Question: Hi! Please prepare journal entries to record each transaction using the information from the perpetual inventory schedule (table) provided above. Please record in exact format

Hi! Please prepare journal entries to record each transaction using the information from the perpetual inventory schedule (table) provided above. Please record in exact format provided.

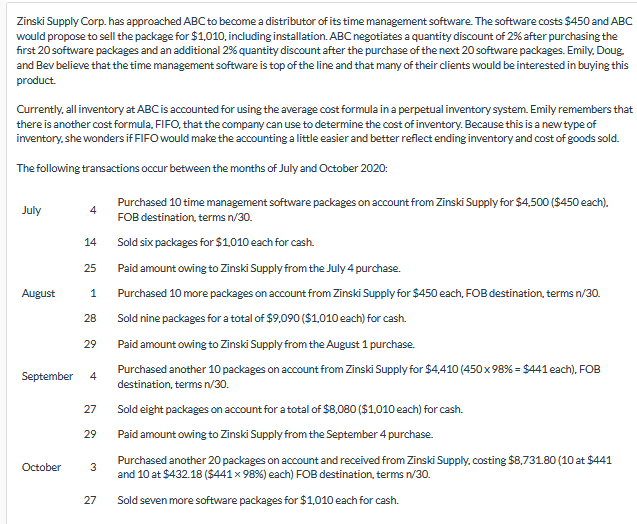

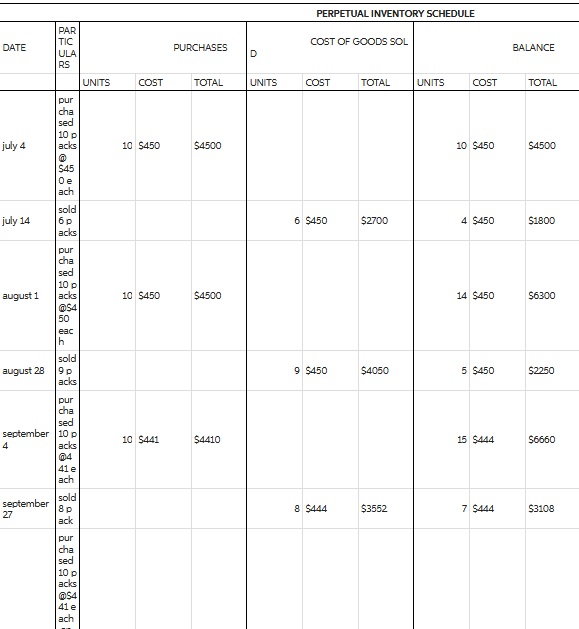

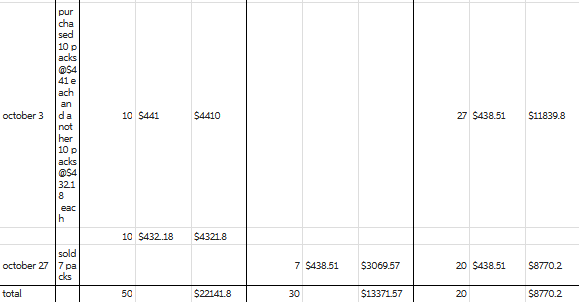

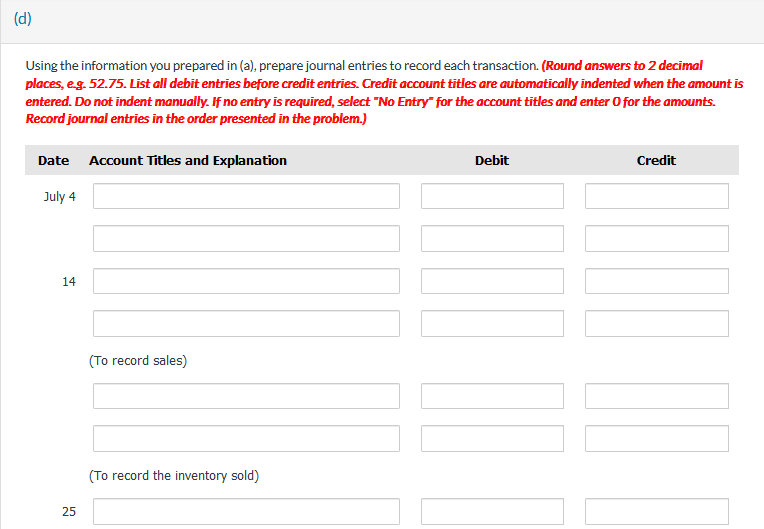

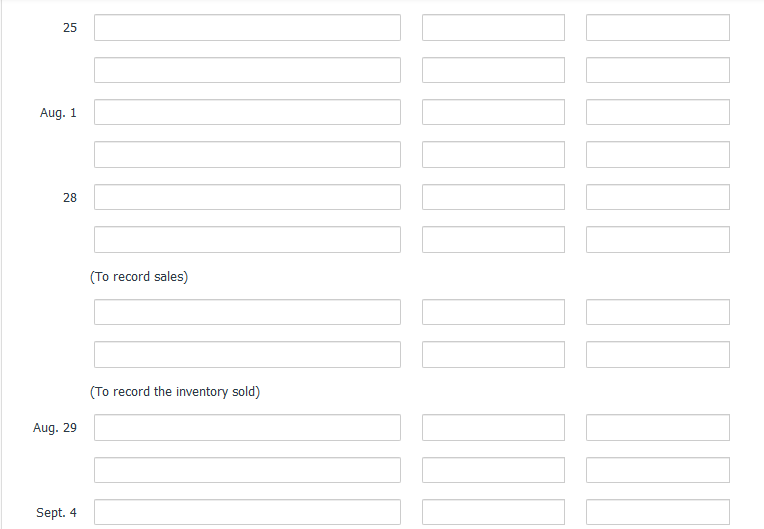

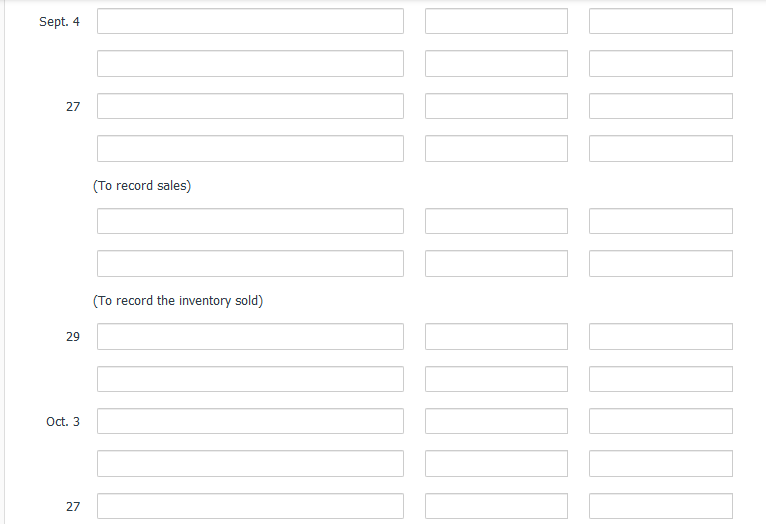

Zinski Supply Corp. has approached ABC to become a distributor of its time management software. The software costs $450 and ABC would propose to sell the package for $1,010, including installation. ABC negotiates a quantity discount of 2% after purchasing the first 20 software packages and an additional 2% quantity discount after the purchase of the next 20 software packages. Emily, Doug. and Bev believe that the time management software is top of the line and that many of their clients would be interested in buying this product. Currently, all irventory at ABC is accounted for using the average cost formula in a perpetual inventory system. Emily remembers that there is a nother cost formula, FIFO, that the company can use to determine the cost of inventory. Because this is a new type of imventory, she wonders if FIFO would make the accounting a little easier and better reflect ending inventory and cost of goods sold. The following transactions occur between the months of July and October 2020 : July 4 Purchased 10 time management FOB destination, terms n/30. 14 Sold six packages for $1,010 each for cash. 25 Paid amount owing to Zinski Supply from the July 4 purchase. August 1 Purchased 10 more packages on account from Zinski Supply for $450 each, FOB destination, terms n/30. 28 Sold nine packages for a total of $9,090($1,010 each ) for cash. 29 Paid amount owing to Zinski Supply from the August 1 purchase. September 4 Purchased another 10 packages on account from Zinski Supply for $4,410 (450x 98%=$441 each). FOB destination, terms n/30. 27 Sold eight packages on account for a total of $8,080 (\$1,010 each) for cash. 29 Paid amount owing to Zinski Supply from the September 4 purchase. October 3 Purchased another 20 packages on account and received from Zinski Supply, costing $8,731.80(10 at $441 and 10 at $432.18($44198% ) each) FOB destination, terms n/30. 27 Sold seven more software packages for $1,010 each for cash. PERPETUAL INVENTORY SCHEDULE Using the information you prepared in (a), prepare journal entries to record each transaction. (Round answers to 2 decimal places, e.g. 52.75. List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.) 25 Aug. 1 28 (To record sales) (To record the inventory sold) Aug. 29 Sept. 4 Sept. 4 27 (To record sales) (To record the inventory sold) 29 Oct. 3 27 27 (To record sales) (To record the inventory sold)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts