Question: Hi pls help me solve this question this is different question previously answer not same ..Thanks a) Develop a spreadsheet model and use it to

Hi pls help me solve this question

this is different question previously answer not same ..Thanks

a) Develop a spreadsheet model and use it to find the projects NPV, IRR, and payback. b) Conduct a scenario analysis to determine the sensititity of NPV to changes in

sales price number of units sold variable cost per unit fixed cost cost of captital. Set these variables at 10% above and 10% below their base-case scenario, please include a grahph in your analysis.

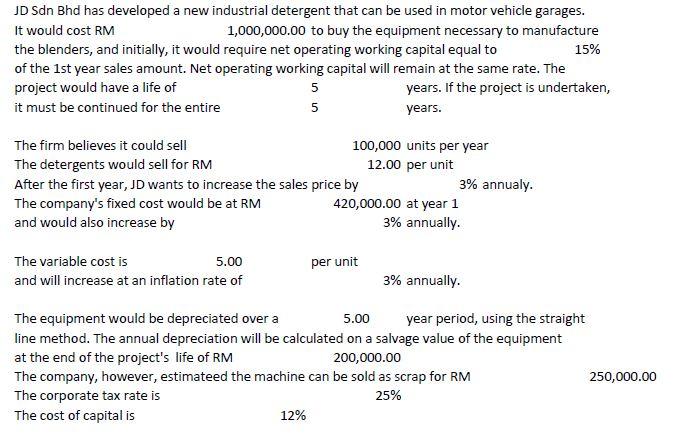

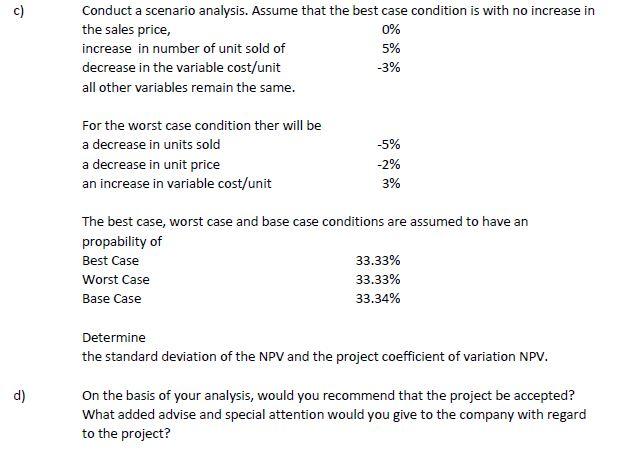

JD Sdn Bhd has developed a new industrial detergent that can be used in motor vehicle garages. It would cost RM 1,000,000.00 to buy the equipment necessary to manufacture the blenders, and initially, it would require net operating working capital equal to 15% of the 1st year sales amount. Net operating working capital will remain at the same rate. The pri undertaken, it r The variable cost is 5.00 per unit and will increase at an inflation rate of 3% annually. The equipment would be depreciated over a 5.00 year period, using the straight line method. The annual depreciation will be calculated on a salvage value of the equipment at the end of the project's life of RM 200,000.00 The company, however, estimateed the machine can be sold as scrap for RM 250,000.00 The corporate tax rate is 25% The cost of capital is 12% The best case, worst case and base case conditions are assumed to have an Determine the standard deviation of the NPV and the project coefficient of variation NPV. On the basis of your analysis, would you recommend that the project be accepted? What added advise and special attention would you give to the company with regard to the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts