Question: Hi! Please help with the following.. QUESTION 2 A startup pharmaceutical company is considering developing a drug that has a $1,000 million initial investment (in

Hi! Please help with the following..

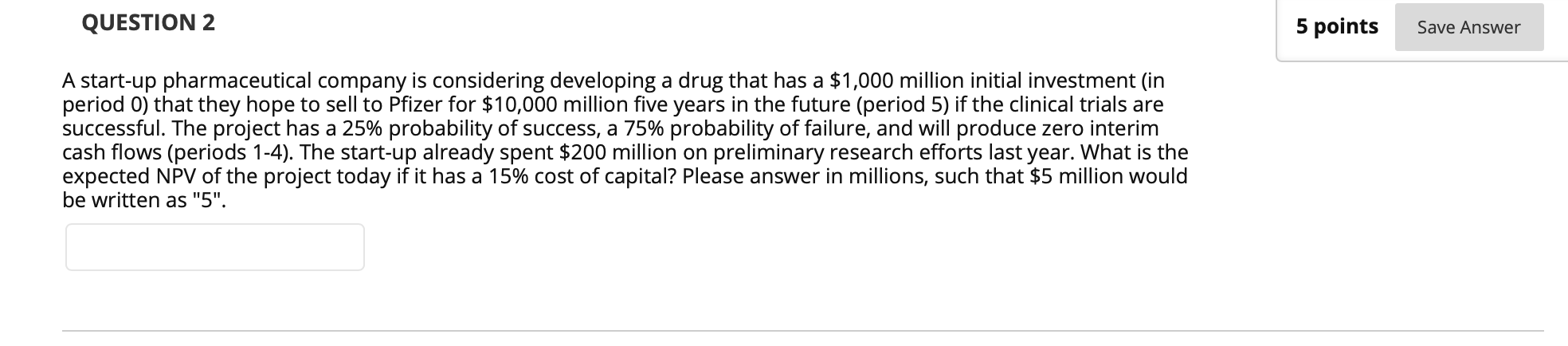

QUESTION 2 A startup pharmaceutical company is considering developing a drug that has a $1,000 million initial investment (in period 0) that they hope to sell to Pfizer for $10,000 million ve years in the future (period 5) if the clinical trials are successful. The project has a 25% probability of success, a 75% probability of failure, and will produce zero interim cash ows (periods 1-4). The startup already spent $200 million on preliminary research efforts last year. What is the expected NPV of the project today if it has a 15% cost of capital? Please answer in millions, such that $5 million would be written as \"'5' 5 points Save

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts