Question: hi this is the question thanks! Problem 2 [Numerical pricing of vanilla options using transform methods] In general, computing the riskneutral price of most derivatives

hi this is the question thanks!

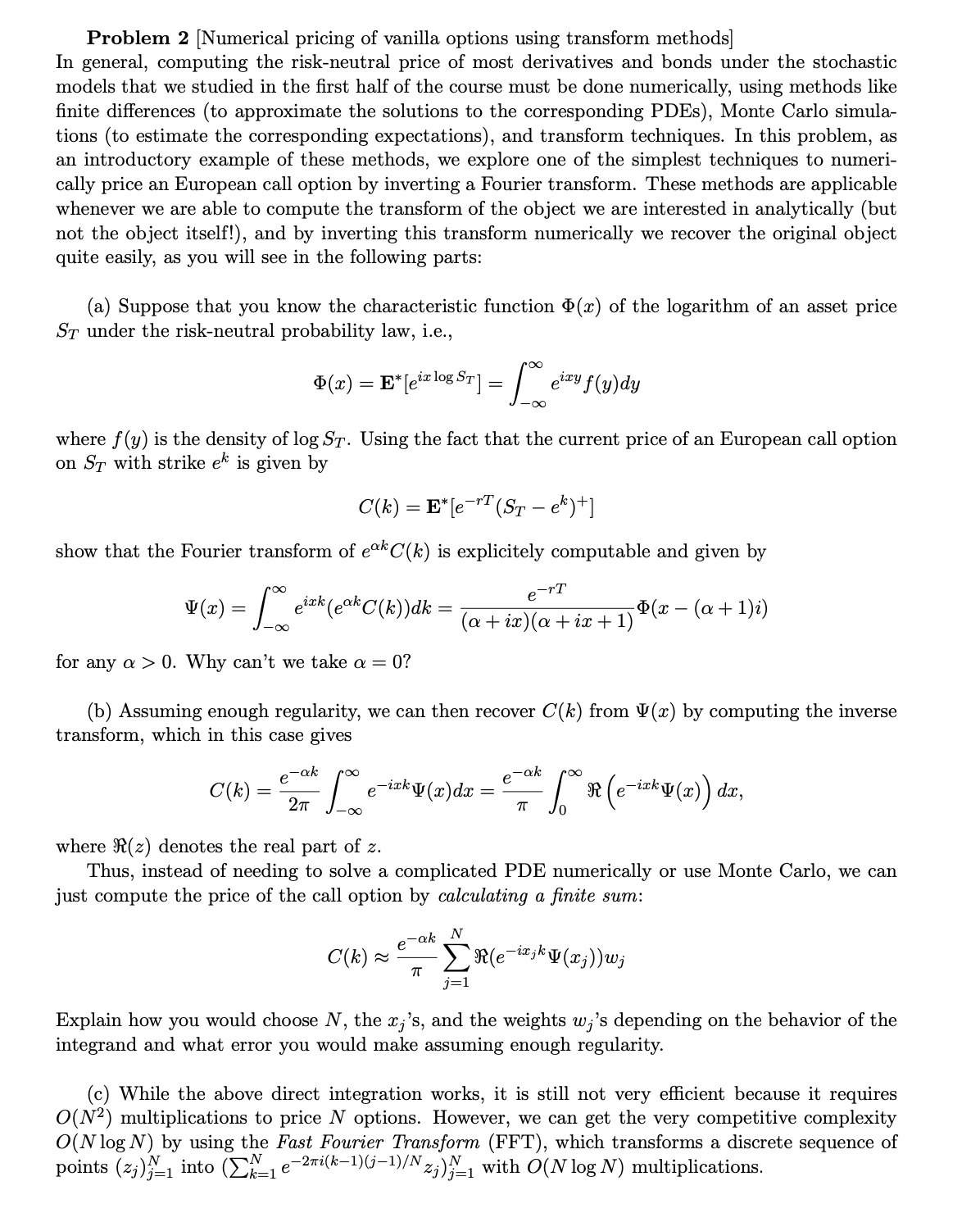

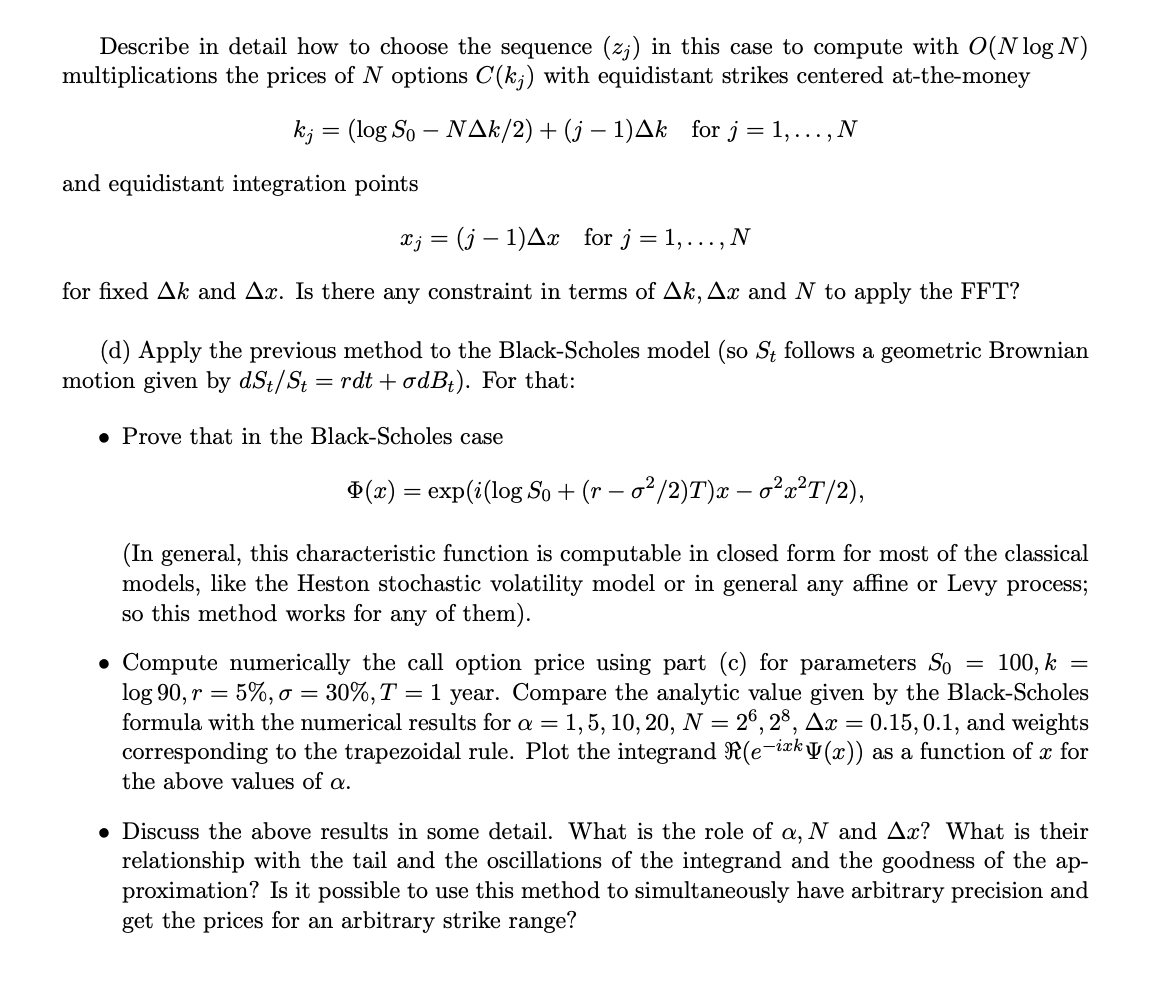

Problem 2 [Numerical pricing of vanilla options using transform methods] In general, computing the riskneutral price of most derivatives and bonds under the stochastic models that we studied in the rst half of the course must be done numerically, using methods like nite differences (to approximate the solutions to the corresponding PDEs), Monte Carlo simula- tions (to estimate the corresponding expectations), and transform techniques. In this problem, as an introductory example of these methods, we explore one of the simplest techniques to numeri- cally price an European call option by inverting a Fourier transform. These methods are applicable whenever we are able to compute the transform of the object we are interested in analytically (but not the object itself l), and by inverting this transform numerically we recover the original object quite easily, as you will see in the following parts: (a) Suppose that you know the characteristic function (13(3) of the logarithm of an asset price ST under the risk-neutral probability law, i.e., @(m) = E*[ei'\"1gSTi = / eimywdy where y) is the density of log ST. Using the fact that the current price of an European call option on ST with strike 6"\" is given by C(k) = Eve\"(ST air] show that the Fourier transform of axiom) is explicitely computable and given by 00 31: ale eTT . \\IJ(:::) = [00 e (e C(k))dk = mc (a + 1):) for any or > 0. Why can't we take 0: = O? (b) Assuming enough regularity, we can then recover 009) from \\I'(zc) by computing the inverse transform, which in this case gives 0(a) = (a [00 e'ifk'llchm = 3\" [0C at (e'if'c'MrD am, 2w ,oo 7r where 3K2) denotes the real part of 2. Thus, instead of needing to solve a complicated PDE numerically or use Monte Carlo, we can just compute the price of the call option by calculating a nite sum: Explain how you would choose N, the sis, and the weights wj's depending on the behavior of the integrand and what error you would make assuming enough regularity. (c) While the above direct integration works, it is still not very efcient because it requires 0(N2) multiplications to price N options. However, we can get the very competitive complexity 0(N log N) by using the Fast Fourier Transfom (FFT), which transforms a discrete sequence of points (zj'Ll into (2:21 e'gik'l){j'1l/N2j):1 with 0(N log N) multiplications. Describe in detail how to choose the sequence (23-) in this case to compute with 0(N log N) multiplications the prices of N options C(kj) with equidistant strikes centered at-themoney kj = (logSo NAk/2) + (j DAR: forj = 1,.. . ,N and equidistant integration points 33.? =(j1)A:c forj=1,...,N for xed AR: and As. Is there any constraint in terms of Ala, Am and N to apply the FFT? (d) Apply the previous method to the BlackScholes model (so St follows a geometric Brownian motion given by ng/St 2 rd)? + adBt). For that: e Prove that in the BlackScholes case @(m) = exp('(log 30 + (r 02/2)T)m 022:2T/2), (In general, this characteristic function is computable in closed form for most of the classical models, like the Heston stochastic volatility model or in general any afne or Levy process; so this method works for any of them). 0 Compute numerically the call option price using part (c) for parameters 80 = 100, k = log 90, \"r : 5%, a : 30%,T : 1 year. Compare the analytic value given by the Black-Scholes formula with the numerical results for a = 1,5,10,20, N = 25, 23, Ar = 0.15, 0.1, and weights corresponding to the trapezoidal rule. Plot the integrand R(e_\"kl11(x)) as a function of 33 for the above values of a. 0 Discuss the above results in some detail. What is the role of a,N and Am? What is their relationship with the tail and the oscillations of the integrand and the goodness of the ap- proximation? Is it possible to use this method to simultaneously have arbitrary precision and get the prices for an arbitrary strike range