Question: Hi please show work, I am solving it wrong and cannot figure out what the calculations are I took 160,000 * 12% / 4 and

Hi please show work, I am solving it wrong and cannot figure out what the calculations are I took 160,000 * 12% / 4 and it wasnt right

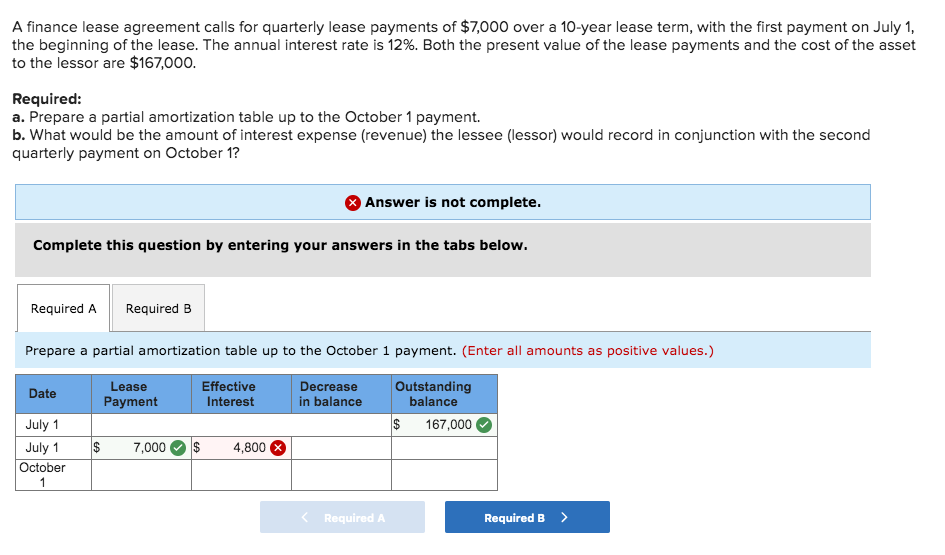

A finance lease agreement calls for quarterly lease payments of $7,000 over a 10-year lease term, with the first payment the beginning of the lease. The annual interest rate is 12%. Both the present value of the lease payments and the cost of the asset to the lessor are $167,000 July 1, on Required: Prepare a partial amortization table up to the October1 payment b. What would be the amount of interest expense (revenue) the lessee (lessor) would record in conjunction with the second quarterly payment on October 1? a. Answer is not complete. Complete this question by entering your answers in the tabs below. Required B Required A Prepare a partial amortization table up to the October 1 payment. (Enter all amounts as positive values.) Outstanding balance Lease Effective Interest Decrease in balance Date Payment July 1 $ 167,000 July 1 7,000 4,800 October 1 Required B> Required A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts