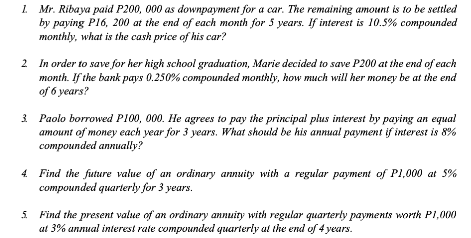

Question: Hi! Pls answer. I badly need help. Gen. Instruction: Complete solution is required. Please do not shortcut the procedure. Hoping for a right sequence of

Hi! Pls answer. I badly need help.

Gen. Instruction: Complete solution is required.Please do not shortcut the procedure.Hoping for a right sequence of solving each num so I can understand.Thank you!

Explanation NOT needed.

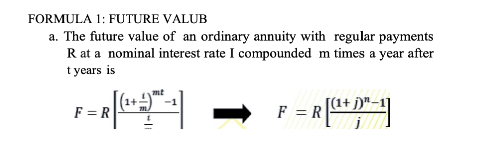

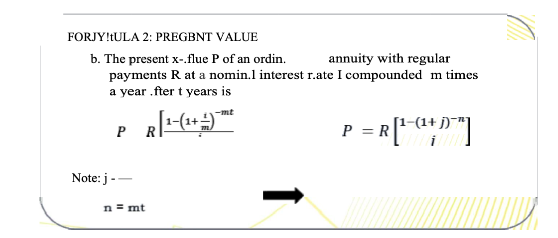

Topic: FUTURE AND PRESENT VALUE OF ANNUITY

Reference:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts