Question: Hi there are just short answer question, if I post separately, it is like I will lose 15 times asking a question and it is

Hi there are just short answer question, if I post separately, it is like I will lose 15 times asking a question and it is not worth. Do I still need to post separately

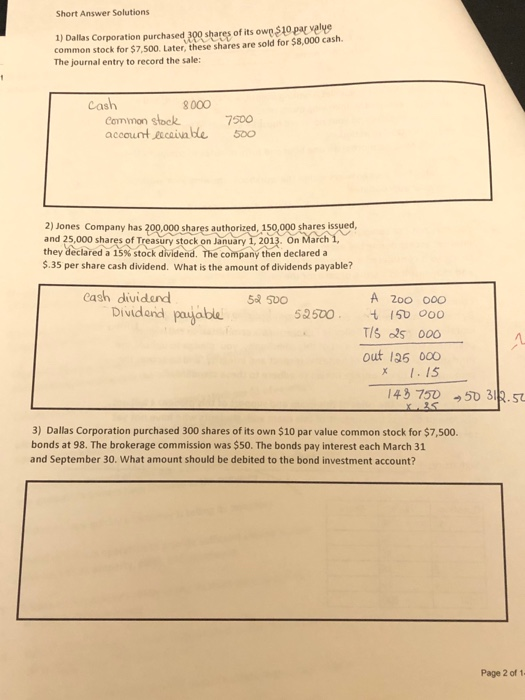

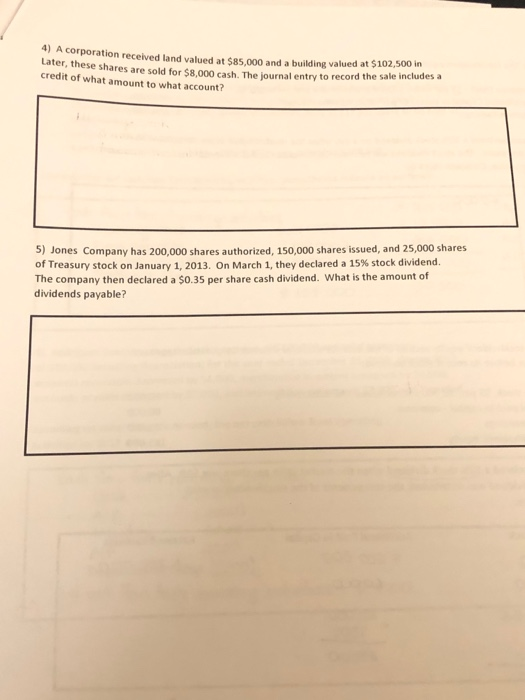

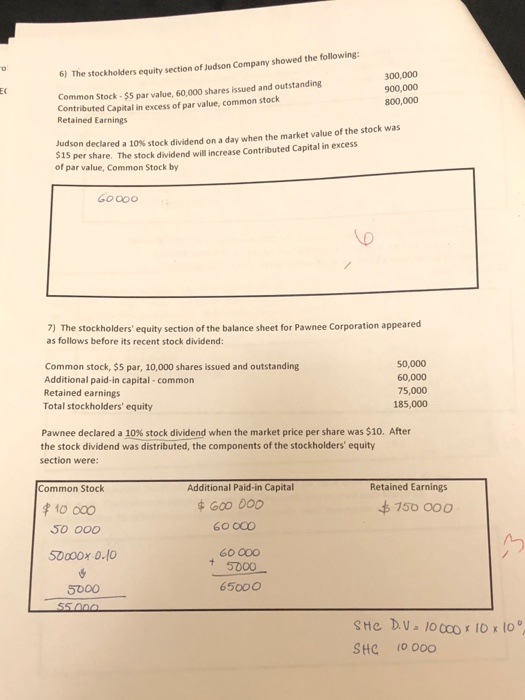

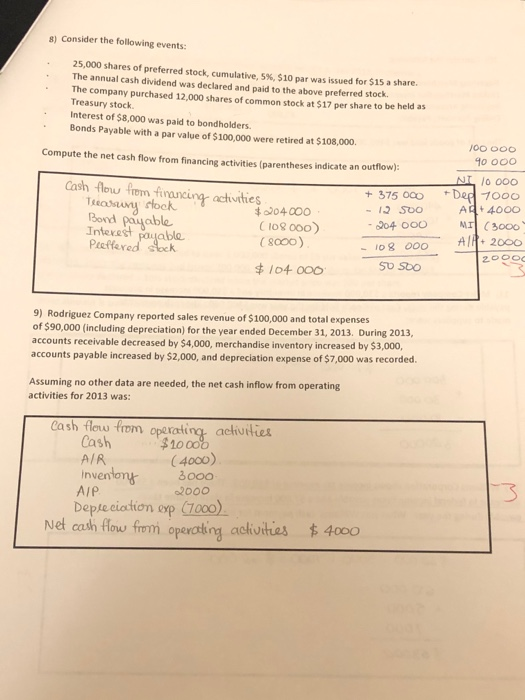

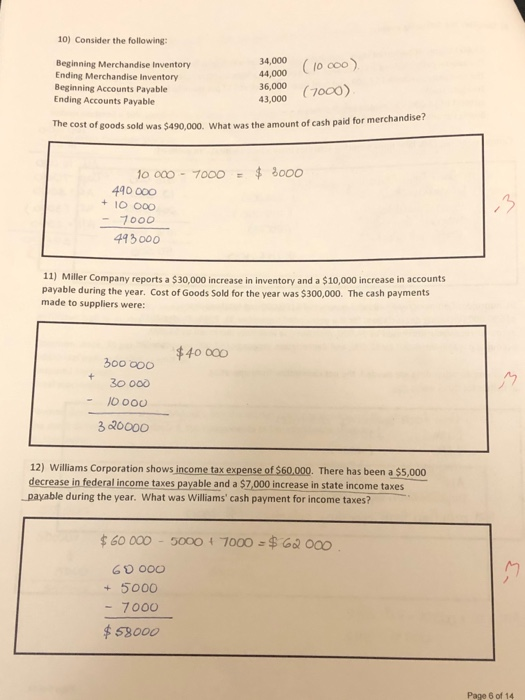

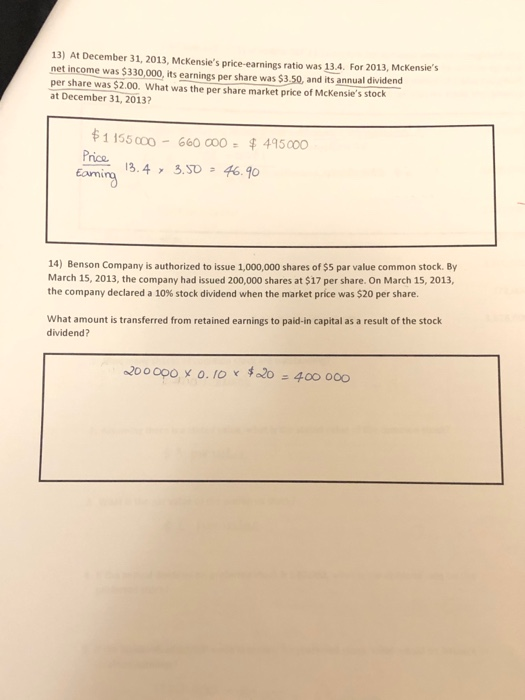

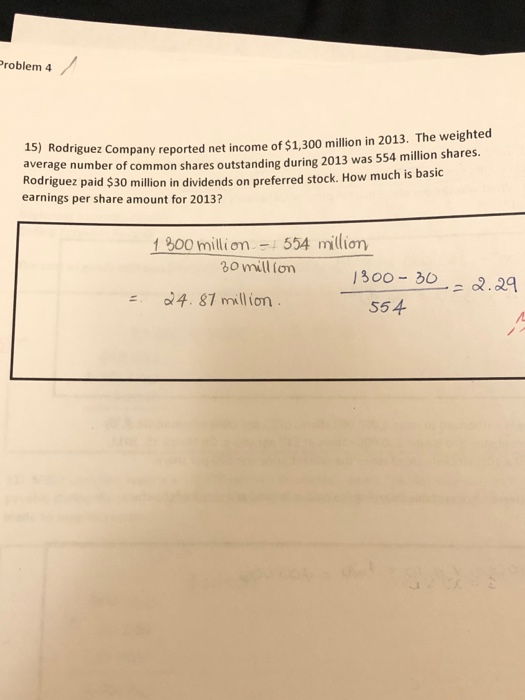

Short Answer Solutions 1) Dallas Corporation purchased 300 shares of its own $10 par valve common stock for $7,500. Later, these shares are sold for $8,000 cash. The journal entry to record the sale: Cash 8000 Common stock account ecceivable 7500 500 2) Jones Company has 200,000 shares authorized, 150,000 shares issued, and 25,000 shares of Treasury stock on January 1, 2013. On March 1, they declared a 15% stock dividend. The company then declared a $.35 per share cash dividend. What is the amount of dividends payable? Cash dividend Dividend payable 52 500 52500 A 200 000 + 150 000 T/S 25000 out 125 000 X 1.15 143 750 -50 310.52 3) Dallas Corporation purchased 300 shares of its own $10 par value common stock for $7,500. bonds at 98. The brokerage commission was $50. The bonds pay interest each March 31 and September 30. What amount should be debited to the bond investment account? Page 2 of 1 A corporation received and valued at SRS 000 and a building valued at $102,500 m Later, these shares are sold for S000 cach The lournal entry to record the sale includes credit of what amount to what account? 5) Jones Company has 200,000 shares authorized, 150,000 shares issued, and 25,000 shares of Treasury stock on January 1, 2013. On March 1, they declared a 15% stock dividend. The company then declared a $0.35 per share cash dividend. What is the amount of dividends payable? 6) The stockholders equity section of Judson Company showed the following 300,000 Common Stock - $5 par value, 60 000 shares issued and outstanding 900,000 Contributed Capital in excess of par value, common stock 800,000 Retained Earnings Judson declared a 10 stock didend on a day when the market value of the stock was $15 per share. The stock dividend will increase Contributed Capital in excess of par value, Common Stock by GOOOO 7) The stockholders' equity section of the balance sheet for Pawnee Corporation appeared as follows before its recent stock dividend: Common stock, $5 par, 10,000 shares issued and outstanding Additional paid-in capital - common Retained earnings Total stockholders' equity 50,000 60,000 75,000 185,000 Pawnee declared a 10% stock dividend when the market price per share was $10. After the stock dividend was distributed, the components of the stockholders' equity section were: Common Stock $10 000 50 000 Additional Paid-in Capital $ 600 DOD 6000 Retained Earnings $ 750 000 50000x 0.10 60 000 + 5000 65000 5000 55000 SHC D.V. 10 000 * 10 x 10 SHC 10000 s) Consider the following events: 25,000 shares of preferred stock, cumulative, 5%, $10 par was issued for $15 a share. The annual cash dividend was declared and paid to the above preferred stock The company purchased 12.000 shares of common stock at $17 per Share to be held as Treasury stock Interest of $8,000 was paid to bondholders. Bonds Payable with a par value of $100,000 were retired at $108,000. Compute the net cash flow from financing activities (parentheses indicate an outflow: Cash flow from financing activities Treasury clock $204000 Bond payable 108 000) Interest payable (8000) Peffered cock $ 104 000 + 375 000 - 1 Soo - 204 OOO - 000 50 500 100 DOO 90 000 NI 10 000 *D 1000 A4.000 MI (3000 AR 2000 ZOOO 9) Rodriguez Company reported sales revenue of $100,000 and total expenses of $90,000 (including depreciation) for the year ended December 31, 2013. During 2013, accounts receivable decreased by $4,000, merchandise inventory increased by $3,000, accounts payable increased by $2,000, and depreciation expense of $7,000 was recorded Assuming no other data are needed, the net cash inflow from operating activities for 2013 was: Cash flow from operating activities Cash $10000 AIR (4000) Inventory 3000 AIP 2000 Depreciation exp (7000) Net cash flow from operating activities $ 4000 10) Consider the following: Beginning Merchandise Inventory Ending Merchandise Inventory Beginning Accounts Payable Ending Accounts Payable 34.000 36,000 43,000 (10000) (7000) The cost of goods sold was $490.000. What was the amount of cash paid for merchandiser $ 8000 10 000 - 7000 490 000 + 10 000 - 7000 495.000 11) Miller Company reports a $30,000 increase in inventory and a $10,000 increase in accounts payable during the year. Cost of Goods Sold for the year was $300,000. The cash payments made to suppliers were: $40 000 + 300 000 30 000 - 10000 320000 12) Williams Corporation shows income tax expense of $60,000. There has been a $5,000 decrease in federal income taxes payable and a $7,000 increase in state income taxes payable during the year. What was Williams' cash payment for income taxes? $ 60 000 - 5000 + 7000 - $ 62 000 60 000 + 5000 - 7000 $ 58000 Page 6 of 14 Problem 4 Rodriguez Company reported net income of $1.300 million in 2013. The weighted average number of common shares outstanding during 2013 was 554 million shares. Rodriguez paid $30 million in dividends on preferred stock. How much is basic earnings per share amount for 2013? 1 300 million - 554 million 30 million 24.87 million 554 1300- 30 - 2.29 = Short Answer Solutions 1) Dallas Corporation purchased 300 shares of its own $10 par valve common stock for $7,500. Later, these shares are sold for $8,000 cash. The journal entry to record the sale: Cash 8000 Common stock account ecceivable 7500 500 2) Jones Company has 200,000 shares authorized, 150,000 shares issued, and 25,000 shares of Treasury stock on January 1, 2013. On March 1, they declared a 15% stock dividend. The company then declared a $.35 per share cash dividend. What is the amount of dividends payable? Cash dividend Dividend payable 52 500 52500 A 200 000 + 150 000 T/S 25000 out 125 000 X 1.15 143 750 -50 310.52 3) Dallas Corporation purchased 300 shares of its own $10 par value common stock for $7,500. bonds at 98. The brokerage commission was $50. The bonds pay interest each March 31 and September 30. What amount should be debited to the bond investment account? Page 2 of 1 A corporation received and valued at SRS 000 and a building valued at $102,500 m Later, these shares are sold for S000 cach The lournal entry to record the sale includes credit of what amount to what account? 5) Jones Company has 200,000 shares authorized, 150,000 shares issued, and 25,000 shares of Treasury stock on January 1, 2013. On March 1, they declared a 15% stock dividend. The company then declared a $0.35 per share cash dividend. What is the amount of dividends payable? 6) The stockholders equity section of Judson Company showed the following 300,000 Common Stock - $5 par value, 60 000 shares issued and outstanding 900,000 Contributed Capital in excess of par value, common stock 800,000 Retained Earnings Judson declared a 10 stock didend on a day when the market value of the stock was $15 per share. The stock dividend will increase Contributed Capital in excess of par value, Common Stock by GOOOO 7) The stockholders' equity section of the balance sheet for Pawnee Corporation appeared as follows before its recent stock dividend: Common stock, $5 par, 10,000 shares issued and outstanding Additional paid-in capital - common Retained earnings Total stockholders' equity 50,000 60,000 75,000 185,000 Pawnee declared a 10% stock dividend when the market price per share was $10. After the stock dividend was distributed, the components of the stockholders' equity section were: Common Stock $10 000 50 000 Additional Paid-in Capital $ 600 DOD 6000 Retained Earnings $ 750 000 50000x 0.10 60 000 + 5000 65000 5000 55000 SHC D.V. 10 000 * 10 x 10 SHC 10000 s) Consider the following events: 25,000 shares of preferred stock, cumulative, 5%, $10 par was issued for $15 a share. The annual cash dividend was declared and paid to the above preferred stock The company purchased 12.000 shares of common stock at $17 per Share to be held as Treasury stock Interest of $8,000 was paid to bondholders. Bonds Payable with a par value of $100,000 were retired at $108,000. Compute the net cash flow from financing activities (parentheses indicate an outflow: Cash flow from financing activities Treasury clock $204000 Bond payable 108 000) Interest payable (8000) Peffered cock $ 104 000 + 375 000 - 1 Soo - 204 OOO - 000 50 500 100 DOO 90 000 NI 10 000 *D 1000 A4.000 MI (3000 AR 2000 ZOOO 9) Rodriguez Company reported sales revenue of $100,000 and total expenses of $90,000 (including depreciation) for the year ended December 31, 2013. During 2013, accounts receivable decreased by $4,000, merchandise inventory increased by $3,000, accounts payable increased by $2,000, and depreciation expense of $7,000 was recorded Assuming no other data are needed, the net cash inflow from operating activities for 2013 was: Cash flow from operating activities Cash $10000 AIR (4000) Inventory 3000 AIP 2000 Depreciation exp (7000) Net cash flow from operating activities $ 4000 10) Consider the following: Beginning Merchandise Inventory Ending Merchandise Inventory Beginning Accounts Payable Ending Accounts Payable 34.000 36,000 43,000 (10000) (7000) The cost of goods sold was $490.000. What was the amount of cash paid for merchandiser $ 8000 10 000 - 7000 490 000 + 10 000 - 7000 495.000 11) Miller Company reports a $30,000 increase in inventory and a $10,000 increase in accounts payable during the year. Cost of Goods Sold for the year was $300,000. The cash payments made to suppliers were: $40 000 + 300 000 30 000 - 10000 320000 12) Williams Corporation shows income tax expense of $60,000. There has been a $5,000 decrease in federal income taxes payable and a $7,000 increase in state income taxes payable during the year. What was Williams' cash payment for income taxes? $ 60 000 - 5000 + 7000 - $ 62 000 60 000 + 5000 - 7000 $ 58000 Page 6 of 14 Problem 4 Rodriguez Company reported net income of $1.300 million in 2013. The weighted average number of common shares outstanding during 2013 was 554 million shares. Rodriguez paid $30 million in dividends on preferred stock. How much is basic earnings per share amount for 2013? 1 300 million - 554 million 30 million 24.87 million 554 1300- 30 - 2.29 =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts