Question: Hi, please help with the question below! Please follow the below instruction before you wrote the answer to this question: 1. Follow the exact format

Hi, please help with the question below! Please follow the below instruction before you wrote the answer to this question:

1. Follow the exact format of the chart when you write down the answer

2. Provide the detailed solution of how you get these answers

3. Make sure you will answer all the questions when you answer them.

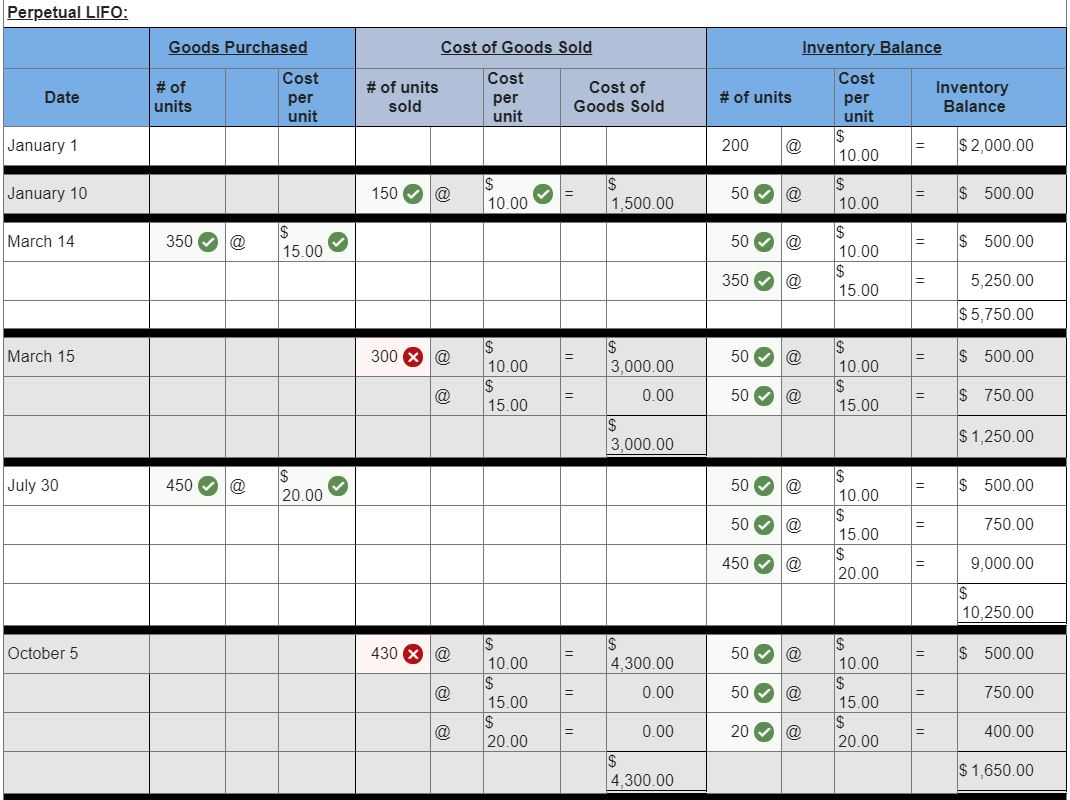

In this case, you only need to answer the part that is marked as red (incorrect). Thank you.

In other words, the blank should be filled.

In other words, the blank should be filled.

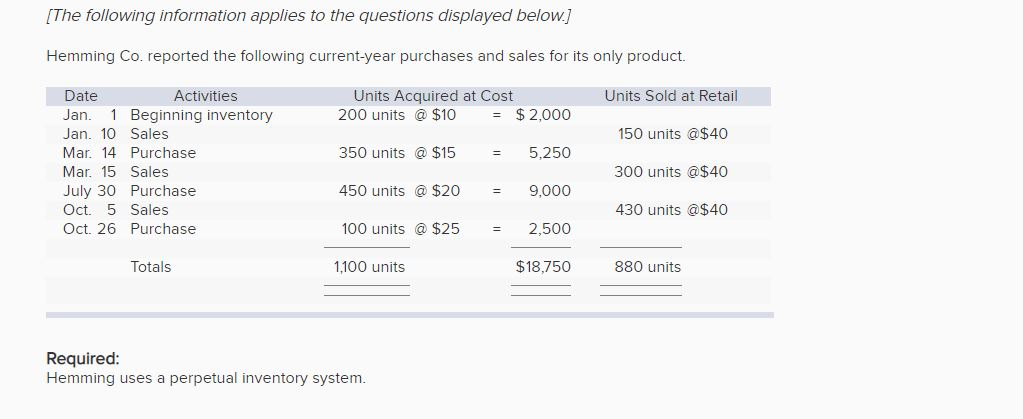

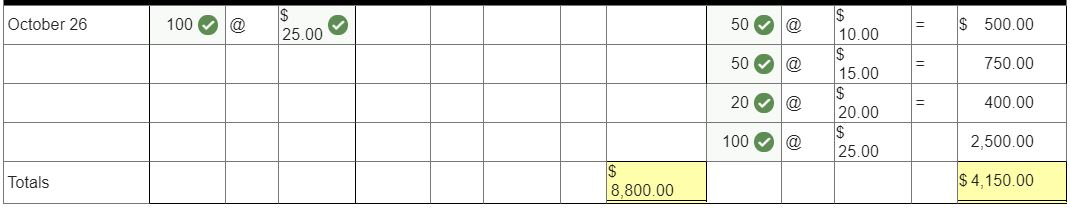

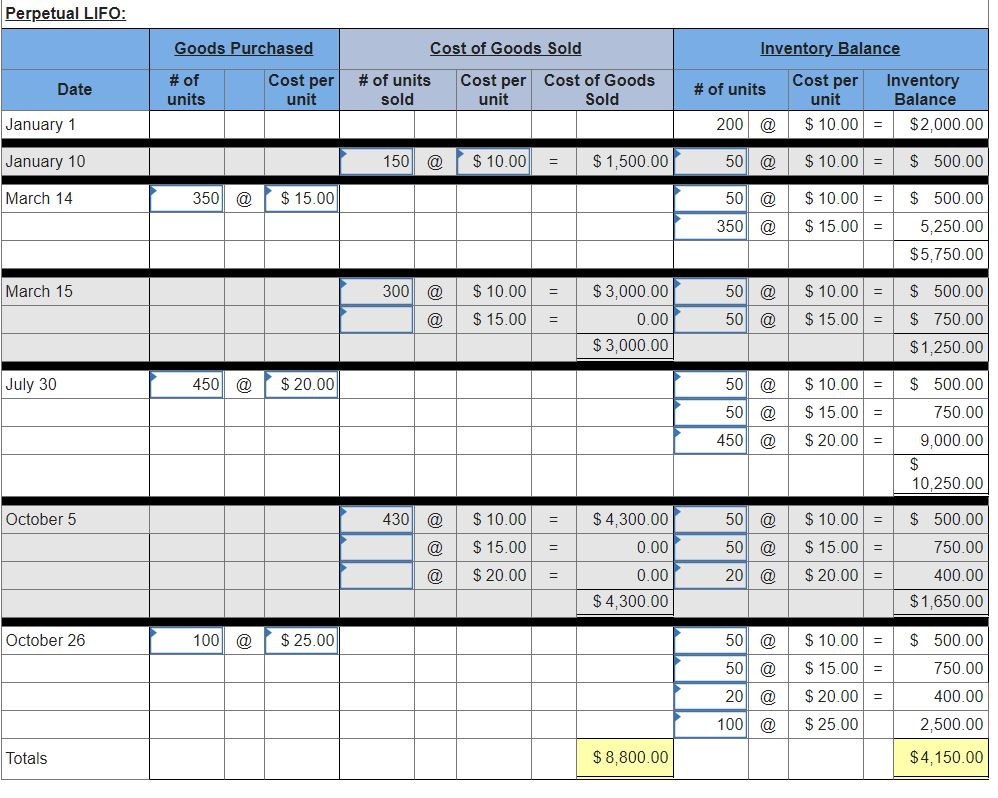

[The following information applies to the questions displayed below.] Hemming Co. reported the following current-year purchases and sales for its only product. Units Sold at Retail Units Acquired at Cost 200 units @ $10 = $2,000 150 units @$40 350 units @ $15 = 5,250 Date Activities Jan. 1 Beginning inventory Jan. 10 Sales Mar. 14 Purchase Mar. 15 Sales July 30 Purchase Oct. 5 Sales Oct. 26 Purchase 300 units @$40 450 units @ $20 = 9,000 430 units @$40 100 units @ $25 = 2,500 Totals 1,100 units $18,750 880 units Required: Hemming uses a perpetual inventory system. Perpetual LIFO: Goods Purchased Cost of Goods Sold Date Inventory Balance Cost Inventory per Balance Cost per # of units Cost per # of units sold Cost of Goods Sold # of units unit unit January 1 200 2 $ 2,000.00 January 10 150 @ 10.00 - 1.500.00 10.00 60.00 50 50 @ @ = = March 14 350 @ 15.00 $ 500.00 500.00 5,250.00 $5,750.00 350 @ 15.00 March 15 300X @ 10.00 $ 500.00 3.000.00 50 50 @ @ 10.00 15.00 @ 15.00 0.00 $ 750.00 3.000.00 $ 1,250.00 July 30 450 @ 20.00 $ 500.00 50 50 @ @ 10.00 15.00 750.00 450 $ @ 20.00 9,000.00 10.250.00 October 5 430 @ 10.00 @ 50 50 10.00 $ 500.00 4,300.00 0.00 15.00 750.00 15.00 @ 0.00 20 20.00 @ 20.00 400.00 $ 1.650.00 4,300.00 October 26 100 @ 25.00 @ 10.00 $ 500.00 750.00 15.00 50 50 20 100 400.00 20.00 @ @ $ 2,500.00 25.00 Totals 8,800.00 $ 4,150.00 Perpetual LIFO: Goods Purchased # of Cost per units unit Cost of Goods Sold # of units Cost per Cost of Goods sold unit Sold Date Inventory Balance # of units Cost per cost per Inventory unit Balance 200 @ $ 10.00 = $2,000.00 50 @ $ 10.00 = $ 500.00 January 1 January 10 150 @ $ 10.00 = $1,500.00 March 14 350 @ $ 15.00 50 350 @ @ $ 10.00 = $ 15.00 = $ 500.00 5.250.00 $5,750.00 March 15 300 @ @ $ 10.00 $ 15.00 = = $3,000.00 0.00 $3,000.00 50 50 @ @ $ 10.00 = $15.00 = $ 500.00 $ 750.00 $1,250.00 July 30 450 @ $ 20.00 50 50 450 @ @ @ $ 10.00 = $ 15.00 = $ 20.00 = $ 500.00 750.00 9,000.00 10,250.00 October 5 430 @ $ 10.00 $ 15.00 $ 20.00 = = = $4,300.00 0.00 0.00 $ 4,300.00 50 50 20 @ @ @ $ 10.00 = $ 15.00 = $ 20.00 = $ 500.00 750.00 400.00 $1,650.00 @ October 26 100 @ $ 25.00 50 50 20 100 @ @ @ @ $ 10.00 = $ 15.00 = $ 20.00 = $ 25.00 $ 500.00 750.00 400.00 2,500.00 Totals $ 8,800.00 $4,150.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts