Question: hi pls help answer all pls pls thanks For Items 16 through 25: Given below is the Unadjusted Trial balance of MLR Service Enterprise for

hi pls help answer all pls pls thanks

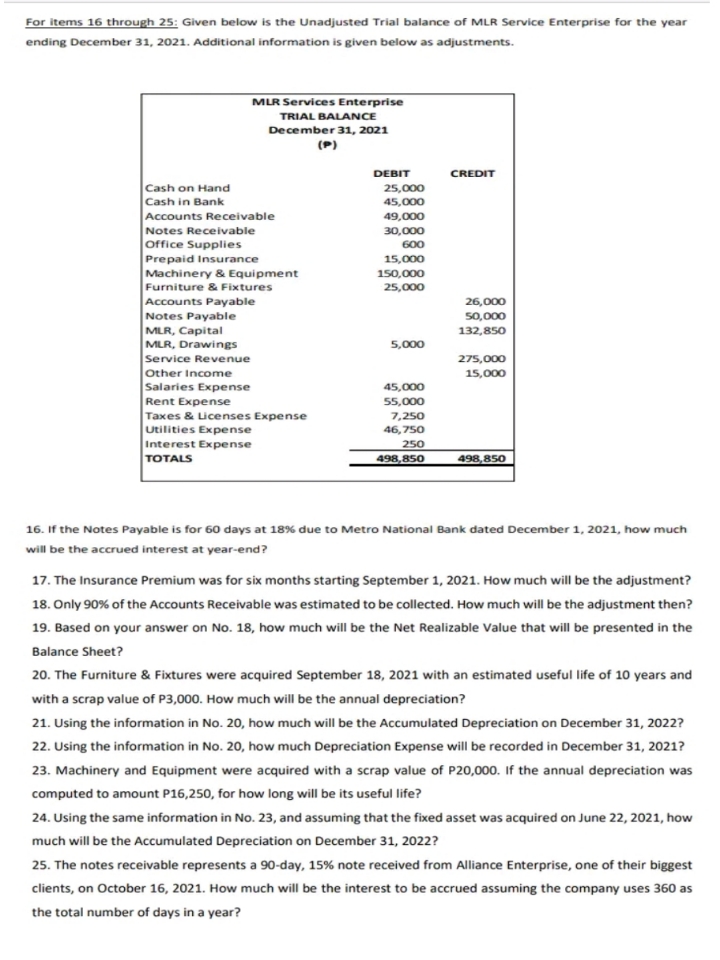

For Items 16 through 25: Given below is the Unadjusted Trial balance of MLR Service Enterprise for the year ending December 31, 2021. Additional information is given below as adjustments. MLR Services Enterprise TRIAL BALANCE December 31, 2021 (P) DEBIT CREDIT Cash on Hand 25,000 Cash in Bank 45,000 Accounts Receivable 49,000 Notes Receivable 30,000 Office Supplies GOO Prepaid Insurance 15,000 Machinery & Equipment 150,000 Furniture & Fixtures 25,000 Accounts Payable 26,000 Notes Payable 50,000 MLR, Capital 132,850 MLR, Drawings 5,000 Service Revenue 275,000 Other Income 15,000 Salaries Expense 45,000 Rent Expense 55,000 Taxes & Licenses Expense 7,250 Utilities Expense 46,750 Interest Expense 250 TOTALS 498,850 498,850 16. If the Notes Payable is for 60 days at 18% due to Metro National Bank dated December 1, 2021, how much will be the accrued interest at year-end? 17. The Insurance Premium was for six months starting September 1, 2021. How much will be the adjustment? 18. Only 90% of the Accounts Receivable was estimated to be collected. How much will be the adjustment then? 19. Based on your answer on No. 18, how much will be the Net Realizable Value that will be presented in the Balance Sheet? 20. The Furniture & Fixtures were acquired September 18, 2021 with an estimated useful life of 10 years and with a scrap value of P3,000. How much will be the annual depreciation? 21. Using the information in No. 20, how much will be the Accumulated Depreciation on December 31, 2022? 22. Using the information in No. 20, how much Depreciation Expense will be recorded in December 31, 2021? 23. Machinery and Equipment were acquired with a scrap value of P20,000. If the annual depreciation was computed to amount P16,250, for how long will be its useful life? 24. Using the same information in No. 23, and assuming that the fixed asset was acquired on June 22, 2021, how much will be the Accumulated Depreciation on December 31, 2022? 25. The notes receivable represents a 90-day, 15% note received from Alliance Enterprise, one of their biggest clients, on October 16, 2021. How much will be the interest to be accrued assuming the company uses 360 as the total number of days in a year