Question: Hi there I please need help with the below question - NO EXCEL ANSWERS PLEASE. I need to understand what steps are taken to get

Hi there

I please need help with the below question - NO EXCEL ANSWERS PLEASE. I need to understand what steps are taken to get to the answers. My calculations are below the question, but i'm not sure how to calculate standard deviation. It's my understanding that you must calculate variance first? If so, I believe my answer is incorrect and i'm stuck. Please help/explain next steps in formulas to improve my understanding - not excel.

THE QUESTION

MY ANSWER

Expected Return=WARA+WBRB+WCRC

Asset 1 has an expected return of 10%

E[r] Asset 1 = 1 x 0.1 + 0.75 x 0.1 + 0.5 x 0.1 + 0.25 x 0.1 + 0 x 0.1

= 0.25

25%

To calculate standard deviation, one must first calculate variance for each respective item in Asset 1.

Variance = Squared deviations from the expected value

Variance = 0.25* (1 x 0.01)^2 + (0.75 x 0.01)^2 + (0.5 x 0.01)^2 + (0.25 x 0.01 )^2 + (0 x 0.01)^2

The standard deviation of the investment's returns = the square root of the variance

= ? The above i believe is be incorrect

Asset 2 has an expected return of 20%

E[r] Asset 2 = 0 x 0.2 + 0.25 x 0.2 + 0.5 x 0.2 + 0.75 x 0.2 + 1 x 0.2

= 0.5

50%

Standard deviation? Variance?

Thank you

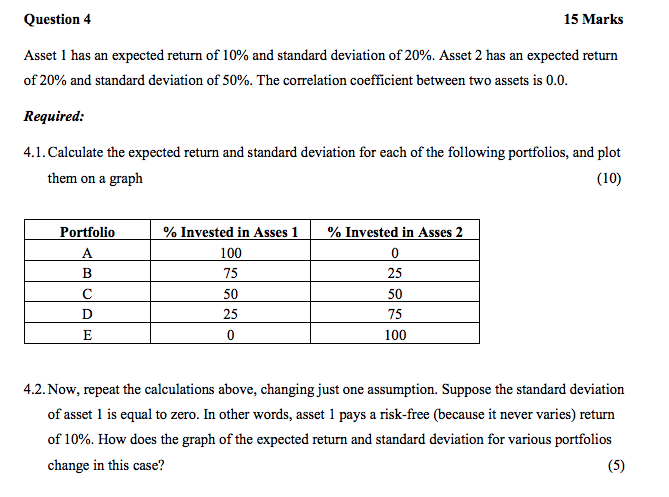

Question 4 15 Marks expected return of 10% and standard deviation of 20%. Asset 2 has an expected return Asset 1 has an of 20% and standard deviation of 50%. The correlation coefficient between two assets is 0.0. Required: 4.1. Calculate the expected return and standard deviation for each of the following portfolios, and plot them on a graph (10) Portfolio % Invested in Asses 1 % Invested in Asses 2 A 100 75 25 C 50 50 D 25 75 0 100 4.2. Now, repeat the calculations above, changing just one assumption. Suppose the standard deviation of asset 1 is equal to zero. In other words, asset 1 pays a risk-free (because it never varies) return of 10%. How does the graph of the expected return and standard deviation for various portfolios change in this case? (5) 1.23-04 x10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts