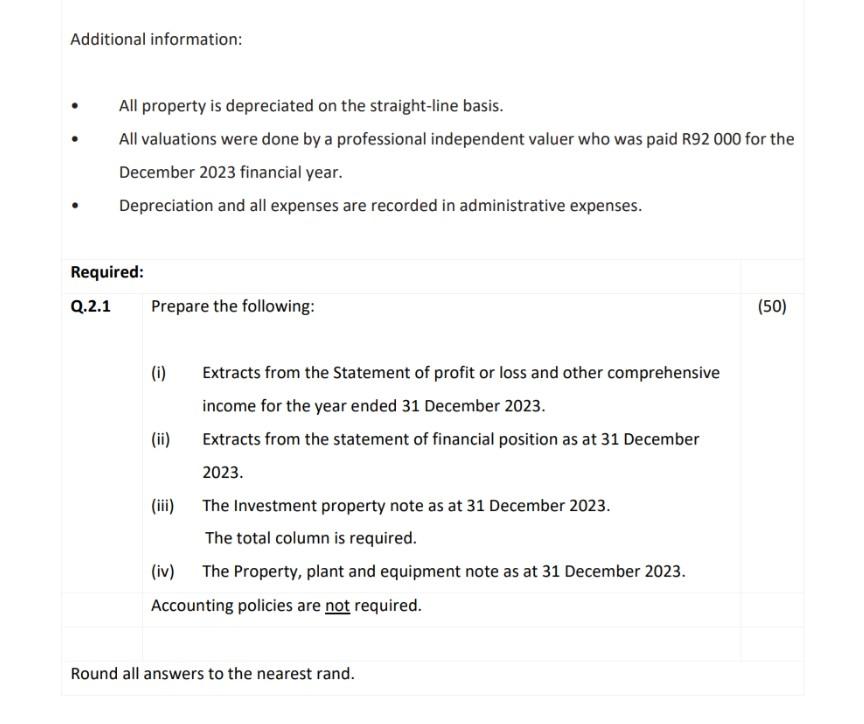

Additional information: - All property is depreciated on the straight-line basis. - All valuations were done by a professional independent valuer who was paid R92000 for the December 2023 financial year. - Depreciation and all expenses are recorded in administrative expenses. Required: Q.2.1 Prepare the following: (50) (i) Extracts from the Statement of profit or loss and other comprehensive income for the year ended 31 December 2023. (ii) Extracts from the statement of financial position as at 31 December 2023. (iii) The Investment property note as at 31 December 2023. The total column is required. (iv) The Property, plant and equipment note as at 31 December 2023. Accounting policies are not required. Round all answers to the nearest rand. The transactions below relate to Prop-Co (Pty) Ltd for the year ended 31 December 2023: The Lease for Property 2 expired on 30 June 2023. Prop-Co (Pty) Ltd decided to use the property as an administrative office from 30 June 2023. (C) The Independent Institute of Education (Pty) Ltd 2023 23 Additional information: - All property is depreciated on the straight-line basis. - All valuations were done by a professional independent valuer who was paid R92000 for the December 2023 financial year. - Depreciation and all expenses are recorded in administrative expenses. Required: Q.2.1 Prepare the following: (50) (i) Extracts from the Statement of profit or loss and other comprehensive income for the year ended 31 December 2023. (ii) Extracts from the statement of financial position as at 31 December 2023. (iii) The Investment property note as at 31 December 2023. The total column is required. (iv) The Property, plant and equipment note as at 31 December 2023. Accounting policies are not required. Round all answers to the nearest rand. Additional information: - All property is depreciated on the straight-line basis. - All valuations were done by a professional independent valuer who was paid R92000 for the December 2023 financial year. - Depreciation and all expenses are recorded in administrative expenses. Required: Q.2.1 Prepare the following: (50) (i) Extracts from the Statement of profit or loss and other comprehensive income for the year ended 31 December 2023. (ii) Extracts from the statement of financial position as at 31 December 2023. (iii) The Investment property note as at 31 December 2023. The total column is required. (iv) The Property, plant and equipment note as at 31 December 2023. Accounting policies are not required. Round all answers to the nearest rand

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts