Question: Hi, Someone can help me to get solutions E11-2B and E 11-6B CHAPTER 11: Reporting and Analyzing Stockholders' Equity E11-2B: DuBois Co. had these transactions

Hi, Someone can help me to get solutions E11-2B and E 11-6B

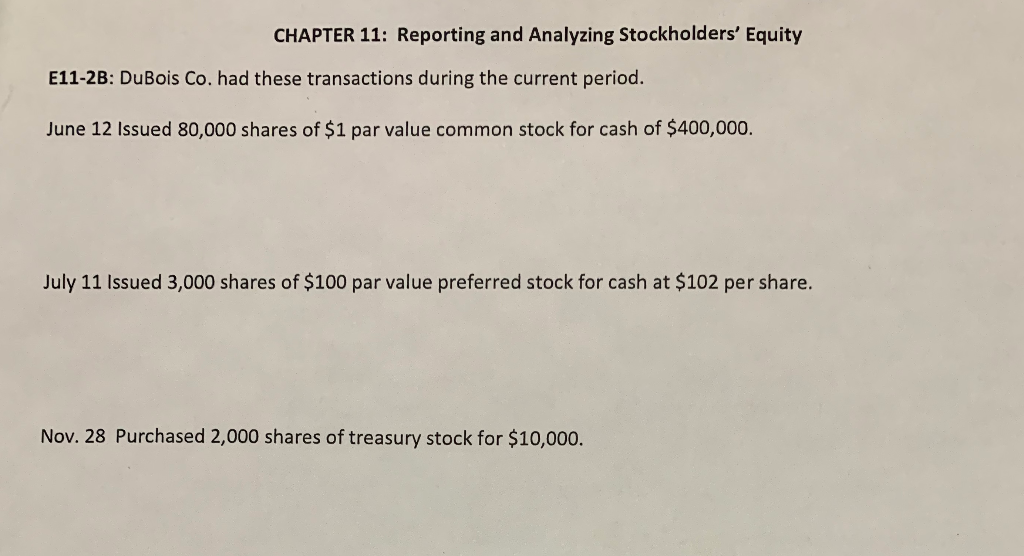

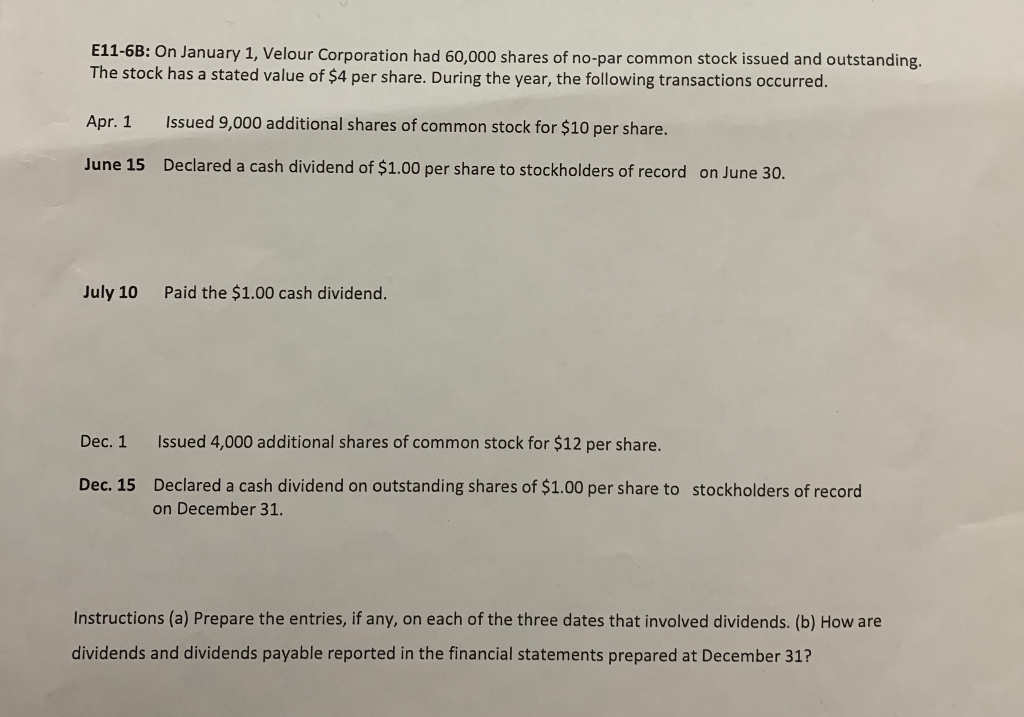

CHAPTER 11: Reporting and Analyzing Stockholders' Equity E11-2B: DuBois Co. had these transactions during the current period. June 12 Issued 80,000 shares of $1 par value common stock for cash of $400,000. July 11 Issued 3,000 shares of $100 par value preferred stock for cash at $102 per share. Nov. 28 Purchased 2,000 shares of treasury stock for $10,000. E11-6B: On January 1, Velour Corporation had 60,000 shares of no-par common stock issued and outstanding he stock has a stated value of $4 per share. During the year, the following transactions occurred Apr. 1 Issued 9,000 additional shares of common stock for $10 per share. June 15 Declared a cash dividend of $1.00 per share to stockholders of record on June 30. July 10 Paid the $1.00 cash dividend. Dec. 1 Issued 4,000 additional shares of common stock for $12 per share Declared a cash dividend on outstanding shares of $1.00 per share to on December 31. Dec. 15 stockholders of record Instructions (a) Prepare the entries, if any, on each of the three dates that involved dividends. (b) How are dividends and dividends payable reported in the financial statements prepared at December 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts