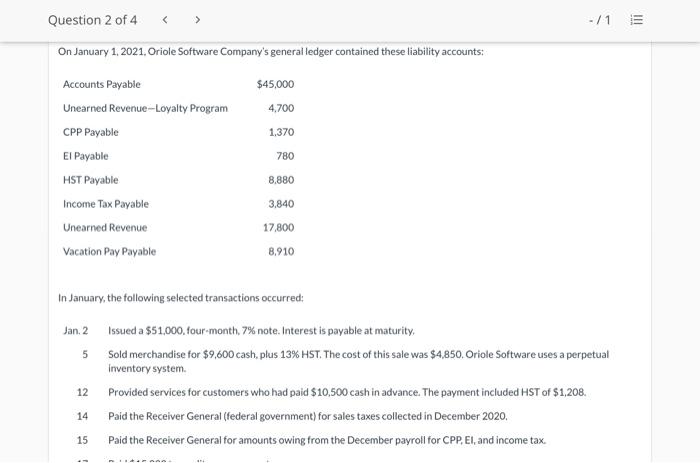

Question: Hi, please write it in correct format. Thanks! Question 2 of 4 -/15 On January 1, 2021. Oriole Software Company's general ledger contained these liability

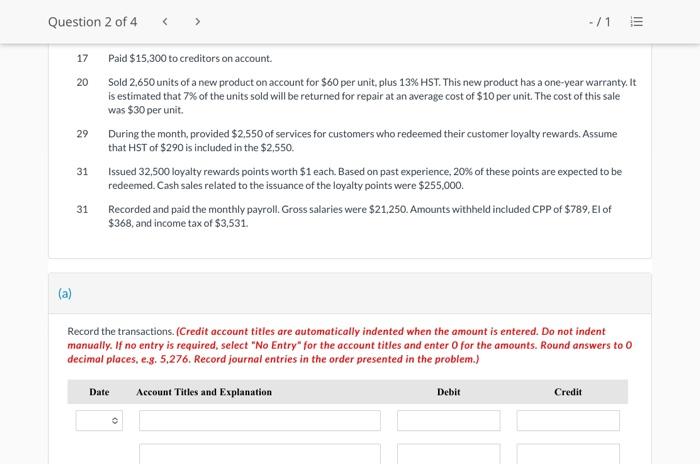

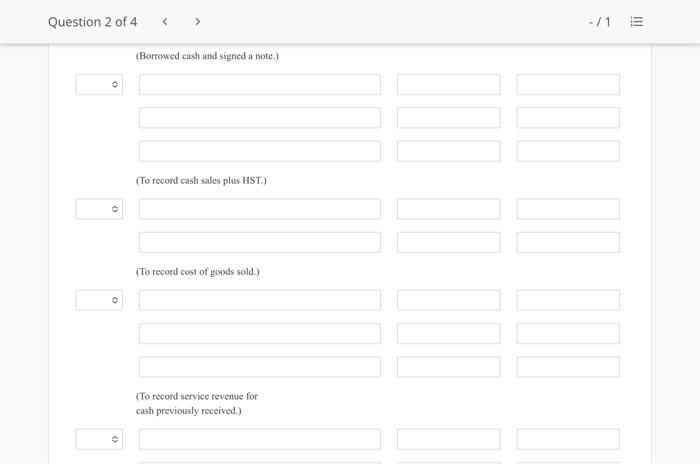

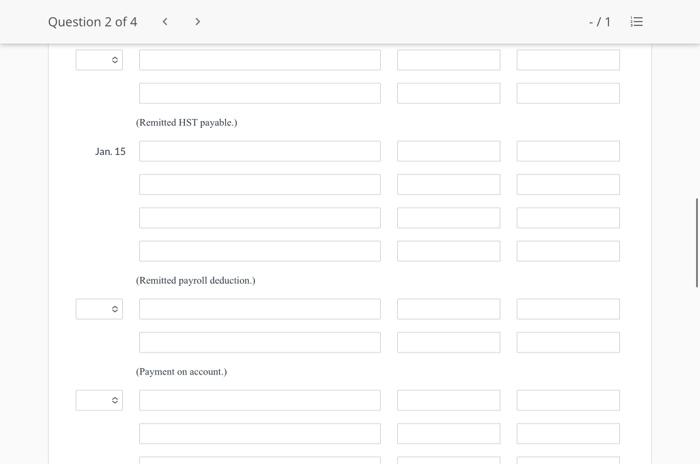

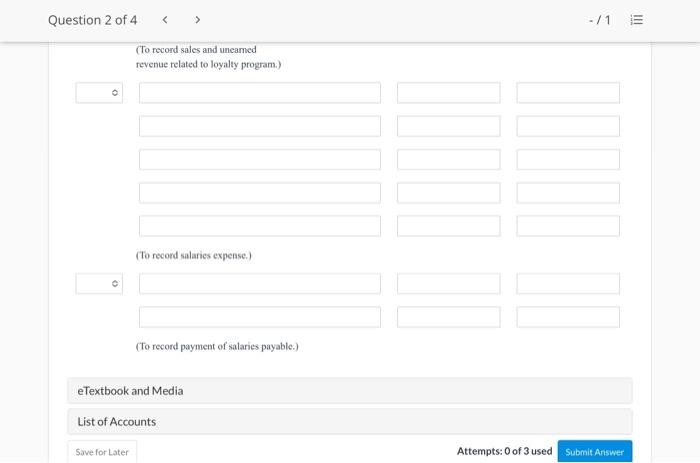

Question 2 of 4 -/15 On January 1, 2021. Oriole Software Company's general ledger contained these liability accounts: $45,000 4,700 1.370 780 Accounts Payable Unearned Revenue-Loyalty Program CPP Payable El Payable HST Payable Income Tax Payable Unearned Revenue Vacation Pay Payable 8.880 3.840 17,800 8,910 In January, the following selected transactions occurred: Jan. 2 Issued a $51,000, four-month. 7% note. Interest is payable at maturity, 5 Sold merchandise for $9,600 cash, plus 13% HST. The cost of this sale was $4,850. Oriole Software uses a perpetual Inventory system Provided services for customers who had paid $10,500 cash in advance. The payment included HST of $1,208. Paid the Receiver General (federal government) for sales taxes collected in December 2020, Paid the Receiver Generalfor amounts owing from the December payroll for CPP, EI, and income tax. 12 14 15 BON Question 2 of 4 -/1 20 17 Paid $15,300 to creditors on account Sold 2.650 units of a new product on account for $60 per unit, plus 13% HST. This new product has a one-year warranty. It is estimated that 7% of the units sold will be returned for repair at an average cost of $10 per unit. The cost of this sale was $30 per unit. 29 During the month, provided $2,550 of services for customers who redeemed their customer loyalty rewards. Assume that HST of $290 is included in the $2,550. Issued 32,500 loyalty rewards points worth $1 each. Based on past experience, 20% of these points are expected to be redeemed. Cash sales related to the issuance of the loyalty points were $255,000. Recorded and paid the monthly payroll. Gross salaries were $21,250. Amounts withheld included CPP of $789, El of $368, and income tax of $3,531. 31 31 (a) Record the transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Round answers to o decimal places, e.g. 5,276. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit Question 2 of 4 -/15 (To record sales and uneamed revenue related to loyalty program.) (To record salaries expense) (To record payment of salaries payable.) eTextbook and Media List of Accounts Save for Later Attempts: 0 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts