Question: Hi ! This is a multi - part question, and I don't know much about how to manipulate Excel as I need to . I

Hi This is a multipart question, and I don't know much about how to manipulate Excel as I need to I have included the question in its entirety and a screenshot showing all columns but just some rows of the data. Thanks!

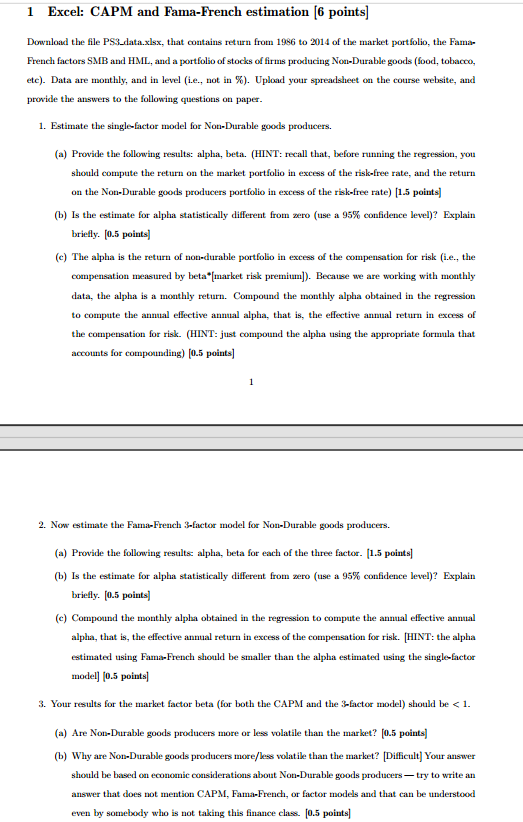

Excel: CAPM and FamaFrench estimation points Download the file PSdata.xlsx that contains return from to of the market portfolio, the FamaFrench factors SMB and HML and a portfolio of stocks of firms producing NonDurable goods food tobacco, etc Data are monthly, and in level ie not in Upload your spreadsheet on the course website, and provide the answers to the following questions on paper. Estimate the singlefactor model for NonDurable goods producers. a Provide the following results: alpha, beta. HINT: recall that, before running the regression, you should compute the return on the market portfolio in excess of the riskfree rate, and the return on the NonDurable goods producers portfolio in excess of the riskfree rate pointsb Is the estimate for alpha statistically different from zero use a confidence level Explain briefly. pointsc The alpha is the return of nondurable portfolio in excess of the compensation for risk ie the compensation measured by betamarket risk premium Because we are working with monthly data, the alpha is a monthly return. Compound the monthly alpha obtained in the regression to compute the annual effective annual alpha, that is the effective annual return in excess of the compensation for risk. HINT: just compound the alpha using the appropriate formula that accounts for compounding points Now estimate the FamaFrench factor model for NonDurable goods producers. a Provide the following results: alpha, beta for each of the three factor. mathbf pointsb Is the estimate for alpha statistically different from zero use a confidence level Explain briefly. pointsc Compound the monthly alpha obtained in the regression to compute the annual effective annual alpha, that is the effective annual return in excess of the compensation for risk. HINT: the alpha estimated using FamaFrench should be smaller than the alpha estimated using the singlefactor model points Your results for the market factor beta for both the CAPM and the factor model should be a Are NonDurable goods producers more or less volatile than the market? pointsb Why are NonDurable goods producers moreless volatile than the market? Difficult Your answer should be based on economic considerations about NonDurable goods producers try to write an answer that does not mention CAPM, FamaFrench, or factor models and that can be understood even by somebody who is not taking this finance class. points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock