Question: hi please only answer if you can do all parts. thank you! A proposed project has fixed costs of $45,000 per year. The operating cash

hi please only answer if you can do all parts. thank you!

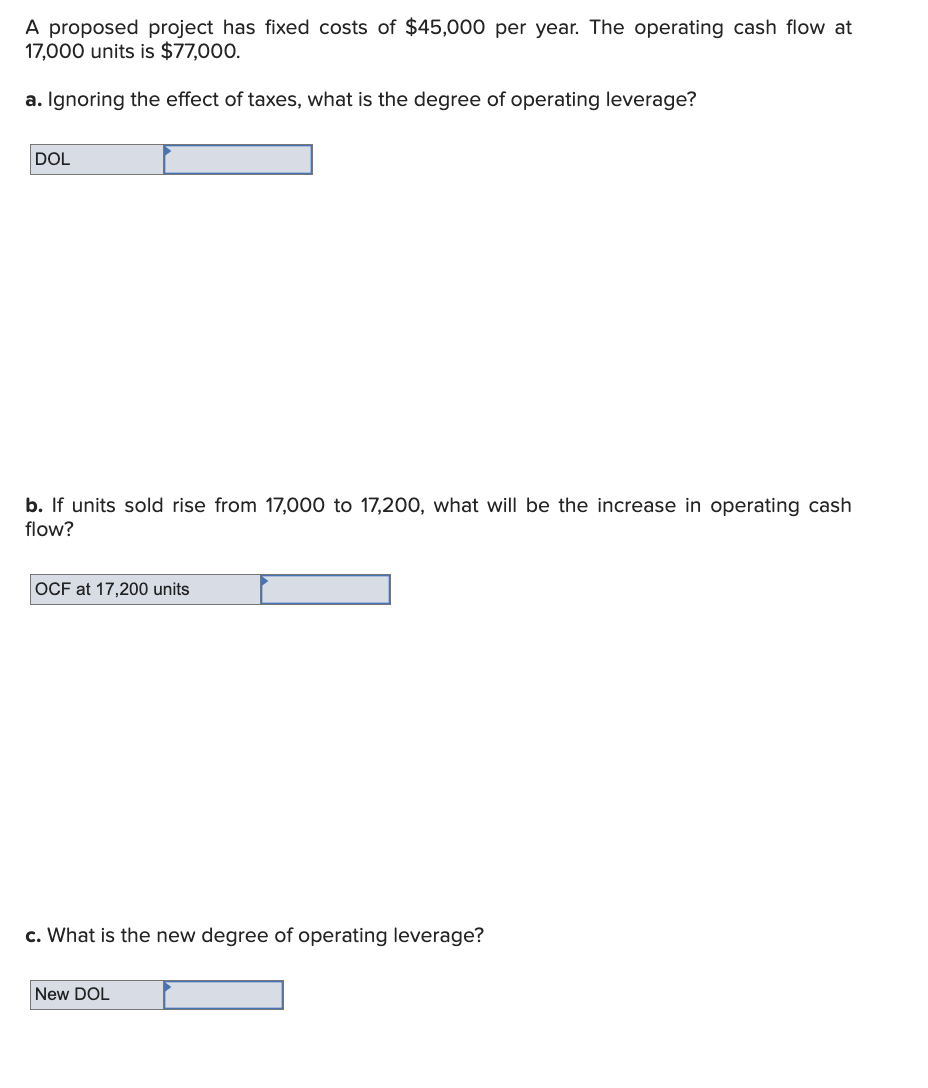

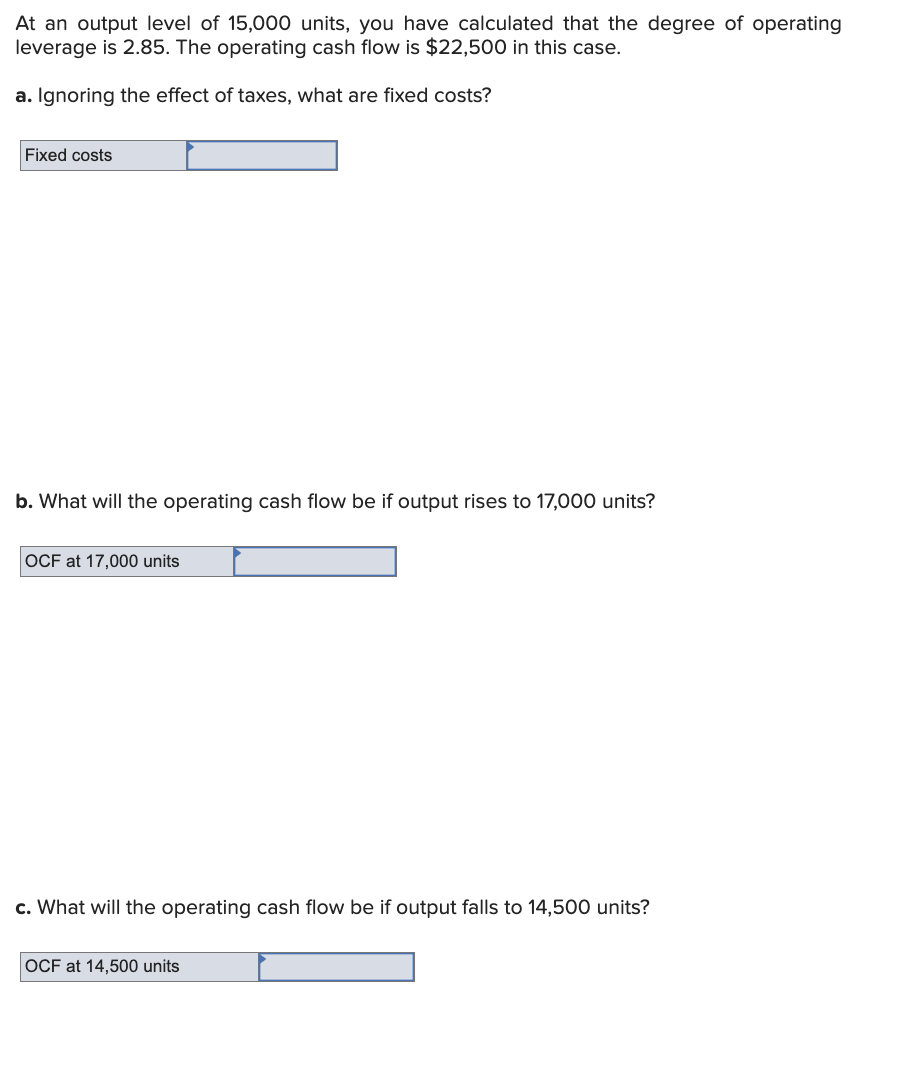

A proposed project has fixed costs of $45,000 per year. The operating cash flow at 17,000 units is $77,000. a. Ignoring the effect of taxes, what is the degree of operating leverage? b. If units sold rise from 17,000 to 17,200 , what will be the increase in operating cash flow? c. What is the new degree of operating leverage? At an output level of 15,000 units, you have calculated that the degree of operating leverage is 2.85 . The operating cash flow is $22,500 in this case. a. Ignoring the effect of taxes, what are fixed costs? b. What will the operating cash flow be if output rises to 17,000 units? c. What will the operating cash flow be if output falls to 14,500 units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts