Question: hi there! i was wondering if some one could help me with 3.4 and 3.5? thnk you so much! (i) A one year zero coupon

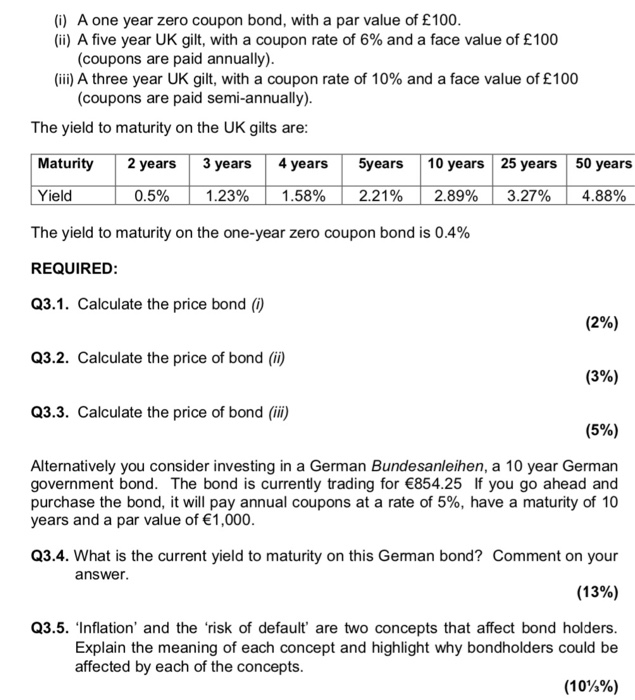

(i) A one year zero coupon bond, with a par value of 100 (ii) A five year UK gilt, with a coupon rate of 6% and a face value of 100 (coupons are paid annually) (iii) A three year UK gilt, with a coupon rate of 10% and a face value of 100 (coupons are paid semi-annually) The yield to maturity on the UK gilts are Matuity 2 years 3 years 4 years 5years 10 years 25 years 50 years Yield 0.5% | 1.23% | 1.58% | 2.21% | 2.89% | 3.27% | 4.88% The yield to maturity on the one-year zero coupon bond is 0.4% REQUIRED Q3.1. Calculate the price bond (i) (2%) Q3.2. Calculate the price of bond (ii) (3%) Q3.3. Calculate the price of bond (ii) (5%) Alternatively you consider investing in a German Bundesanleihen, a 10 year German government bond. The bond is currently trading for 854.25 If you go ahead and purchase the bond, it will pay annual coupons at a rate of 5%, have a maturity of 10 years and a par value of 1,000 Q3.4. What is the current yield to maturity on this German bond? Comment on your answe (13%) Q3.5. "Inflation' and the risk of default are two concepts that affect bond holders Explain the meaning of each concept and highlight why bondholders could be affected by each of the concepts (10 %)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts