Question: Hi Please help with the question below. Prepare tax documents for individuals- Small business entities Answer to Q-6.13 (Various concessions applied) Note- Please show all

Hi Please help with the question below. Prepare tax documents for individuals- Small business entities

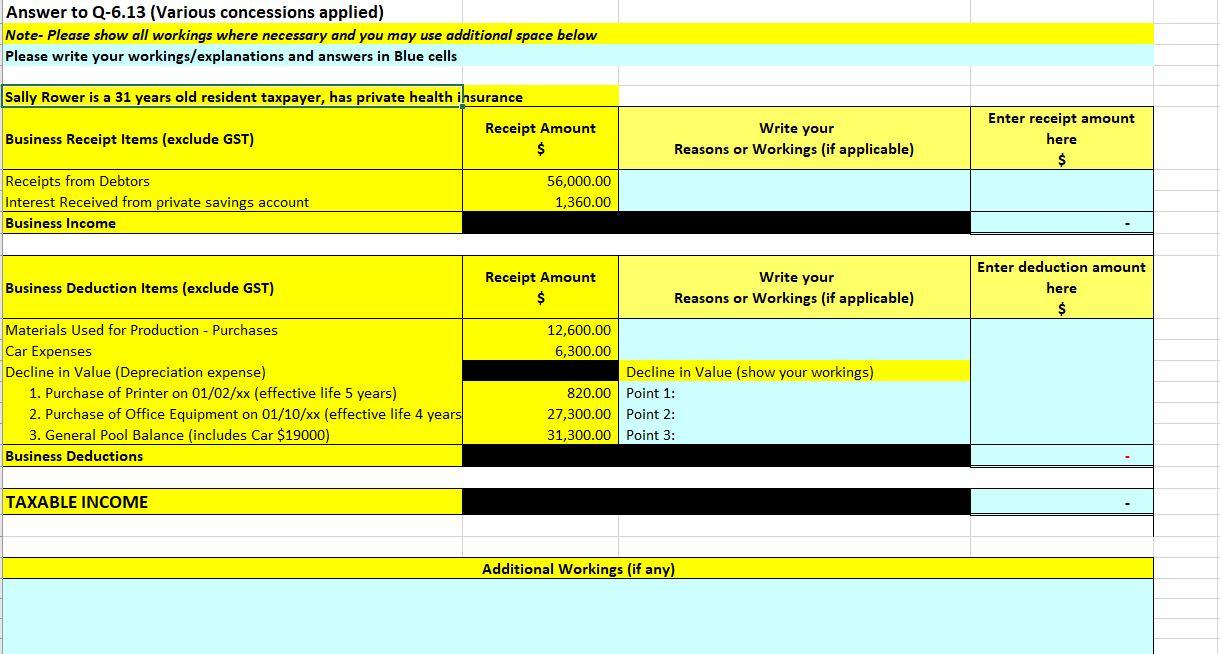

Answer to Q-6.13 (Various concessions applied) Note- Please show all workings where necessary and you may use additional space below Please write your workings/explanations and answers in Blue cells Sally Rower is a 31 years old resident taxpayer, has private health ihsurance Business Receipt Items (exclude GST) Receipt Amount $ Write your Reasons or Workings (if applicable) Enter receipt amount here $ Receipts from Debtors Interest Received from private savings account Business Income 56,000.00 1,360.00 Business Deduction Items (exclude GST) Receipt Amount $ Write your Reasons or Workings (if applicable) Enter deduction amount here $ Materials Used for Production - Purchases Car Expenses Decline in Value (Depreciation expense) 1. Purchase of Printer on 01/02/xx (effective life 5 years) 2. Purchase of Office Equipment on 01/10/xx (effective life 4 years 3. General Pool Balance (includes Car $19000) Business Deductions 12,600.00 6,300.00 Decline in Value (show your workings) 820.00 Point 1: 27,300.00 Point 2: 31,300.00 Point 3: TAXABLE INCOME Additional Workings (if any) Answer to Q-6.13 (Various concessions applied) Note- Please show all workings where necessary and you may use additional space below Please write your workings/explanations and answers in Blue cells Sally Rower is a 31 years old resident taxpayer, has private health ihsurance Business Receipt Items (exclude GST) Receipt Amount $ Write your Reasons or Workings (if applicable) Enter receipt amount here $ Receipts from Debtors Interest Received from private savings account Business Income 56,000.00 1,360.00 Business Deduction Items (exclude GST) Receipt Amount $ Write your Reasons or Workings (if applicable) Enter deduction amount here $ Materials Used for Production - Purchases Car Expenses Decline in Value (Depreciation expense) 1. Purchase of Printer on 01/02/xx (effective life 5 years) 2. Purchase of Office Equipment on 01/10/xx (effective life 4 years 3. General Pool Balance (includes Car $19000) Business Deductions 12,600.00 6,300.00 Decline in Value (show your workings) 820.00 Point 1: 27,300.00 Point 2: 31,300.00 Point 3: TAXABLE INCOME Additional Workings (if any)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts