Question: hi please show all work using financial calculator. The table below provides 8 years of projected cash flows for a property that you have been

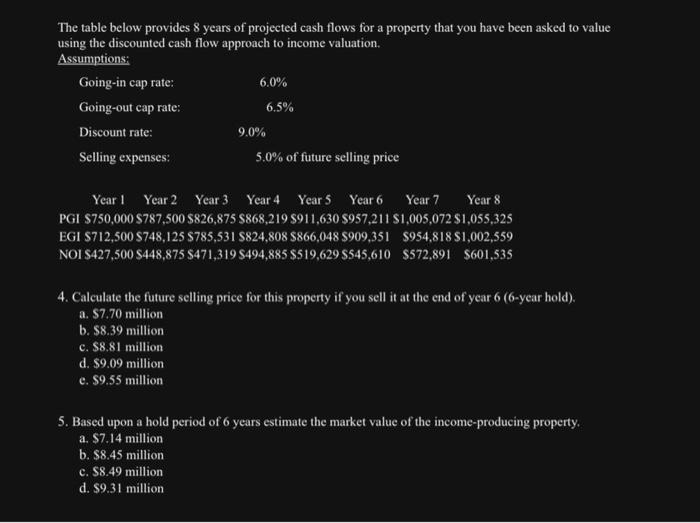

The table below provides 8 years of projected cash flows for a property that you have been asked to value using the discounted cash flow approach to income valuation. Assumptions: 4. Calculate the future selling price for this property if you sell it at the end of year 6 ( 6 -year hold). a. $7.70 million b. $8.39 million c. $8.81 million d. $9.09 million e. $9.55 million 5. Based upon a hold period of 6 years estimate the market value of the income-producing property. a. $7.14 million b. $8.45 million c. $8.49 million d. $9.31 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts