Question: hi there can someone please explain how the solutions are derived. Also, can someone explain the temporary differences all of them that could be asked.

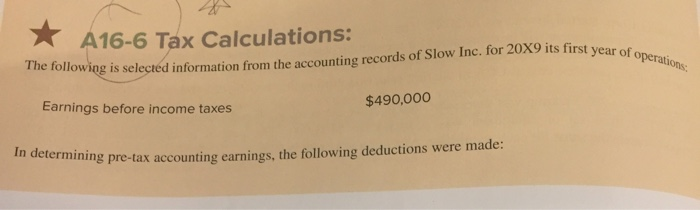

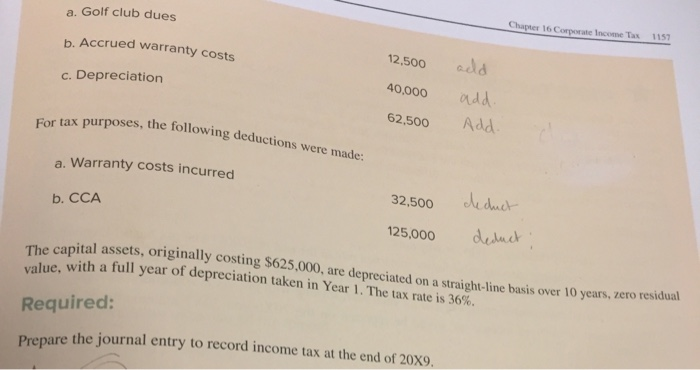

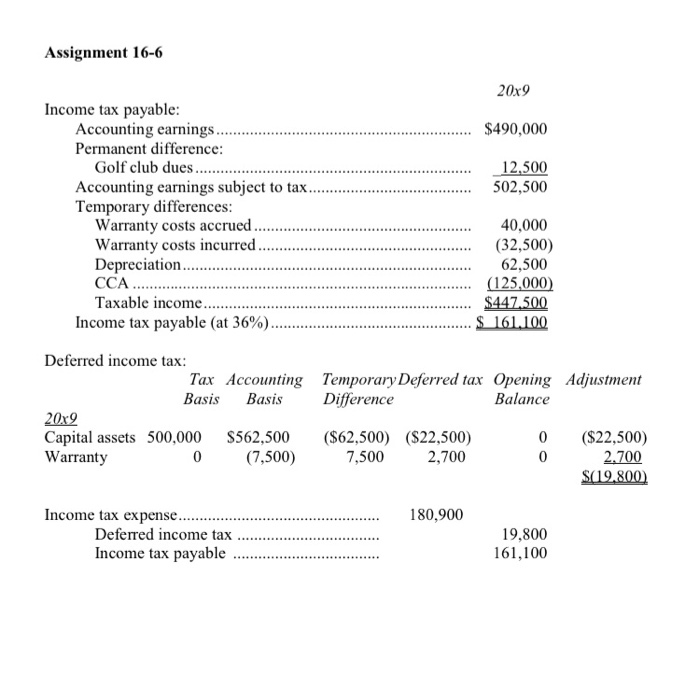

* A16-6 Tax Calculations: vear of operations: a records of Slow Inc. for 20X9 its first year of The following is selected information from the accounting records on Earnings before income taxes $490,000 In determining pre-tax accounting cu rmining pre-tax accounting earnings, the following deductions were made: a. Golf club dues Chapter 16 Corporate Income Tax b. Accrued warranty costs 1157 c. Depreciation 12,500 40.000 add add. Add For tax purposes, the following dedi the following deductions were made: 62,500 a. Warranty costs incurred b. CCA 32,500 dicuch 125,000 deduct The capital assets, originally costing $625.000. are 0.000, are depreciated on a straight-line basis over 10 years, zero residual ce with a full year of depreciation taken in Year 1. The tax rate is 36% value, with a full year of Required: Prepare the journal entry to record income tax at the end of 20X9. Assignment 16-6 20x9 $490,000 12,500 502,500 Income tax payable: Accounting earnings.. Permanent difference: Golf club dues.. Accounting earnings subject to tax........... Temporary differences: Warranty costs accrued.... Warranty costs incurred. Depreciation.................. CCA ............... Taxable income................... Income tax payable (at 36%).............. 40,000 (32,500) 62,500 .............. (125,000) ............. $447.500 $161.100 Temporary Deferred tax Opening Adjustment Difference Balance Deferred income tax: Tax Accounting Basis Basis 20x9 Capital assets 500,000 $562,500 Warranty 0 (7,500) ($62,500) ($22,500) 7,500 2,700 ($22,500) 2.700 S(19.800 180,900 Income tax expense...... Deferred income tax ............... Income tax payable 19,800 161,100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts