Question: Hi please help with these I am struggling ABC issues 22,000 shares of preferred stock to investors on January 1 for cash. The 2% $13

Hi please help with these I am struggling

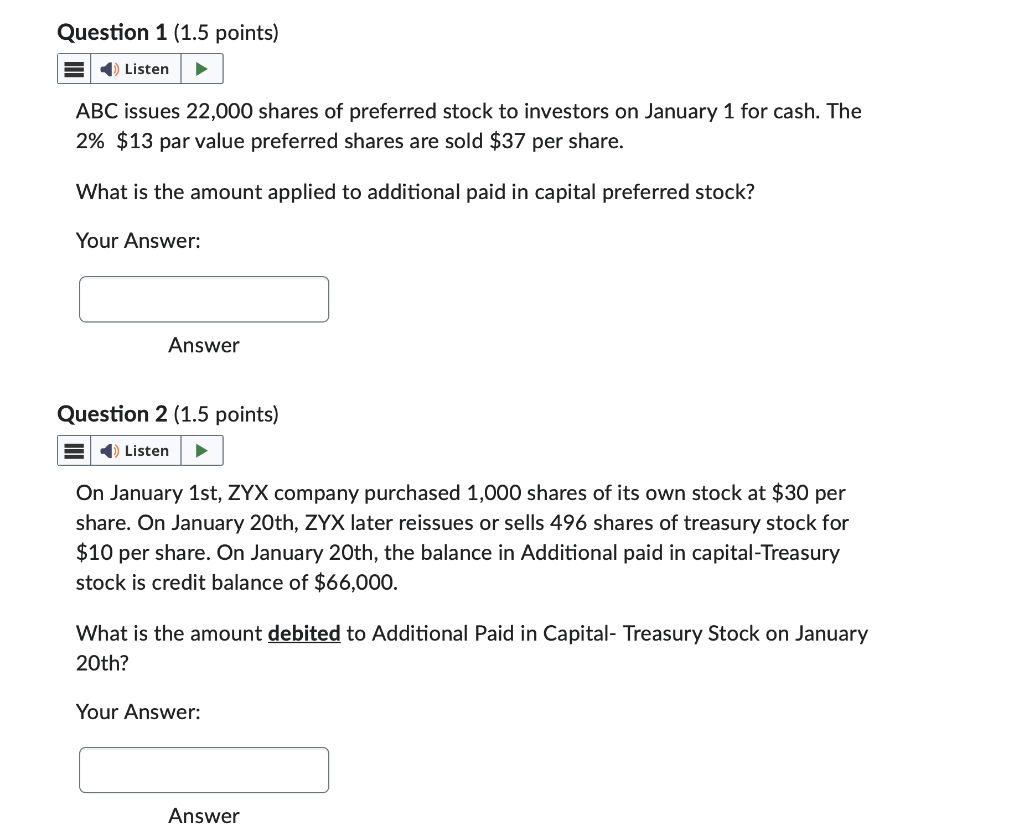

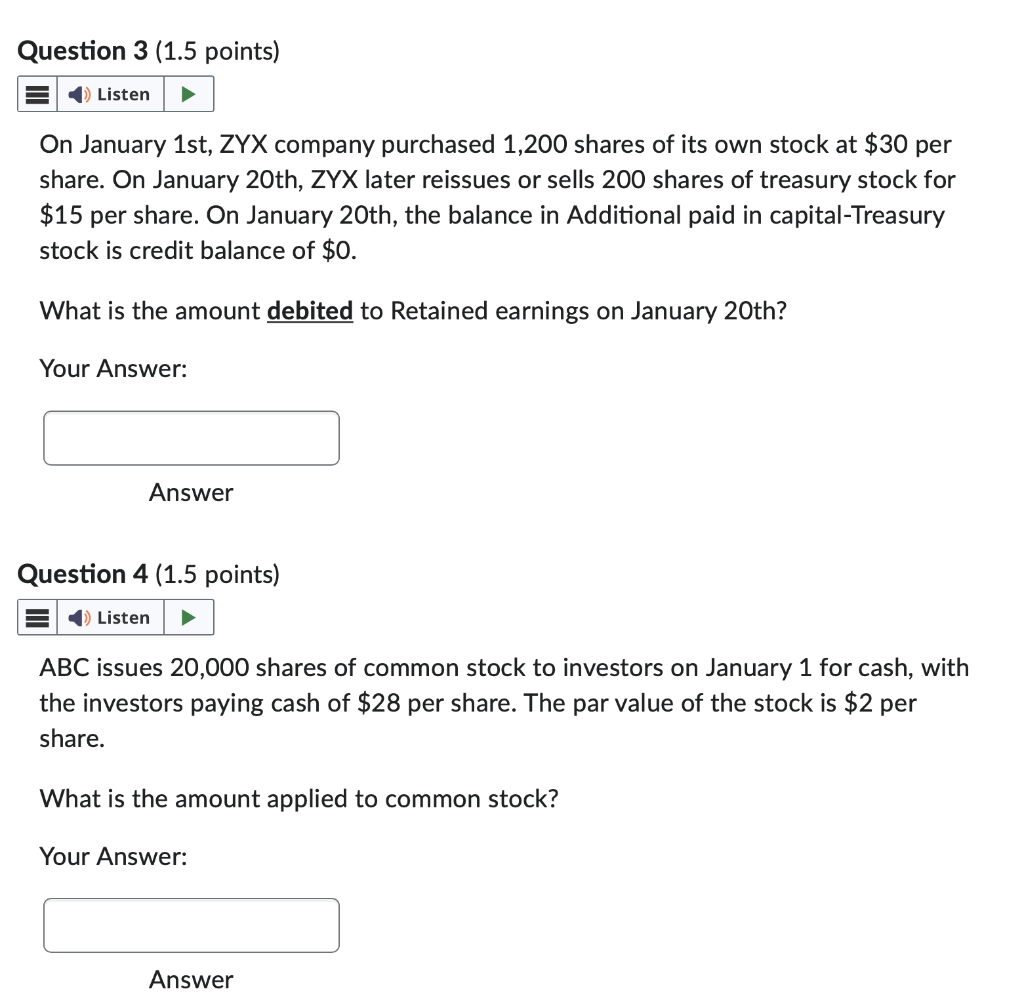

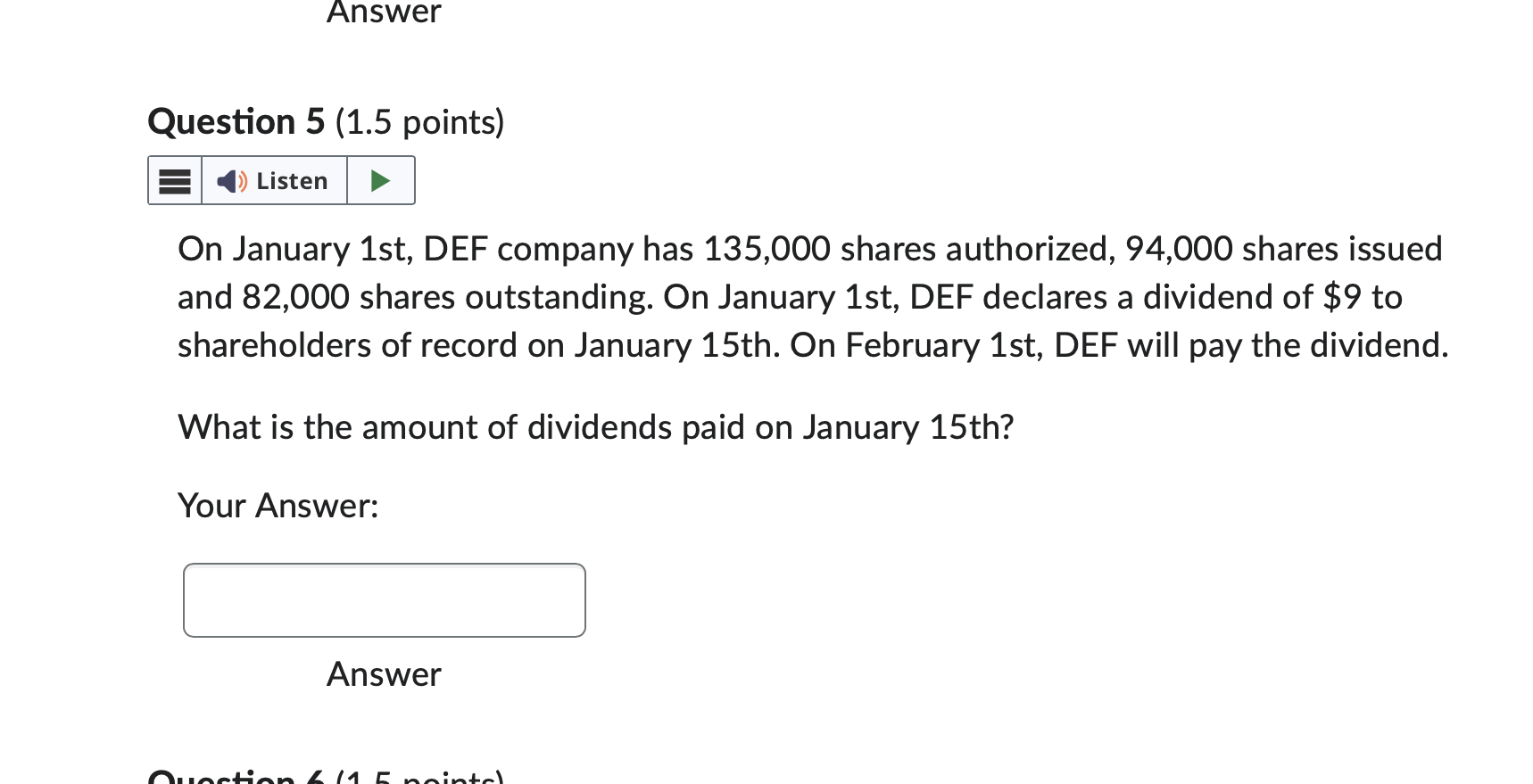

ABC issues 22,000 shares of preferred stock to investors on January 1 for cash. The 2% \$13 par value preferred shares are sold $37 per share. What is the amount applied to additional paid in capital preferred stock? Your Answer: Answer Question 2 (1.5 points) On January 1st, ZYX company purchased 1,000 shares of its own stock at $30 per share. On January 20th, ZYX later reissues or sells 496 shares of treasury stock for $10 per share. On January 20th, the balance in Additional paid in capital-Treasury stock is credit balance of $66,000. What is the amount debited to Additional Paid in Capital- Treasury Stock on January 20th? Your Answer: Answer On January 1st, ZYX company purchased 1,200 shares of its own stock at $30 per share. On January 20th, ZYX later reissues or sells 200 shares of treasury stock for $15 per share. On January 20th, the balance in Additional paid in capital-Treasury stock is credit balance of $0. What is the amount debited to Retained earnings on January 20th? Your Answer: Answer Question 4 (1.5 points) ABC issues 20,000 shares of common stock to investors on January 1 for cash, with the investors paying cash of $28 per share. The par value of the stock is $2 per share. What is the amount applied to common stock? Your Answer: Answer On January 1st, DEF company has 135,000 shares authorized, 94,000 shares issued and 82,000 shares outstanding. On January 1 st, DEF declares a dividend of $9 to shareholders of record on January 15th. On February 1st, DEF will pay the dividend. What is the amount of dividends paid on January 15 th? Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts