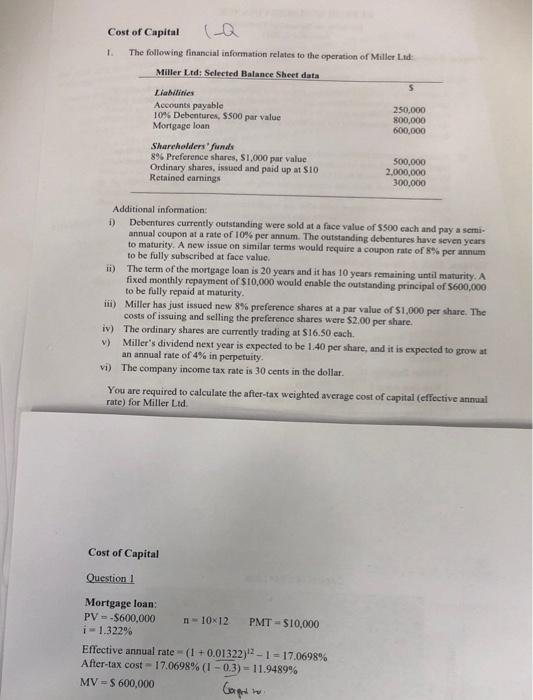

Question: Hi there, the answer is provided on the paper below the question. My question is that how did they know about i=1.322% and MV= $600.000?

Cost of Capital 1 The following financial information relates to the operation of Miller Ltd Miller Ltd: Selected Balance Sheet data 5 Liabilities Accounts payable 250,000 10% Debentures, S500 par value 800,000 Mortgage loan 600,000 Shareholders finds 896 Preference shares, 51.000 par value 500,000 Ordinary shares, issued and paid up at $10 2,000,000 Retained camings 300,000 Additional information: 1) Debentures currently outstanding were sold at a face value of $500 cach and pay a semi- annual coupon at a rate of 10% per annum. The outstanding dcbentures have seven years to maturity. A new issue on similar terms would require a coupon rate of 8% per annum to be fully subscribed at face value. ii) The term of the mortgage loan is 20 years and it has 10 years remaining until maturity. A fixed monthly repayment of $10,000 would enable the outstanding principal of 5600,000 to be fully repaid at maturity. iii) Miller has just issued new 8% preference shares at a par value of $1,000 per share. The costs of issuing and selling the preference shares were $2.00 per share. iv) The ordinary shares are currently trading at $16.50 each. v Miller's dividend next year is expected to be 1.40 per share, and it is expected to grow at an annual rate of 4% in perpetuity. vi) The company income tax rate is 30 cents in the dollar You are required to calculate the after-tax weighted average cost of capital (effective annual rate) for Miller Ltd Cost of Capital Question 1 Mortgage loan: PV-$600,000 n-1012 PMT - $10,000 1-1.322% Effective annual rate (1 +0.01322)2 - 1 - 17.0698% After-tax cost - 17.0698% (1 -0.3) - 11.9489% MV = S 600,000 Corpo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts